Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWe use a 3rd party company to ship orders, we top-up the account in order for us to buy the shipping labels. The total cost for each label purchase includes the label cost/shipping + tax.

The 3rd party company gave us a (just 1 statement, not monthly) statement which covers the year 2022.

The statement only shows the following details:

Our bank statement matches the total top-up (e.g. $1,000) for the year 2022.

Now, We also want to deduct the Total of taxes (e.g. $100), if possible put it under the "taxes" category. Can we achieve it by adding New Expenses?

Thanks!

Solved! Go to Solution.

Hi there, @marumir05.

I'm here to help deduct the taxes in QuickBooks Online (QBO).

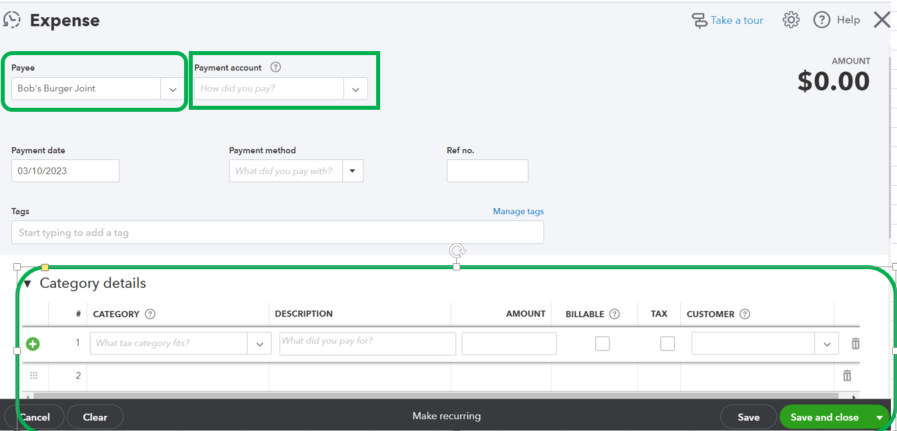

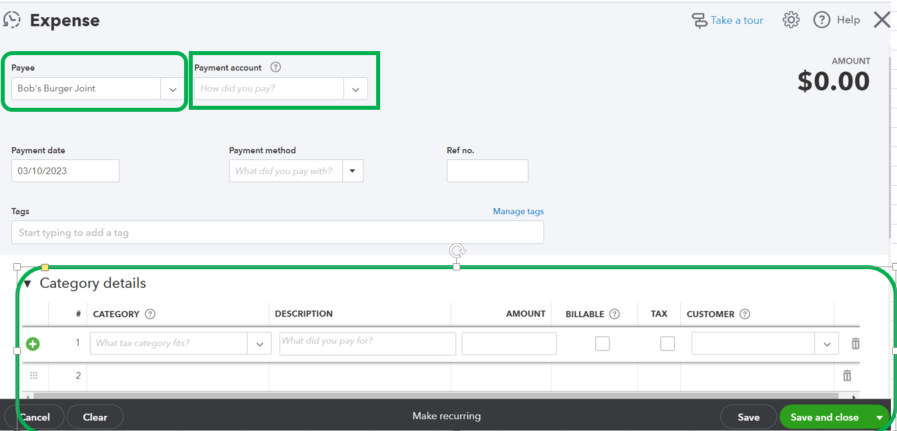

Yes, you can deduct taxes by creating a new Expense transaction and adding sales tax under the category column and the exact amount to match the bank statement.

