Thank you for providing me with a detailed explanation of your concern, jules. I'm here to explain why employees who have received checks now appear in the Details of Funds to be Withdrawn report with a balance of 0.00 under Direct Deposit.

This situation occurs when Direct Deposit checks are sent after creating paychecks, followed by printing and assigning check numbers. Any alterations made to the checks will be updated the next time you connect to send direct deposit orders. To avoid this, print the checks first, then sending them

Additionally, ensure to get the newest tax table in QuickBooks Payroll so you'll have accurate rates and calculations for federal and supported state taxes, payroll tax forms, and e-file and e-pay options.

Here's how:

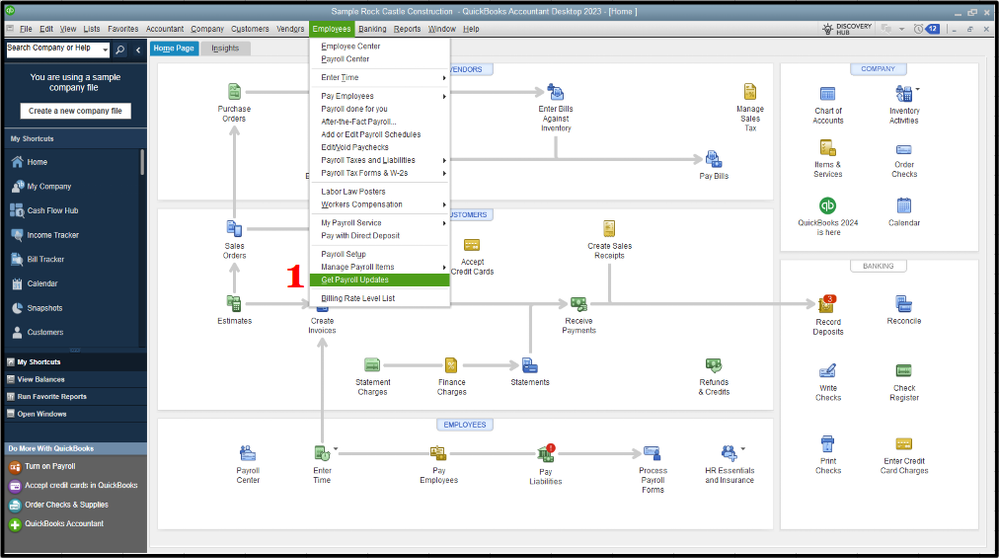

- Go to Employees, then select Get Payroll Updates.

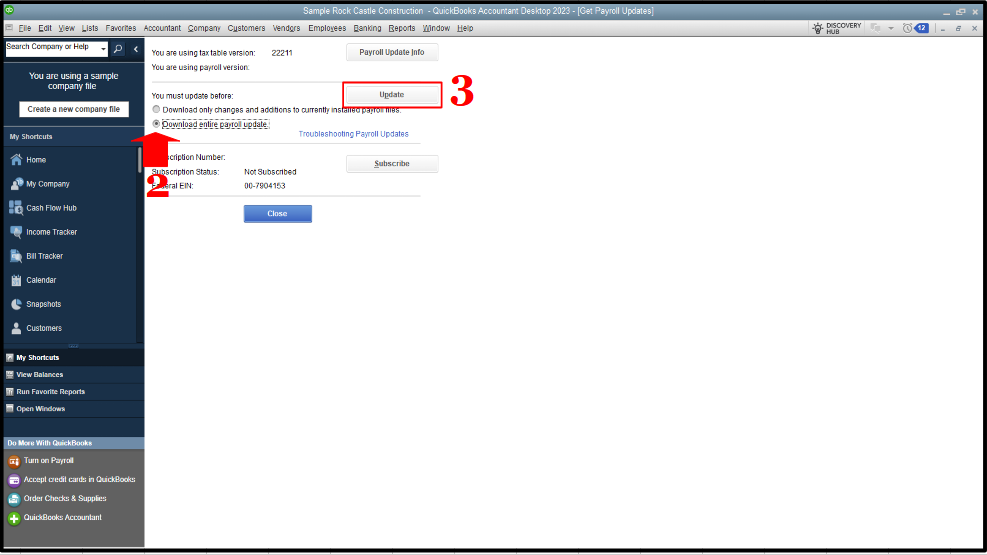

- Choose Download Entire Update.

- Tap Update. An informational window appears when the download is complete.

This adjustment can help streamline your workflow and minimize potential issues, leading to smoother operations, jules. Thank you for your attention to this matter, and please don't hesitate to comment below if you have any further questions or concerns about managing payroll data. We're available around the clock to provide guidance and solutions you need. Take care!