Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are upgrading to include the budget module. The budget we use now (Excel) is divided by ministries. Is that what we would use QB "classes" for? Setting up each ministry as a class? In reading help topics they suggest I open the latest profit and loss report and add classes to each of the income and expense accounts. Is that the first step we should take?

Thanks! It's a bit confusing. I've watched videos on how to add the budget figures, just wanted to make sure I can get reports that compare budget to actual divided by ministries and also total for year-to-date.

Solved! Go to Solution.

Thank you for your prompt reply, @HollyJoy. Let me share some information with each of the details you need.

Here's how you can connect classes to each of your accounts in the chart of accounts:

Follow these steps to be able to run a report for "Class 1 - Worship" that has 12 expense accounts:

To go through with your year-to-date and add class IDs to past bills, you can manually include the class in the existing bills or transactions.

Importantly, make sure you have created a budget before running a Budget vs. Actual by Class report.

Furthermore, you can also check out this article to learn more about running a report in QuickBooks Online.

Please feel free to post a question in the comments below if you have anything else in mind. I'll be sure to get back to you. Have a great day!

Hi there, HollyJoy.

Thank you for visiting again the QuickBooks Community. I'll be sharing details on how setting budget targets for each class works in QuickBooks Online. Then, to ensure you'll be able to achieve your goal.

Classes in QuickBooks Online represent meaningful segments in your company, like store departments or product lines. Once you track transactions by class, it’s easy to plan ahead for each segment. That said, yes, the divided ministries will use in setting up each ministry as a class.

You can create a budget by class based on profit and loss from the last fiscal year. This helps you set more manageable budget targets for each part of your business. Then, you can run reports to see your progress towards your goal, so you can stay on track. to start with, review your profit and loss by class.

Here's how:

Once done, add a budget goal for each class. You can create a monthly, quarterly, or yearly budget. You may also select to pre-fill the fields with actual data from the last fiscal year. This is handy if you want to base your budget on each segment’s past financial performance. To view additional details, you can open this article: Set budget targets for each class. This also provides information on how to compare your actual income and expenses to your budgeted amounts.

Lastly, you may refer to this article to see details on how to filter a balance sheet to view the report by class or location that will help you determine the accuracy of your data: Run a balance sheet by class or location.

Don’t hesitate to post a comment if you need further help about managing the budget with class in QuickBooks. I’ll be more than happy to lend a helping hand. Enjoy the rest of the day.

I've upgraded to QuickBooks Plus and now see the budget link under setting, but I don't see the report "Profit and Loss by Class" under standard reports - I see a ton of other P&L reports, however. Do I need to set up budget accounts as classes before that P&L report can be created?

Let's make sure you'll be able to see the Profit and Loss by Class report in QuickBooks Online, HollyJoy.

Classes consist of a freeform list you can use to tag your transactions. You'll have to turn on class tracking so you'll be able to view the report. To do this, follow the steps below:

Then, you can set up your class list. Once done, you can now run the Profit and Loss by Class report.

Additionally, to make sure that you'll get the information you need, I've added this article for your guide: Customize Reports In QuickBooks Online.

Please reach out to us if you have any concerns about classes. We're here to help you.

Maybe I'm not using the right tool or expecting it to do something it can't, so bear with me. Also, I'm an administrator, not an accountant.

