Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe switched from QuickBooks Desktop to QBO this year and there are a number of things that don't work as well as Desktop did, particularly with respect to reporting. I'm disappointed (really annoyed) to find that when I run income and expense reports for classes, the report simply adds all the numbers and doesn't net the debits and credits. The attached pdf illustrates the "incorrect" (pulled directly from QBO) versus the "correct" (manually manipulated in Excel) report for one class, Is there a solution that will make the report correct this issue? It seems like a coding problem. Any thoughts are appreciated.

Hi there.

Your perspective matters and I appreciate you taking the time to provide the supporting documents. Yes, you can correct this report by ensuring to use the proper customization. Let me help you pull up your Profit & Loss by Class reports and display the accurate net balance for all transactions.

Here's how:

These steps ensure the displayed report is synced to your QBO data. Then, you'll see the correct net balances for each transaction.

Alternatively, you can consider running a General Ledger report filtered to the class and accounts you prefer. Here's how:

By running the General Ledger report, you'll see the correct amount increase or decrease depending on the transactions. The image below is an example showing the accurate calculation of the amounts.

After that, you can memorize the report so you can access it easily in the future. Additionally, you can also email your memorized reports on a recurring schedule in QuickBooks Online.

Let me know if you need help memorizing reports or any other report-related concerns in QuickBooks Online. I'm always available to help.

RE: We switched from QuickBooks Desktop to QBO this year and there are a number of things that don't work as well as Desktop did, particularly with respect to reporting.

Yes, you are correct.

And that may be the understatement of the century!

Thank you for the information. I re-ran the Profit and Loss by Class and was able to get the correct outcome. However, when I clicked on the net amount to drill deeper, I couldn’t reorganize the data by date. QBO kept it separated by account. I need to see when the net hits zero. The GL report only allows you to select balance sheet accounts, but I need income statement ones – not helpful. Desktop reports were very flexible and reliable. Unfortunately, I don’t have the same level of confidence in the ones that I pull from QBO.

The ability to drill down reports accurately and reorganize your data to meet your needs is crucial for effectively managing your finances and seeing when the net amount hits zero, tlandis_ksu. Let me provide more information on how QuickBooks handles this data and possible solutions to your concerns.

Currently, QuickBooks Online organizes the drilled-down data by account, and it doesn't have the option to reorganize this data by date directly within the report details. I recognize how this limitation can impact your workflow, especially given your need for more flexible and reliable reporting, which you experienced with QuickBooks Desktop.

That said, I encourage you to submit feedback directly to our product development team, suggesting enhancing report flexibility in QuickBooks Online. Feedback from customers like you helps us better understand user needs and improve our services and features. I'll list the steps below on how you can do it.

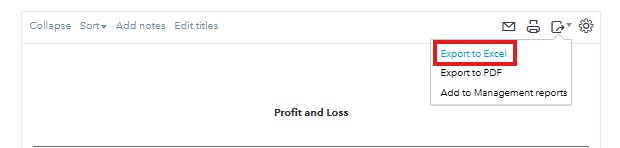

As a workaround, you can export your data to Excel to further manipulate and reorganize it by date. Here's how:

For additional help and details about generating and customizing reports, you might find the following articles useful:

Additionally, to save time in the future, you can save your custom report settings. Here's a handy article on how to do this: Save a customized report in QuickBooks Online.

Feel free to holler if you have other concerns about running reports in QuickBooks. We're continuously striving to enhance our features, and your feedback plays a vital role in these improvements. Thank you for your patience and understanding and for helping us improve QuickBooks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here