Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSo I have a product that shows a unit cost of $2.49 but it should be $5.02. So let's say we have 600 items at $2.49 with an inventory value of $1,494.00. It should be 600 items at $5.02 for an inventory value of $3,012.00. I thought to correct this I would need to remove my inventory to 0, go in and change the unit cost to $5.02 and the adjust the quantity back to 600 but when I do the inventory value report still shows $2.49. I don't want to adjust the starting value just the current value. Is there another way to do this?

You can create a Journal Entry to adjust the inventory value, Dawn. I'd be glad to share some insights about this and guide you through the steps.

In QuickBooks Online (QBO), direct adjustments to the inventory value are unavailable since the system operates on a First In, First Out (FIFO) basis, which prioritizes the sale or usage of older inventory items first.

However, you can make adjustments through a Journal Entry (JE). Before following the steps below, I recommend consulting with your accountant when creating a JE to ensure accuracy.

Here's how:

For more information, refer to this article: Create journal entries in QBO.

In case you want to export your inventory value report or journal entry to use outside of QuickBooks, check this resource: Export your reports to Excel from QBO.

You can tag me in the comment section if you have any other concerns about adjusting the inventory value. I'll be around to further assist you.

But I want to correct the unit cost along with the individual product value. Won't a journal entry just correct the total inventory value and not the individual product?

That's correct, a journal entry will adjust the total inventory value in your accounting records, but not the unit cost or value of individual products in your inventory, Dawn.

As my colleague pointed out, QuickBooks utilizes a FIFO (First In, First Out) method for inventory management. Given your specific inquiry about correcting unit cost or value of individual products, I strongly recommend consulting with your accountant. They can provide tailored advice and suggest alternative approaches that align better with your particular business needs, ensuring precise adjustments in your inventory system.

For a comprehensive guide on adjusting inventory quantities in QuickBooks Online, please visit the following link for detailed instructions: Adjust inventory quantity on hand in QuickBooks Online.

Additionally, click on impacts of inventory tracking on the Balance Sheet and Profit & Loss reports in QuickBooks Online to learn how it can affect your financial reports.

Should you encounter any issues or have more queries about managing inventories, please add them in the comments. I’m here to provide further assistance.

I understand the FIFO process but why doesn't removing inventory (taking it to 0) and then changing the unit cost and receiving inventory back in doesn't change the unit cost? If I remove 600 books at $2.49/bk and then change the cost to $5.02 and receive 600 books in the new unit cost should be $5.02. I can't create a new item because all my sales history is tied to this item. We pay royalties on our books some increase by quantity sales

Adding value to the over all inventory is what's being done but I need the unit cost to be correct. Otherwise the inventory value won't balance to the balance sheet.

This is a huge system flaw if you can't correct the unit cost of a product.

Hello Dawn Dockrill,

Thanks for mentioning this! I will take this and submit feedback to our Product Developers about adding a system to correct the unit cost of a product. I encourage you to join me as well and submit feedback. Here's how:

Please let me know if you have any other questions or concerns. My team and I will do our best to assist. See you later.

I tried creating the situation you describe, but didn't see any issues:

RE: If I remove 600 books at $2.49/bk and then change the cost to $5.02 and receive 600 books in the new unit cost should be $5.02.

What do you mean by remove and then receive? What type of transactions are you entering to record these events?

Note that the cost on the item record is just a default and doesn't change the valuation.

RE: Adding value to the over all inventory is what's being done but I need the unit cost to be correct.

Your cost per item, and related Cost of Good sold when you sell an item, is based on whatever you paid for the items on hand. If the cost appears wrong, then either the cost on purchase transactions were not entered correctly or the cost is not wrong. (Unless there is a bug, but that seems unlikely).

They have known for years that you can't adjust the value of stock items in QBO, and there's no sign Intuit will ever fix it. There is no point in you submitting a feedback request via the cogwheel, as they will ignore it.

What sort of accounting package doesn't let you amend stock value?! QB Desktop, which they have discontinued in the UK, was able to do it.

Therefore, I now have to spend countless hours entering data in to spreadsheets to do the calculations for the year end, which I then need to reverse and recalculate the following year. More work, and more chance of errors.

This is just one of QBO's many shortcomings.

QB Online is a really pisspoor product.

