Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

You're on the right track, rachelmele.

I'm here to ensure you're able to clear out your vendor credit.

Since the credit still shows, you'll have to make sure that you've selected the correct Accounts Payable (A/P) account. I'd suggest going to the Pay bills window to verify it. For your visual reference, I've attached a screenshot below.

In case you're using a single A/P account, please disregard the screenshot provided.

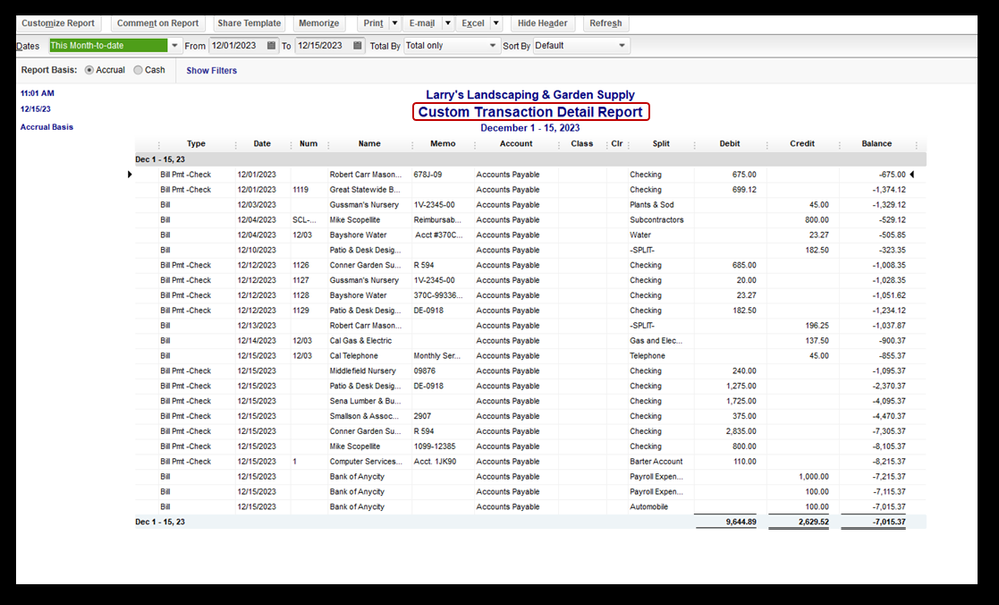

Also, I'd recommend running and customizing the Transaction Detail report. This way, we'll be able to check if the transactions are correctly linked together.

Here's how:

Otherwise, you'll have to delete the refund transactions, then recreate a new one.

Additionally, I've added this article that'll help you manage your vendor transactions in QuickBooks Desktop: Expenses and Vendors Articles.

Please feel free to click the Reply button if you have follow-up questions about recording refund checks in QuickBooks. I’m always here to help you out.

There's a simple solution to this. Deposit (Make Deposit) the money to your business account and use the expense account of whatever you've paid for. This reverses the overpaid portion of that expense... You can edit your deposit and replace the A/P with that expense account.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here