Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIs it possible in QBs Online to bill a tenant for sublease (rent) income and then customize that income to be applied against rental expense- so that the rental income reduces your rental expense.

I am being billed $11k for rent by my landlord, and billing my subtenant $11k and I would like my rent expense in my P&L to be zero?

thanks in advance for any help..

Hi there, Tom. I'm here to ensure you can record the tenant's sublease.

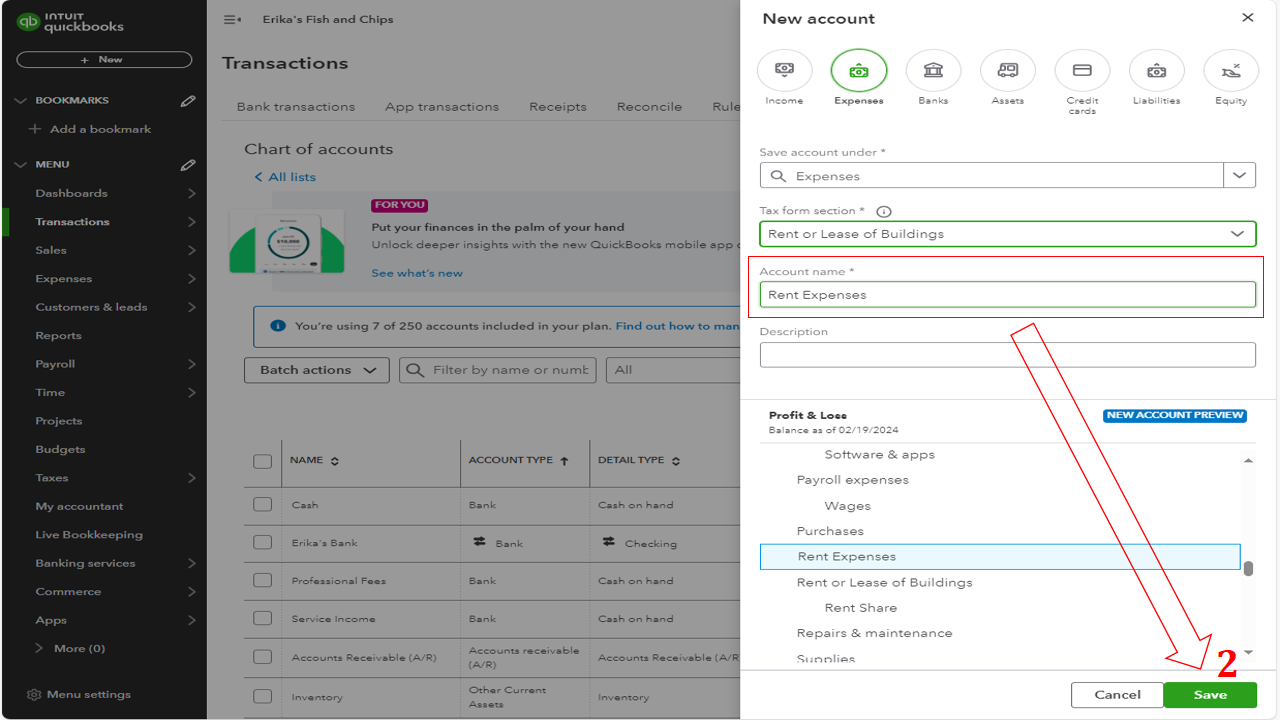

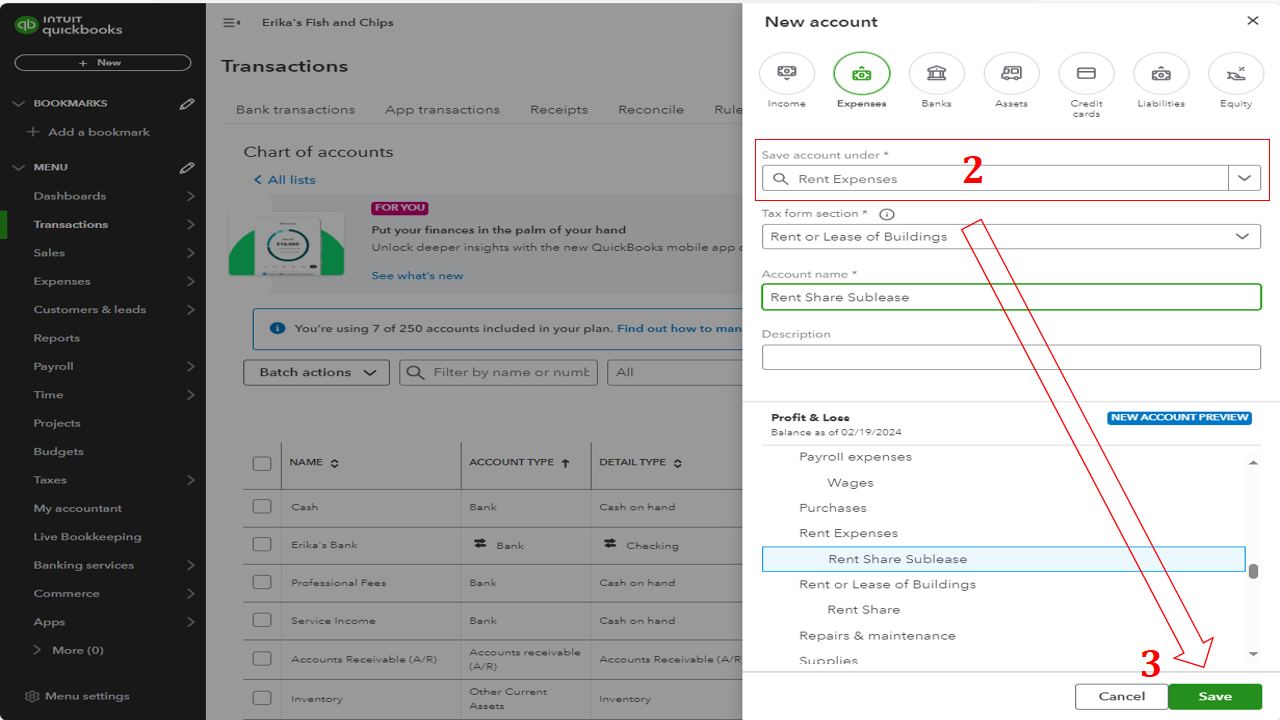

In QuickBooks Online (QBO), we can bill a tenant for sublease income and customize it to apply it against the rental expense. This way, the rental income reduces the rental expense. To accomplish this, we can create an expense account and a sub-account first.

Here's how:

To create a sub-account, we can:

