Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe are a construction company and one of our charges on every estimate is a "reuse fee" for the plans they chose us to build. How do I get this cost to show on the Estimate vs Actual report without an actual bill? We need it to appear on this report as we share this report with our clients.

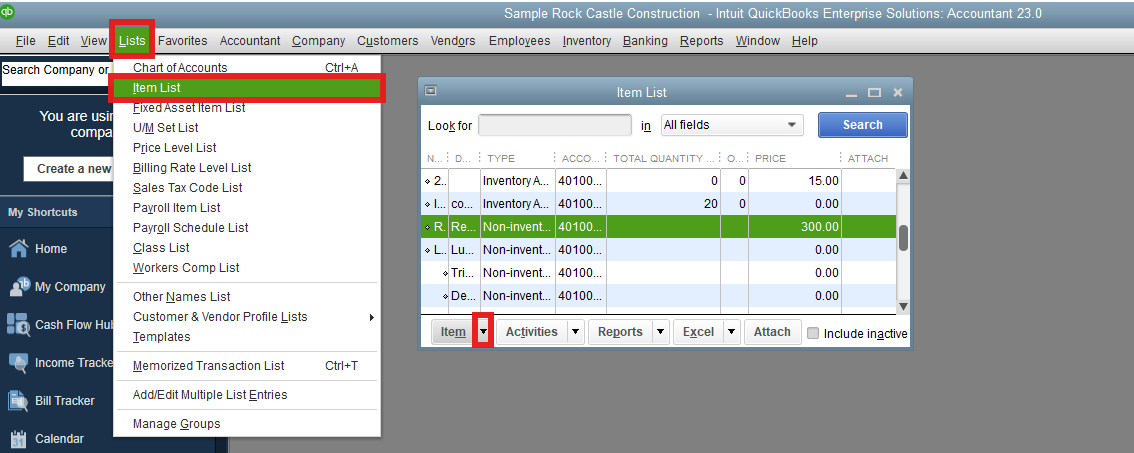

To display the cost on the Estimate vs. Actual report without an actual bill, you can enter the fee as a non-inventory item on the estimate.

Please note that the estimate cost will not appear in the Actual Cost column because estimates are considered as non-posting transactions. Actual cost, on the other hand, are based on real transactions such as vendor bills that directly impact your financial records.

Here’s how:

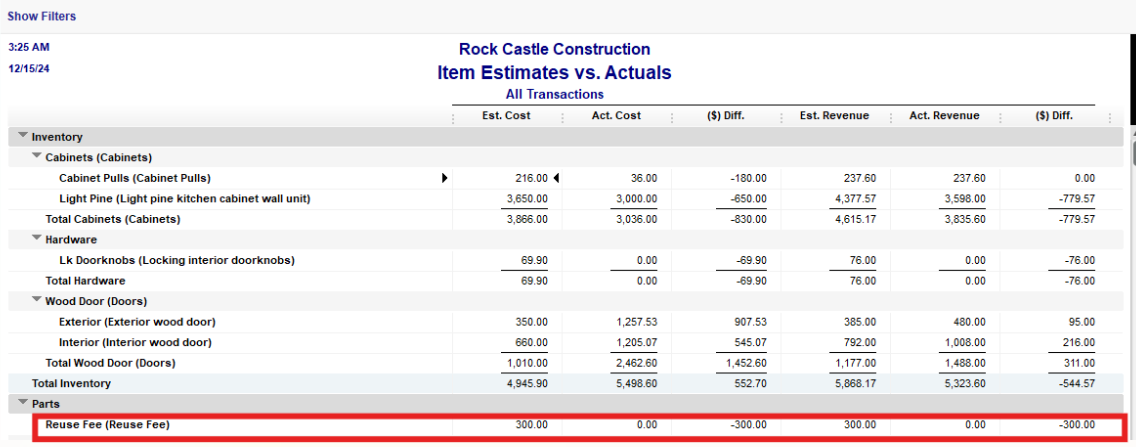

Once done, when you create an estimate. Add the Reuse fee item that you’ve created, then generate the Item Estimate vs Actual Report. Please see the attached screenshot below:

Don't hesitate to revisit this thread if you have additional questions.

Thank you! I have been able to get it to show as part of the Estimate on the report (under hte Est. Cost column), but I can't get it to show under the "Act. Cost" column. We share this report with our clients, so I need them to see that they have been charged the Plan Reuse Fee as well. Any idea how to show it under the Actual Cost without a bill?

Thank you. I do understand this and have no problem getting it to show as part of the Estimate. I really just need to find a way for it to show under the Actual Costs column. You mentioned Journal Entry. Is there a way to create a Journal Entry that will show the cost under the Actual Costs column on the Est vs Act report? As mentioned with the previous support received, this specific report is shared with our customer, so they need to see what that actual cost is to track their costs associated with the job (we bill our customers the actual costs of the job plus a management fee, so it is open-book). Thank you!

Hi, Kelly. To display information in the Actual Cost column of the Estimate vs. Actual Cost report in QuickBooks Desktop (QBDT), you can create a zero-dollar check. This allows the data to appear in the report without inflating expenses.

While we can technically create a Journal Entry (JE) to record costs, it will not effectively reflect in the Actual Costs column on the Estimate vs. Actual report because we can only choose accounts in JEs; therefore, they can't be tied to the Reuse fee item created.

Here's how you can write a zero-dollar check:

Once done, run the Estimate vs. Actual cost report to verify that the amount is displayed under the Actual Cost column.

In the report, you'll see a comparison between the estimates you entered earlier and the actual costs incurred based on the checks, bills, or other vendor transactions tied to the job.

Please don't hesitate to reach out if you have any additional questions or concerns. We're here to provide ongoing support and assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here