There's no need to worry, Brita. I'll enlighten you on how to modify the Income and COGS account for an item in QuickBooks Desktop (QBDT). This way, you can correct the errors with ease and proceed with your task.

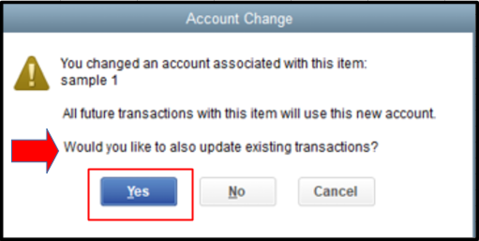

When you change an item's account in QBDT, you will receive a prompt asking if you want to update existing transactions. If you select "Yes," all previous entries will be revised, eliminating the need to enter Adjusting Journal Entries (AJE).

By pressing the highlighted button above, you can easily fix the mistakes and continue changing associated accounts in your inventory. I'll share the steps below:

- Go to Lists and click Item List.

- Locate the item.

- Right-click and tap Edit item.

- In the Account dropdown, make your revisions.

- Tap OK and hit Yes.

If you choose "No", past data will not be updated.

In case you need further guidance on managing your accounts and items, please feel free to drop your queries in the comment section below. The Community and I are eager to extend our assistance and help you out in any way we can.