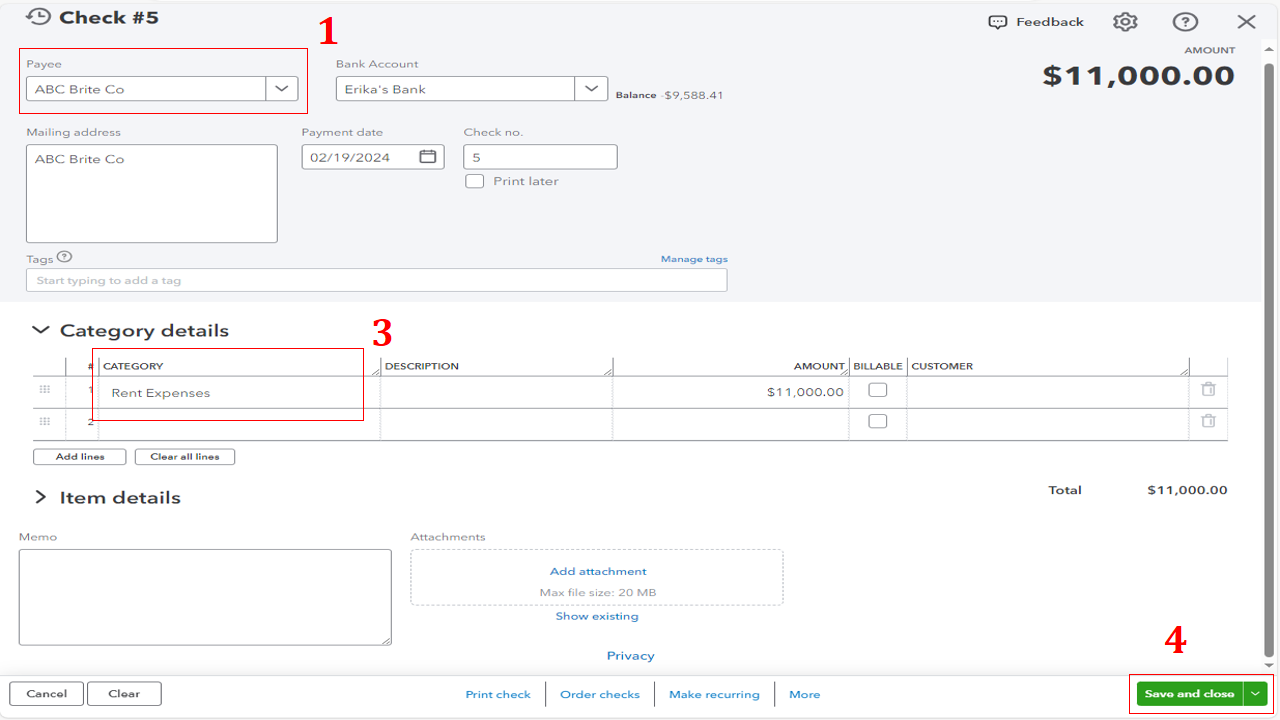

Second, we create a check or expense to record the rent issued by your landlord, affecting the expense account. Let me show you how:

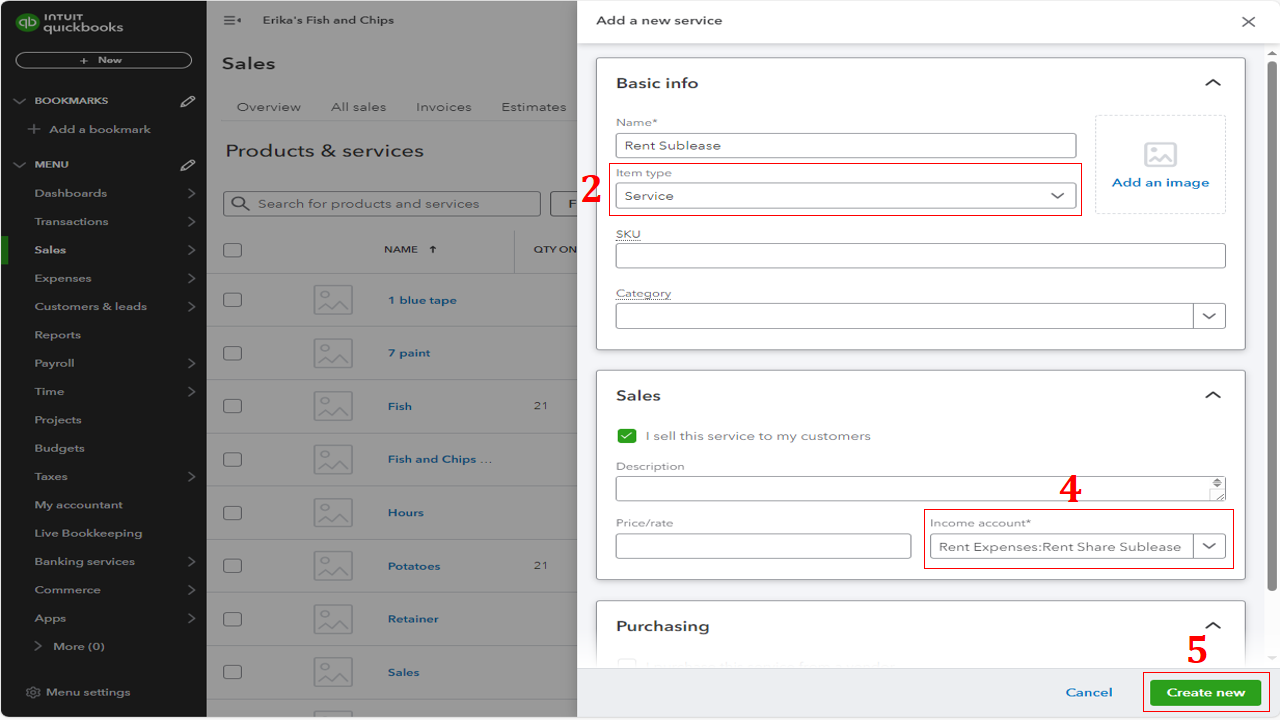

Third, we can bill your tenant by generating an Invoice and selecting the service item specific to the sublease.

