I'll gladly show you the way to enter your equipment in QuickBooks Online, caribbisles.

To do this, we'll have to create an asset account in the Chart of Account. Here's how:

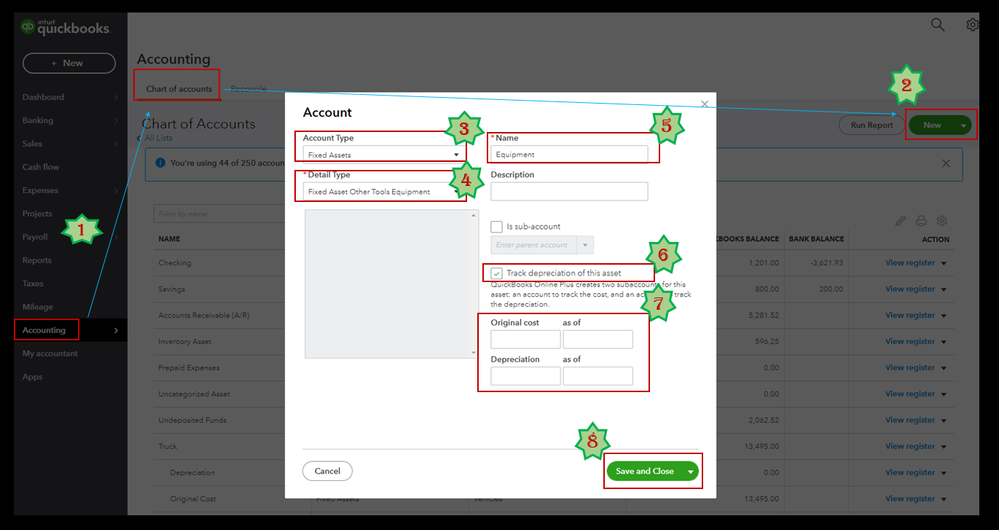

- Go to the Accounting menu and then select Chart of Accounts.

- Select New.

- From the Account Type drop-down menu, select Fixed Assets or Other Assets.

- From the Detail Type drop-down menu, select the option that closely describes the asset.

- Name the account.

- Place a checkmark in the Track depreciation of this asset box.

- Enter the current value of your asset in the Original cost field and the as of date. If recording the loan, leave this blank.

- When you're done, select Save and Close.

For your visual reference, I've attached some screenshots below.

For more details, please see this article: Set up an asset account in QuickBooks Online.

Also, you can check out this article to better understand what each account is for and what it does: Learn about the Chart of Accounts in QuickBooks.

In case you'd like to calculate your equipment's depreciation, I'd suggest checking out this article: Depreciate Assets in QuickBooks Online. Also, it would be best to consult an accountant during the process. This way, you can prevent messing up your books.

Please come back and keep us posted on your progress in recording your assets in QuickBooks. It's my priority to ensure everything is tracked accurately.