Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhy doesn't QB Online have an option to take a vendor discount like all other QB versions from forever ago? How do you print the discount taken on a check to the vendor?

QuickBooks Online (QBO) has a different structure and feature set compared to QuickBooks Desktop, SHELLY. The absence of a vendor discount option in QBO can be due to its focus on streamlined processes and integration with online features.

While QBO allows for discounts on sales transactions, it doesn't offer a dedicated discount field for vendor bills. This is a difference between QBO and QuickBooks Desktop.

On the other hand, you can just print the actual check with the discount since you'll need to add the discount as a separate service item on the bill or other expense transactions in QBO.

Here's how:

You can check out this article for more details about tracking your bills and recording the payments in QBO: Enter and manage bills and bill payments in QuickBooks Online.

As a future reference, let me add this article as a guide in entering refunds and vendor credits in QBO: Enter vendor credits and refunds in QuickBooks Online.

We're always here in the Community if you have clarification in managing vendor discounts in QuickBooks.

You nailed it. This is an area where Desktop was much, much better. If you need the discount taken to print on the remittance, you need to create a vendor credit for the discount amount and apply it to the bill. Not very convenient.

However, I've never had a vendor not be able to figure out the term discount when it wasn't printed on the remittance, and I paid well over 100,000 bills that way in QB. They can always determine the, say, 5% discount by the net amount of the check vs. the bill amount. Credits, on the other hand, for sure need to be printed on the remittance.

"Ensure the discount is included in the check details"

How would you suggest we do that? Is that something that can actually be done?

How can we try to get this changed in QB online? This is more work to have to calculate and enter the discount manually and so crazy it didn't carry over from desktop. I am just switching to online and it is driving me crazy and makes no sense!!

Sometimes the vendors figure the discount different - pretax and I do on the total so with no details on the discount amount I know I am going to be emailing a lot to the vendors so they know the discount amount so another step to do which seems crazy to not carry over from desktop.

Please advise why QB online makes me manually calculate the vendor discount and manually enter it in. This might be a deal breaker for QB Online and it seems like a simple fix for QB since all other desktop versions have this feature.

I understand how this can be a challenge if you're accustomed to the automated functionality in our desktop versions. Your input is valuable to us and we encourage you to share this suggestion directly with our product development team, Shelly.

To submit feedback, you can follow the steps highlighted below:

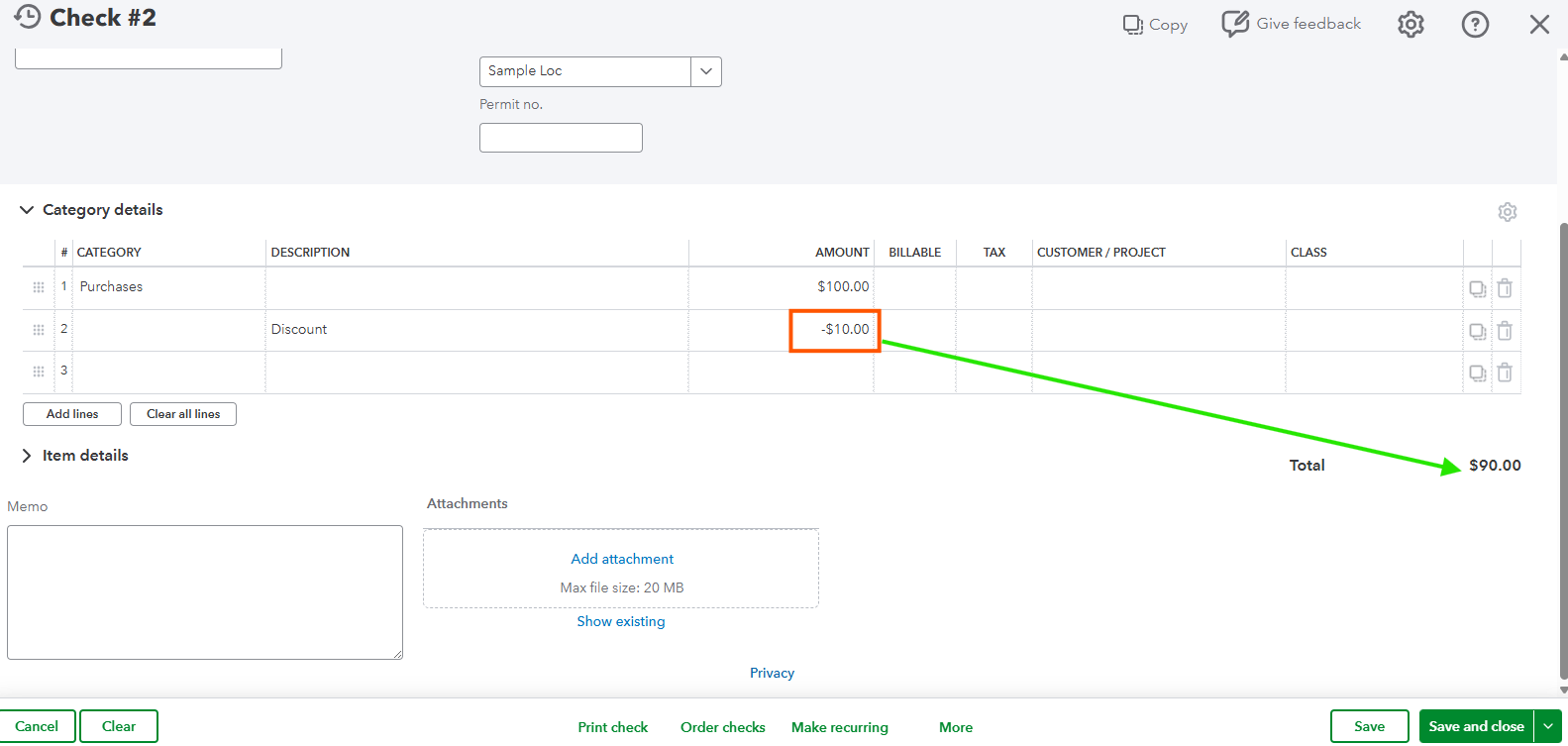

In the meantime, you can manually enter the discount directly on the line item to apply it. I've added this for your visual guide:

If by chance you want to add it to your sales forms like your invoice, estimate, or sales receipt, check this out: Add Discount to an Invoice, Estimate or Sales Receipt in QuickBooks Online.

Post your comment if you have any questions about vendor discount. We're always right here to help you as always.

"Please advise why QB online makes me manually calculate the vendor discount and manually enter it in."

QBO (just like Desktop) can do the calculation for you. If your discount is 5% on a $1234.67 bill, enter 1234.56*.95 in the amount box. There's no need to calculate it manually and then enter it.

Correction: If your discount is 5% on a $1234.67 56 bill, enter 1234.56*.95 in the amount box

What if I decide not to take the discount or miss the discount date? I have to manually change the amount. I am just supppppppper bugged by QB online to not match QB desktop with how the vendor discount is handled and can't believe more people are not bugged with this!!

This is just stupid to have to mentally remember that you may take the discount when entering the bill. I keep on entering bills and don't usually have to think about it till payment time but now I have to remember when entering the invoice or have to go back and edit it and what a pain. Please just consider changing to match desktop!! I see no reason why not - did someone just forget to add this option?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here