You can create a credit memo to refund the payment to the appropriate customer, Joshua71.

This will allow you to accurately reflect the returned amount in your financial records. To create a credit memo, see the steps below:

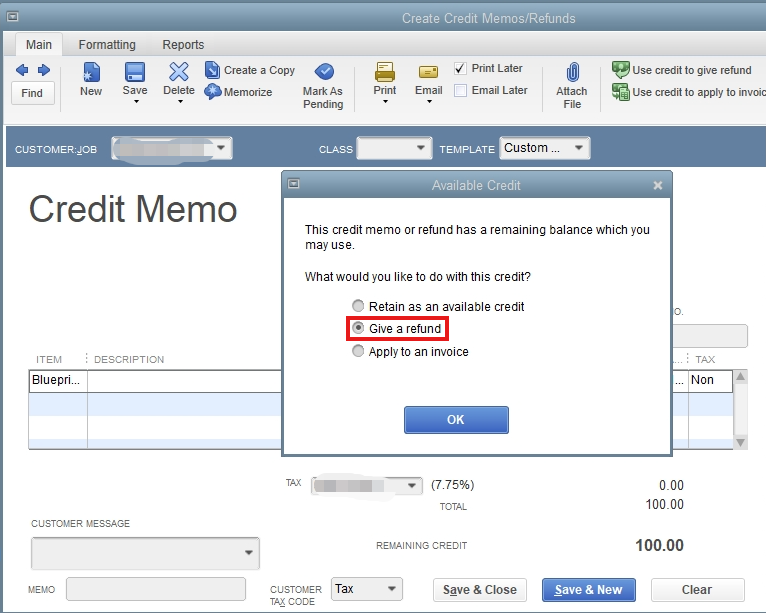

- Go to the Customers menu, then Create Credit Memos/Refunds.

- Select the customer from the Customer:Job dropdown.

- Enter the items you're giving a credit for.

- Click Save & Close.

- In the Available Credit window, choose give a refund.

- Hit OK.

After that, you can now give a refund to your customer. For a detailed guide, follow option 2 of this article: Give your customer a credit or refund in QuickBooks Desktop for Windows.

For future reference, you can send statements to your customers providing summaries of their invoices, payments, credits, and outstanding balances.

If you have additional questions, feel free to return to this thread.