Thanks for visiting the Community today, @johns64.

The Automated Sales Tax system uses the Based on location tax rate on the address provided on an invoice. Otherwise, it'll use your company address' location to calculate the rate.

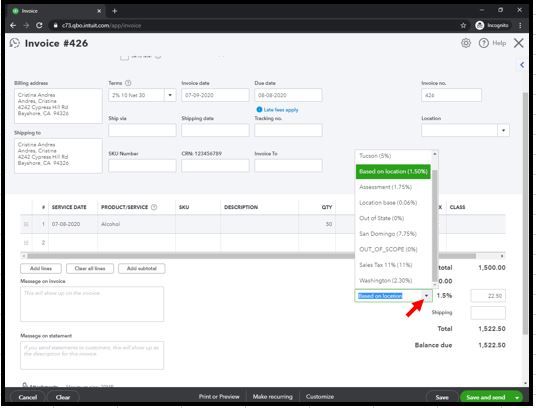

For now, you can manually click the drop-down list and select the custom rate when creating your sales transactions. See screenshot below:

You can also select +Add new from the drop-down list to customize or change the sales tax rate to manually calculate taxes on invoices

Let me also share these additional guides when filing and paying your sales taxes in QBO:

Feel free to come by again if you need additional help. We're always here to guide. Stay safe.