QBO uses FIFO inventory valuation, which is why you cannot adjust an item's stock value like you recall in Desktop. The only reason you could adjust the item's stock value in Desktop is that Desktop Pro, Premier, and Enterprise use the average cost valuation method. If QBO used average cost, there would be an item value adjustment like there is in Desktop. Desktop Enterprise allows you to choose FIFO, and if you do, you can't adjust an item's stock value then either, so this really isn't a QBO issue.

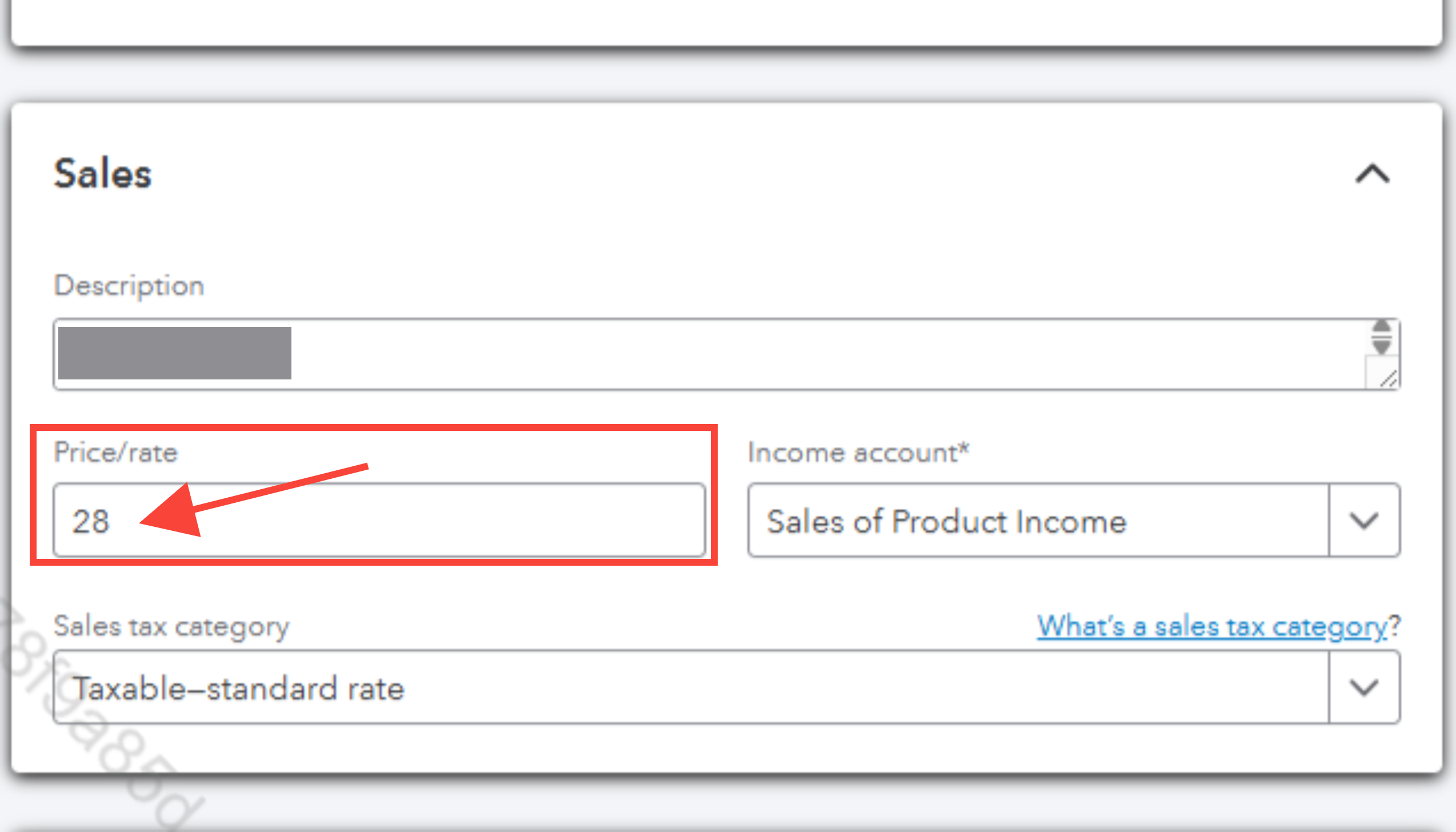

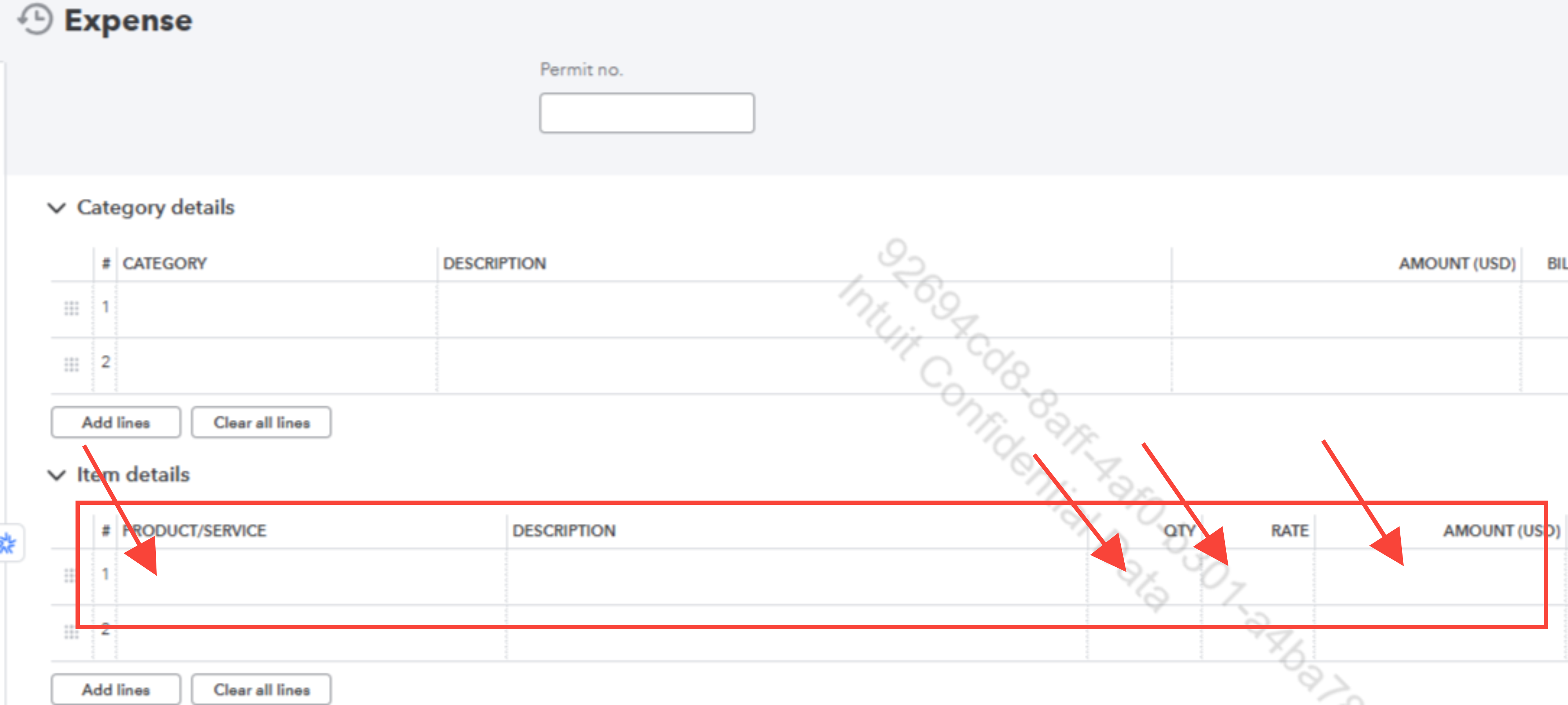

There are a few ways to adjust an item's stock value in QBO. You can zero out an item's stock value by making an inventory quantity adjustment to $0, then re-enter the quantity at the new cost using an Expense (New > Expense) transaction. The 'Payment account' is the adjustment account. You may need to set up an OCA and then journal the adjustment to COGS if COGS is your adjustment account. There are a couple of other ways that use Expense and Credit Card Credit transactions and an adjustment account to raise and lower an item's stock value.

I know this reply is kinda late...

"I understand the FIFO process but why doesn't removing inventory (taking it to 0) and then changing the unit cost and receiving inventory back in doesn't change the unit cost?"

