Hi there, mindfulmassagefo.

Adding a sales tax to an invoice is quick and easy. Let’s add the sales tax line item and manually add the amount on the transaction. I’ll be your guide today on how to enter the information.

Here’s how:

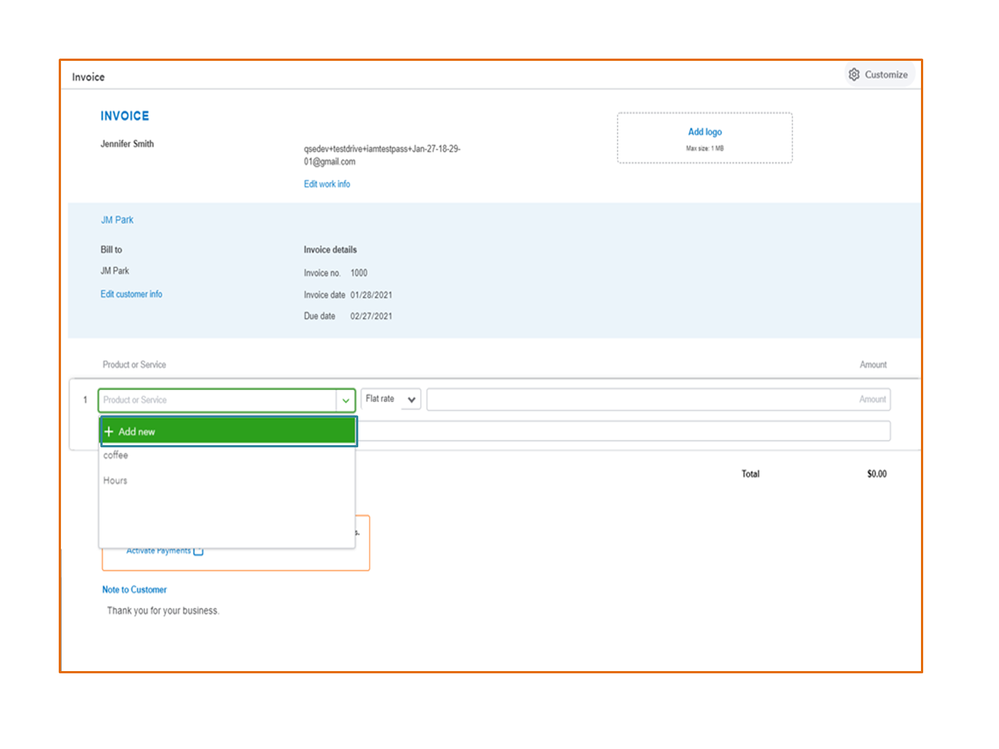

- In your company, tap the Invoice menu on the left panel.

- Fill in the fields with the correct details.

- In the Product of Service section, go to the first line and click the drop-down to choose Add new.

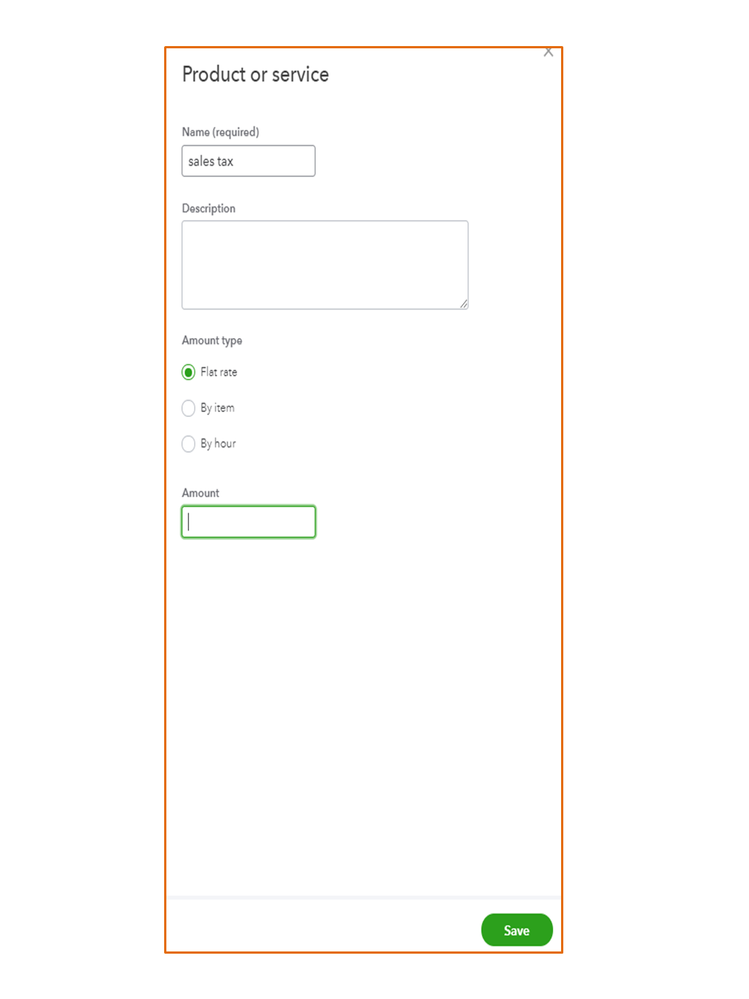

- Key in the sales tax information in the Product or service screen. For example, Manual sales tax.

- Hit the Save button.

After setting up everything, you can add the sales tax to the invoice. Here are a few things to keep in mind when adding the rate.

- Always review the Amount field. Make sure you calculate the sales tax amount for the purchase total.

- Always note in the Description field how much sales tax you added to the invoice. This will help you stay organized during tax season.

Let me share this article to learn more about how the Sales Tax feature works in QBSE. It includes instructions on how to add sales tax to downloaded entries: Manually track sales tax.

You can bookmark the following guide for future reference. It outlines the complete instructions on how to customize and invoice, turn on the payments option, etc: Create invoices in QuickBooks Self-Employed.

If you have any clarifications or other QuickBooks concerns, feel free to post a comment below. I’ll pop right back in to answer them for you. Enjoy the rest of your day.