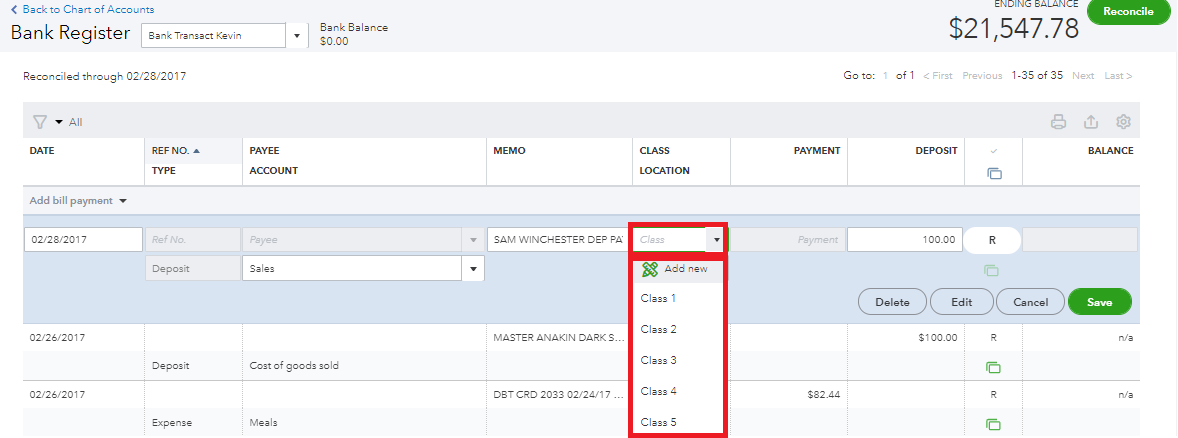

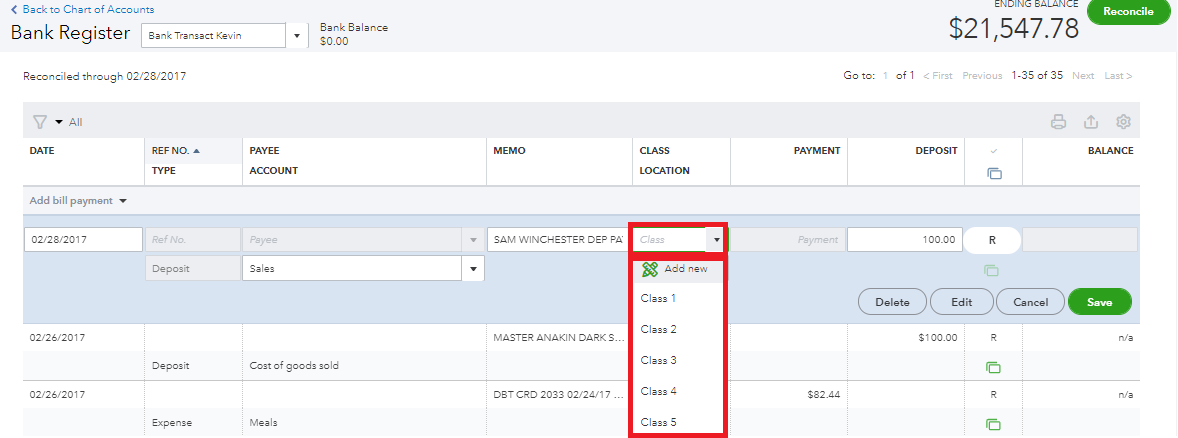

I want to run a report "Budget to Actual Comparison by Ministry" that is divided by ministries (class). I have added our 2020 budget. I have created the 5 classes - one for each area of ministry. How do I connect classes to each account in the chart of accounts? I want to be able to run a report for "Class 1 - Worship" that has 12 expense accounts that apply only to that class. If connecting an expense with a class can only be done when entering a new bill, is there a way to go through the year-to-date and add class IDs to past bills?

Thanks.

Thank you for your prompt reply, @HollyJoy. Let me share some information with each of the details you need.

Here's how you can connect classes to each of your accounts in the chart of accounts:

Follow these steps to be able to run a report for "Class 1 - Worship" that has 12 expense accounts:

To go through with your year-to-date and add class IDs to past bills, you can manually include the class in the existing bills or transactions.

Importantly, make sure you have created a budget before running a Budget vs. Actual by Class report.

Furthermore, you can also check out this article to learn more about running a report in QuickBooks Online.

Please feel free to post a question in the comments below if you have anything else in mind. I'll be sure to get back to you. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here