It changes the inventory valuation of that item, which is what matters. If you make an inventory adjustment to zero out an item and then receive the item back using an Expense transaction at the desired cost, your asset value of the inventory item is the new cost. Keep in mind, the "unit cost' field of an inventory product doesn't update and isn't used to determine the value of on-hand inventory. It's just used to pre-fill the cost field when you purchase the item.

"If I remove 600 books at $2.49/bk and then change the cost to $5.02 and receive 600 books in the new unit cost should be $5.02. "

What do you mean by "unit cost". The unit cost field on an inventory product is just used to pre-fill the cost field when you purchase an item. It doesn't change when you receive items because it's not used to determine inventory value. The 'Rate' and 'Asset value' on the inventory valuation reports are what are used to determine inventory value. Zeroing out an inventory item and receiving them back at the new, desired cost will update the Rate and Asset value.

HAS THIS ISSUE EVER BEEN CORRECTED???

Hi, Barb8112.

As mentioned by Rainflurry in the previous response, the effective way to adjust both the quantity and the total inventory value in your system is by clearing out and then re-entering the stock using an Expense transaction. This method ensures that your inventory and financial records remain accurate and up-to-date.

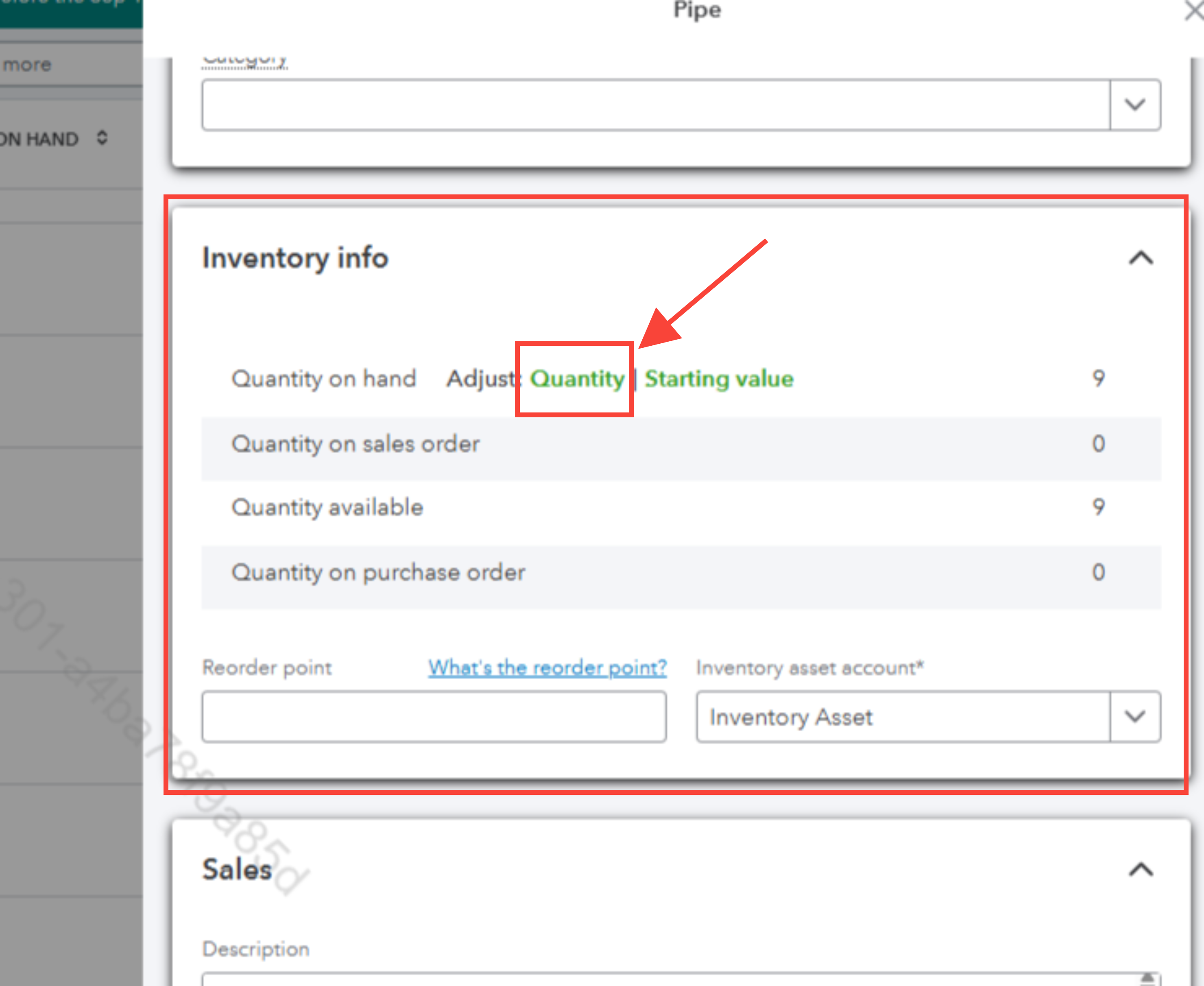

