What you may be experiencing:

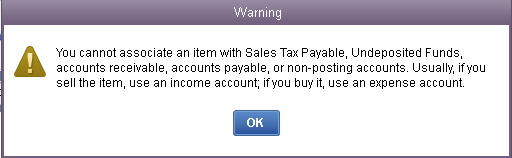

After installing the latest R13 patch for QuickBooks 2017, you may encounter the following warning when trying to record an Invoice or Sales Receipt.

There was an intentional change made in the latest 2017 release around how Discount items should be used. As mentioned in the warning there are certain types of accounts that are no longer allowed to be associated with a Discount item.

What you can try now:

If you need a discount on your Invoice or Sales Receipt that is offset to an account with one of the account types mentioned in the warning, it is suggested to use an Other Charge item to achieve your desired outcome. The associated account type restriction for Discount items does not apply to Other Charge items, so you will be able to use whatever account you choose.