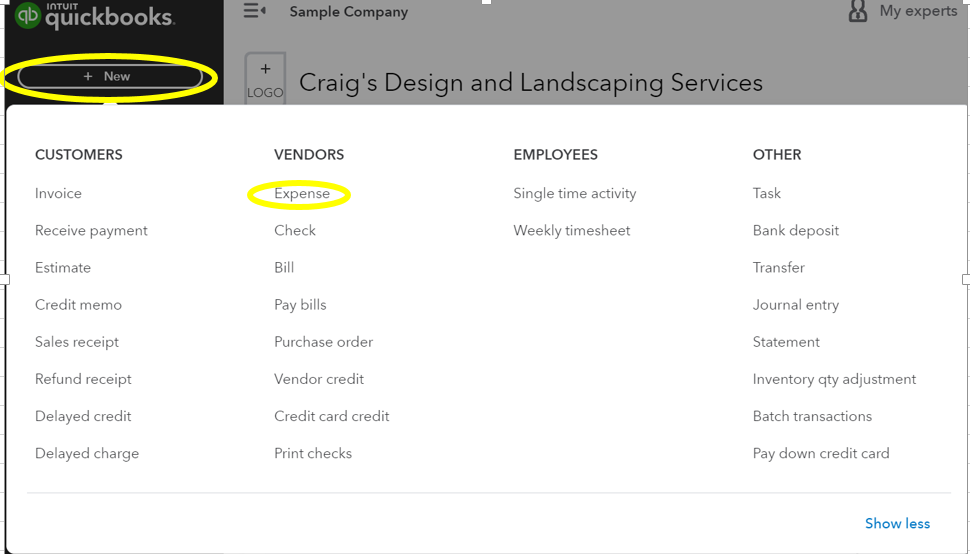

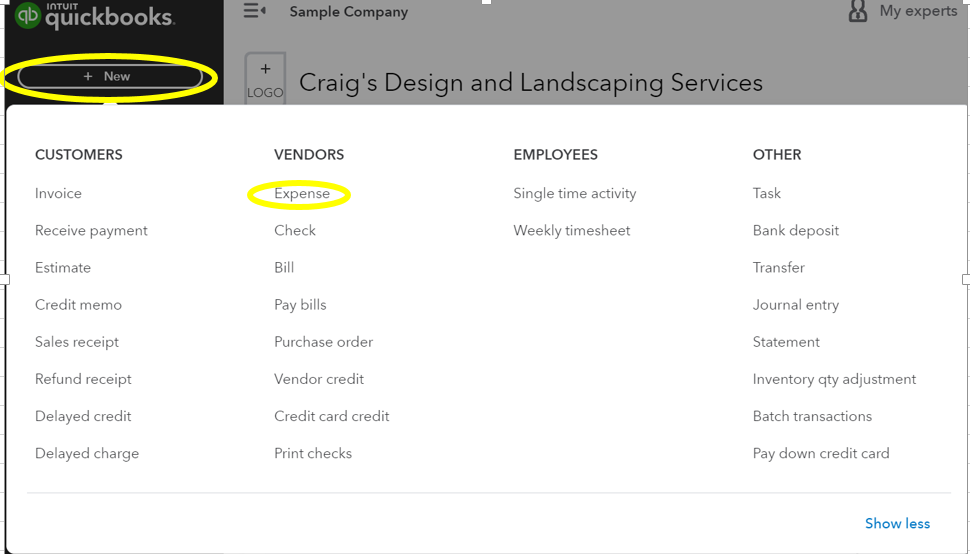

Here's how:

I also advise you to speak with your accountant so they can advise you on how to handle Unrestricted Net Assets. You can check our ProAdvisor page if you aren't associated with one, and we'll assist you to locate one from there if you aren't.

For more information about using a custom tax rate that suits your location and then adding them to your invoice or sales receipt, check out this article: Use custom rates to manually calculate taxes on invoices or receipts in QuickBooks Online.

I'll be sharing with you the following links below. These will provide you with more details on how each sales tax is being calculated in QuickBooks Online as well as steps on how to add sales tax categories to your products and services:

I'm always here if you have further questions about sales taxes in QBO. I'm always glad to help in any way I can. Have a wonderful day!

Hi there, @marumir05.

I'm here to help deduct the taxes in QuickBooks Online (QBO).

Yes, you can deduct taxes by creating a new Expense transaction and adding sales tax under the category column and the exact amount to match the bank statement.

Here's how:

I also advise you to speak with your accountant so they can advise you on how to handle Unrestricted Net Assets. You can check our ProAdvisor page if you aren't associated with one, and we'll assist you to locate one from there if you aren't.

For more information about using a custom tax rate that suits your location and then adding them to your invoice or sales receipt, check out this article: Use custom rates to manually calculate taxes on invoices or receipts in QuickBooks Online.

I'll be sharing with you the following links below. These will provide you with more details on how each sales tax is being calculated in QuickBooks Online as well as steps on how to add sales tax categories to your products and services:

I'm always here if you have further questions about sales taxes in QBO. I'm always glad to help in any way I can. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here