Let's get this resolved, ParagonLLC. I'll go over the steps to do it seamlessly with your QuickBooks Online (QBO) account.

We can use the Resolve the difference option to categorize the processing fee accordingly and match it to the invoice payment.

If you don't already have one, you can start by creating an expense account for processing fees. I'll show you how:

- Go to Transactions and pick Chart of accounts. Then, click New.

- In the Account pop-up, choose Expenses from Account Type dropdown.

- You can select Bank charges from the Detail Type dropdown.

- Enter a Name and hit Save and Close.

After that, you can resolve the difference between the payment transaction and the invoice. Follow these steps to proceed:

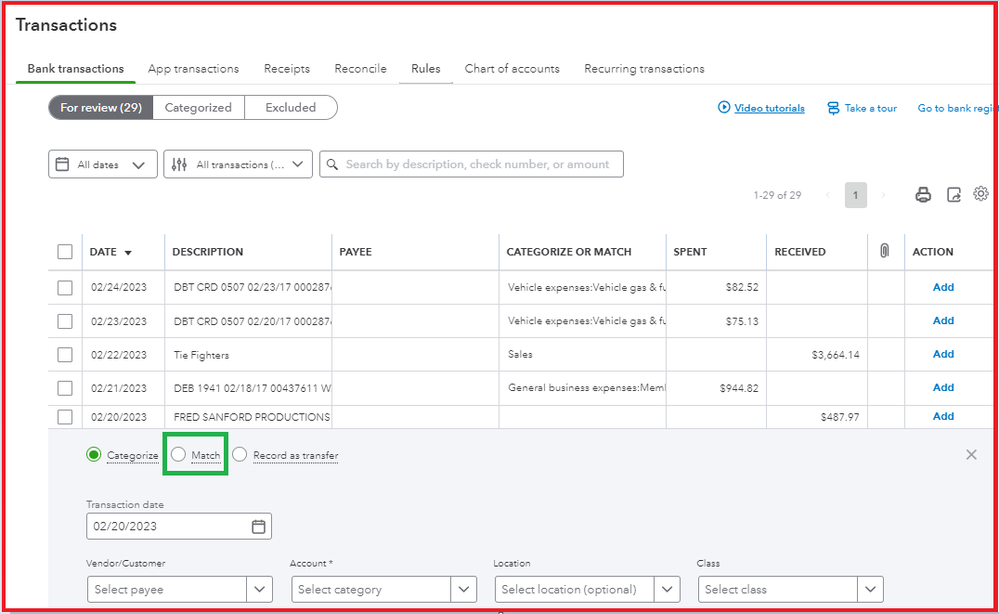

- Go to the Transactions menu, then pick Bank transactions.

- Choose the bank account with the transaction.

- Select the relevant transaction on the For review tab. Click the Match radio button.

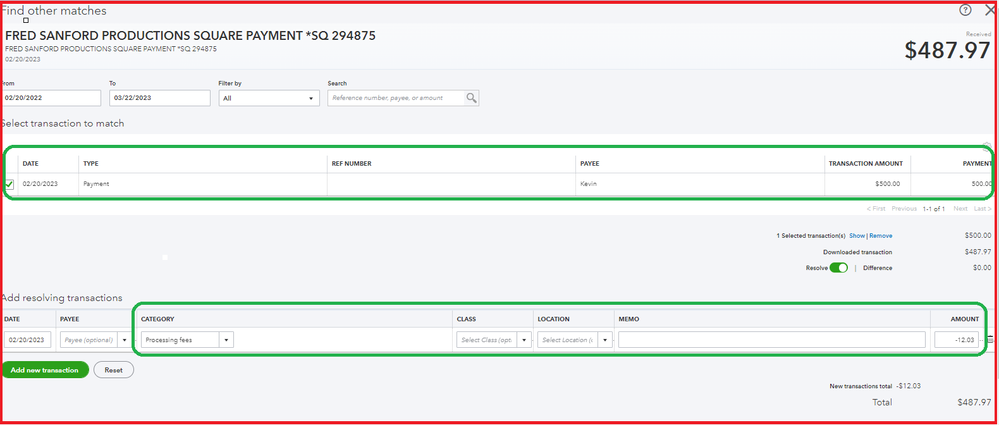

- In the Find other matches window, pick the correct dates and filters and tick the box for the appropriate Invoice or Payment.

- Tap Resolve at the lower-right corner to open Add resolving transactions.

- From the Category dropdown, choose the Processing fees expense account you created.

- Enter the Amount fee as negative. Then, tap Save.

Additionally, you can check out these resources as your guide to view various procedures that will help you reconcile your online transactions:

You can count on me to provide further related resources and details regarding your bank transactions. Kindly comment with any questions you have, and we'll ensure a prompt response.