Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI need to enter the 2020 IRS business mileage rate in desktop QuickBooks so it can calculate mileage costs to be reimbursed. I click on Company > Enter vehicle mileage > click on the "Mileage Rates" tab at the top; a new window displays a 7-row table with the last 7 years' start dates and mileage rates. If I enter the 2020 rate in the top row, where the cursor is automatically positioned, the 2020 rate replaces 2019 rate, which I don't want to do. I don't want to lose ANY of the rates from previous years. So how do I add a new rate for 2020 without losing a previous year's rate? There's no blank row at the top (or bottom)... Does the table only have a maximum of 7 rows?

Solved! Go to Solution.

Hi @Dillopk,

You'll have to click on the last row to add your latest mileage rate. Let me walk you through the steps.

On the other hand, you can add as many rows as you can in the Mileage Rates window. Just use the sidebar to scroll up and down.

For more in-product help articles about vehicle mileage, press F1 on your keyboard and type "Mileage" in the Search field.

I'd be around if you have other questions about QuickBooks. Thanks for dropping in and happy weekend.

Hi @Dillopk,

You'll have to click on the last row to add your latest mileage rate. Let me walk you through the steps.

On the other hand, you can add as many rows as you can in the Mileage Rates window. Just use the sidebar to scroll up and down.

For more in-product help articles about vehicle mileage, press F1 on your keyboard and type "Mileage" in the Search field.

I'd be around if you have other questions about QuickBooks. Thanks for dropping in and happy weekend.

I went through the above steps but QB is still charging the 2020 rate.

I followed these steps but QB is still using the 2020 rate.

I can provide methods here so QuickBooks will set the correct rate, @Stacy5.

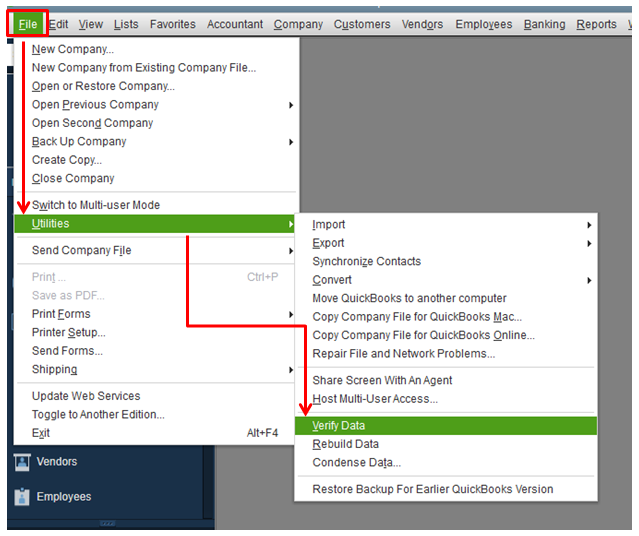

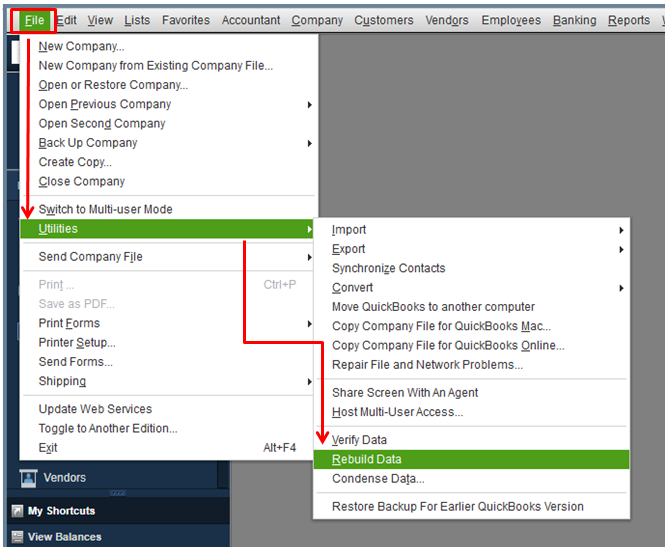

There might be data issues on your end that lead the program to behave unexpectedly. The QuickBooks verify and rebuild tools will find the most common data concerns in a company file and fixes them right away.

Here are the steps to do it:

Please know that you'll need to log in to your Desktop account using the single-user mode when performing this process. Also, ensure that you keep your software up-to-date. This way, you'll always have the latest features and fixes.

To track your business vehicles within the program, you can run Mileage reports by Vehicle Summary/Detail or Job Summary/Detail. Then use the customize feature to display the details you need.

I'll be here to lend a hand if you have more questions about mileage rates in QuickBooks. Have a good one.

I have verified and rebuilt the data. I ran a mileage report like you suggested and the mileage per mile is correct, but when I invoice my customer using Invoice for Time & Expenses, is still using the 2020 rate.

Hey there, @Stacy5.

Thanks for following up with us and providing additional details.

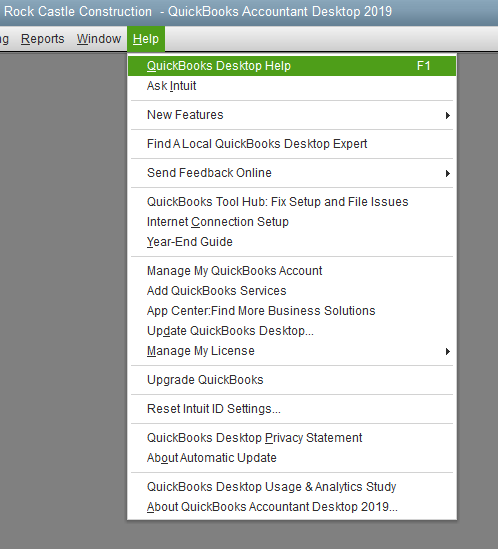

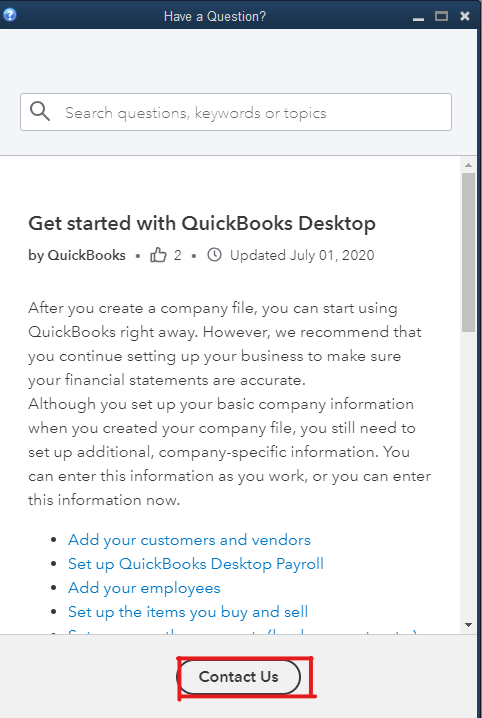

Since the steps provided by my colleagues above aren't working for you, I recommend contacting our technical support team. Our technical support team can review your account in a secure environment and investigate this issue of its odd behavior a bit further. I've included the steps to contact support below.

That's all there is to it. Please let me know if you have further questions or concerns. I'll be here every step of the way. You can reach out to the Community at any time. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here