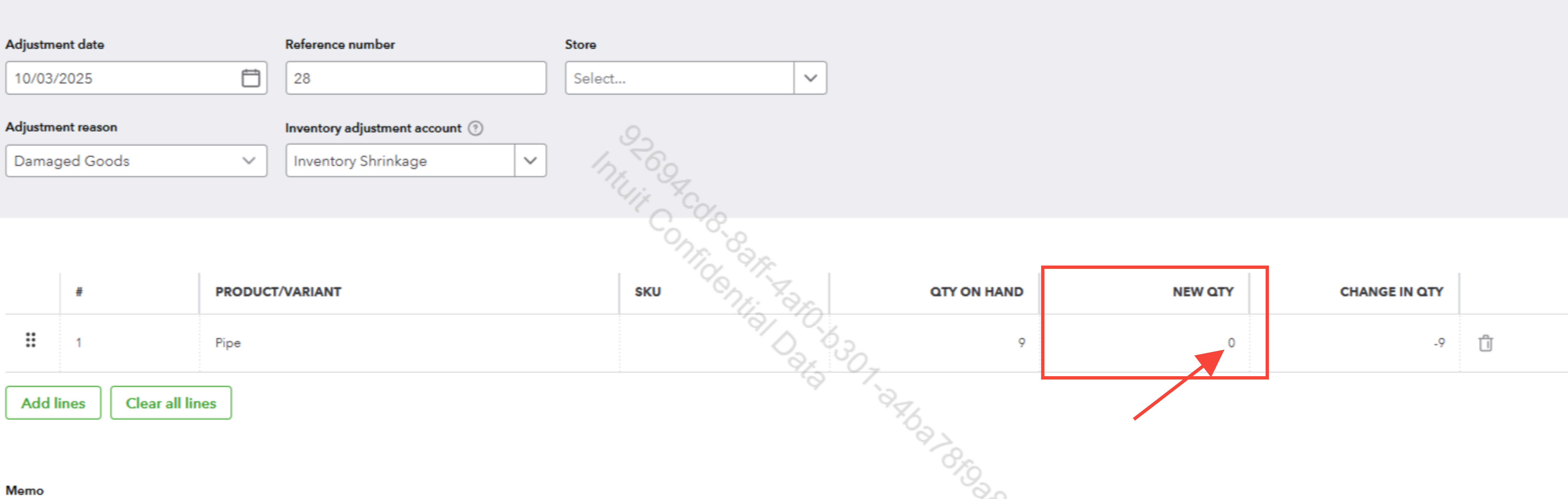

To clear out the inventory, you'll need to set the Quantity on Hand to zero. Here’s how you can do that:

To re-enter the quantity with updated rates, follow these steps:

Once you're done, these updates will automatically apply to future invoices and reflect in your reports.

Please let us know if you have any additional questions.

You're tackling an issue many folks face when inventory values in quickbooks don't match up with actual costs. Changing the unit cost alone doesn't adjust current inventory value. That part's tricky. QuickBooks doesn't recalculate existing stock with the new rate; it applies only to future buys. So, if ya want to get your current inventory value right, without fiddling with starting values, you gotta do an inventory adjustment.

Try this: Reduce your inventory to zero, but pop a reason in there like "Correction." This way, you keep track of why you're making the change. Then, re-enter teh items at the proper cost per unit.

Does it feel like a hassle? Yeah, kinda. But it keeps things neat and tidy. And make sure to do a backup first! Big changes like these can mess things up, and you definitely don't wanna do it twice cuz of a mistake, right?

Anyway, realigning inventory isn't always simple, but getting it right means your financials actually reflect reality. If problems keep popping up, maybe check out automation tools that mesh with quickbooks to cut down on human errors.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here