To create a service item affecting the expense account, perform the outlined steps:

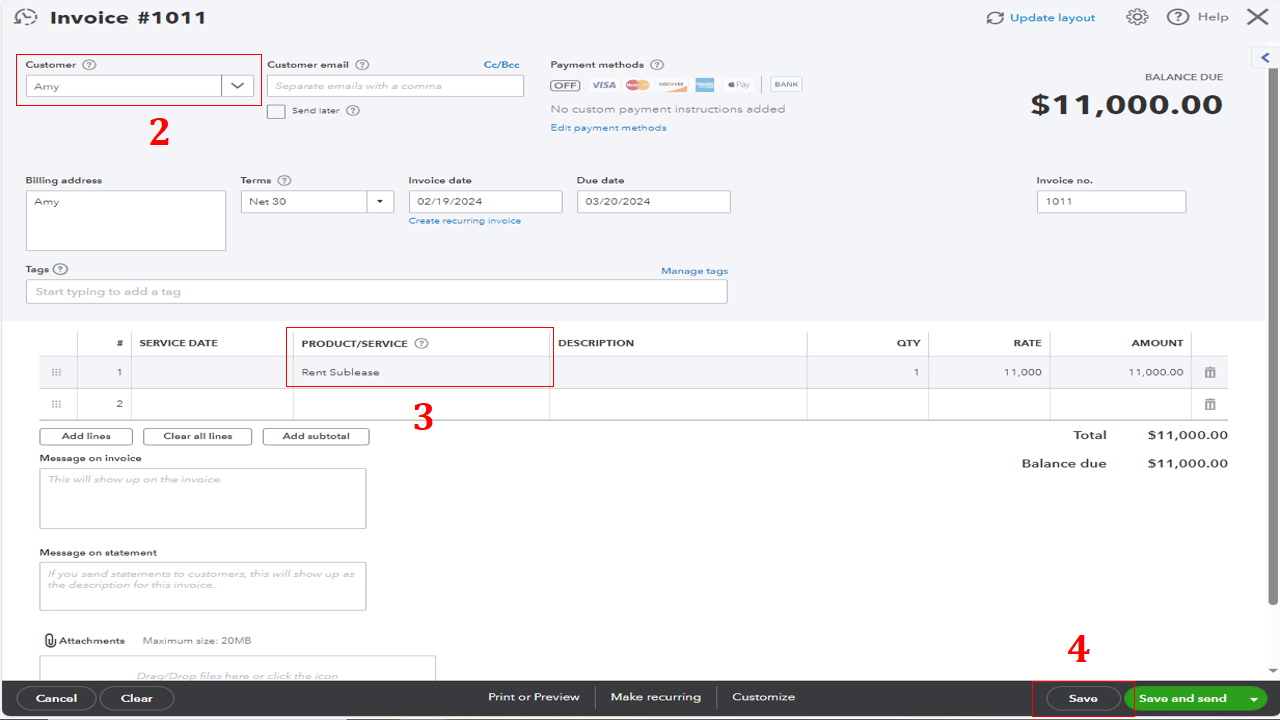

Then, we create the Invoice. Here's how:

Afterward, you can pull up the Profit and Loss report to generate your transactions and provide a snapshot of your tenant's sublease. I'll add an image for visual reference.

Moreover, I've included these articles about managing your reports in QBO:

Keep me posted if you have additional questions about managing your customer invoices in QBO. Keep safe always!

Hi @Tom208, responding to your question... If you simply wish to avoid this rental activity (both payments from tenant and payouts to landlord) from showing up on your P&L, you can simply use liability accounts to track each. This way, the movement is reflected in your balance sheet and can be shown with a transaction report instead of affecting your P&L, all while being able to track the activity. In this case, you are neither tracking this as income or expense. Based on your original question, it seems this might be a solution to consider.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here