Let's get the employee's raises show up, DJoreo.

To ensure the employee's pay records are accurate, we can make an adjustment to show their raises in the pay adjustment history. Here's how:

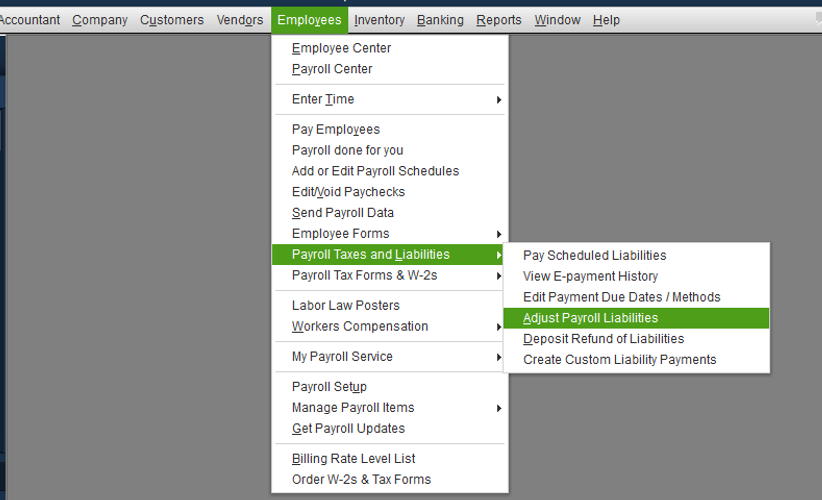

- Click Employees at the top menu bar and choose Payroll Taxes and Liabilities.

- Tap Adjust Payroll Liabilities.

- Enter the Date and Effective Date.

- Under Adjustment is for, choose Employee.

- Select an item and enter the Amount.

- Tick Accounts Affected and then OK.

- Hit OK.

For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, we'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Additionally, if you need help with removing overdue liabilities, you can refer to this article for the detailed steps and instructions: Enter historical tax payments in QuickBooks Desktop Payroll.

Please let me know how it goes by leaving a comment below. If you have more questions about payroll or need anything else with QuickBooks, don’t hesitate to ask. I’ll be here to help, DJoreo. Have a pleasant day!