Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowtwo different things

a bill you get from a vendor, what the bill is for might be an expense, an item, or an asset. You determine that by what you select on the bill

Welcome to the Community, @sphillips1.

I'm happy to provide some insight into converting a bill to an expense.

At this time, it's not possible to convert bills to expenses, you'd have to delete the bill and manually create the expense. Below I've included the steps on how to delete the bill and create an expense.

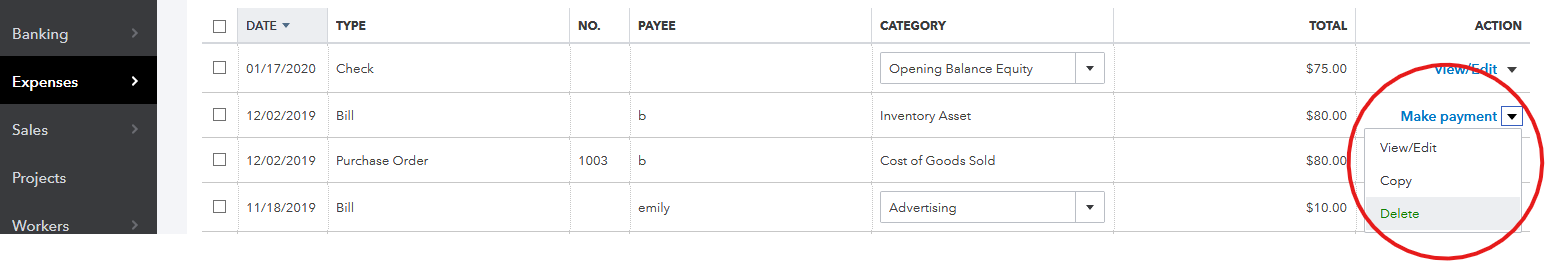

Delete a bill without opening it:

To create an expense:

You can check out these articles for more details:

Please know I'm only a post away if you have further questions. Wishing you continued success. Take care!

Why does quickbooks categorize some scanned expenses as a bill when they are in fact an expense? Now I have to delete the bill and dont have an image to back it up???

Don't let the title of Bill or Expense confuse you. The only difference between a Bill and an Expense in QB is that a bill is used when you will pay the bill in the future and an Expense is used to record the transaction when you pay for it at the time of purchase. Bills and Expenses are just titles of the transactions. The only difference is the timing of when you pay it. If a bill is created, just assign the appropriate expense account to the bill and pay it by going to Pay bills (New > Pay bills).

Thank everyone for their response to this question. I too have been struggling with Bills versus Expenses.

I understand the philosophical concept, but in this case the payments I made to a contractor using a preset Bill, are not showing up for their 1099.

Does this mean I need to delete the Bills and make them manually into an Expense?

-Don

You're in the right place, djones13. I'm here to share some insights about bills in QuickBooks Online (QBO).

One of the reasons why the preset bill is not showing in your 1099 report is that it hasn't been paid yet. For it to be posted, you'll need to pay the bill first or create a bill payment check in QuickBooks.

Moreover, you can check out this article to learn how to get the most out of your financial reports in QBO: Customize reports in QuickBooks Online.

I appreciate you for reaching out today. If you have other concerns about reports, let me know by leaving a comment below. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here