Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

I have a question about this specific situation. One of our employees booked a flight for a business trip with a company business credit card, but the trip was cancelled because of covid19 situation. She asked a refund for flight tickets to the airline company, but got refunded not to our business credit card but to her airline account with store credit for future use(airline policy).

In this case, how we do process or record about this? Should we ask her to payback for the amount of her store credit on her airline accounts? Or just leave it as a travel expense even though it didn't happen? She will have another business trip in the future and she wants to use her credit for the next business trip. And this same situation may happen to other employees very soon, so I would appreciate if I get an advice from you guys!

Thank you and stay healthy!

Solved! Go to Solution.

The expense you posted for the trip needs to be edited, change the expense account to an asset account you create called due from [name]

When the employee books the next flight using that flight credit do a journal entry

debit trip expense, credit the due from asset account

Since you were specific about not getting an actual refund, I'm not sure why @JasroV said to deposit it in the business account

It'll actually depend between you and your employee, @summersummer.

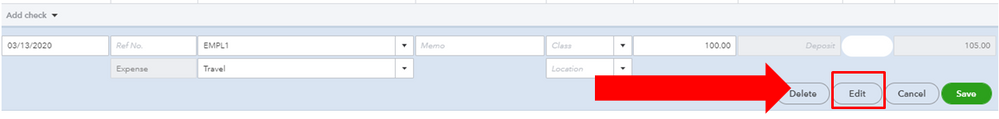

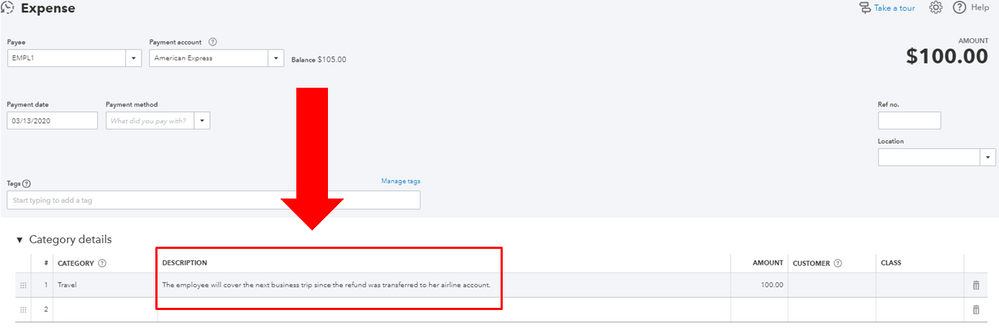

You can let your employee deposit the refund to your business account using her airline account. Or, enter a note in the description field of the travel expense that the employee will cover the next business trip in the future. Let me guide you how.

In your QuickBooks Online (QBO) account:

In case you want more insights on how to better record this, I recommend reaching out to your accountant. Also, do check your Income and expenses page to learn some best practices on managing your expenses.

Then in case you need to reimburse your employee in the future, you can check this great article for the detailed steps: Reimburse an employee.

You're always welcome to post here anytime you have other concerns and questions in the future. Our door is always open to help. Take care and stay healthy!

The expense you posted for the trip needs to be edited, change the expense account to an asset account you create called due from [name]

When the employee books the next flight using that flight credit do a journal entry

debit trip expense, credit the due from asset account

Since you were specific about not getting an actual refund, I'm not sure why @JasroV said to deposit it in the business account

@JasroV Thank you so much and sorry for saying this late! Hope you stay safe!

@Rustler Thank you so much and sorry for the late response! Your explanation is very simple and direct, so I was able to figure out what to do :D

Hope you stay safe and have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here