Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for reaching out, @usermparrish3333. I'd be glad to assist you in getting your charges to show up as expenses.

Hotel charges for business travel should be categorized as Travel expenses. Make sure they're categorized correctly.

Follow these steps:

Once done, you can check your ongoing expenses tally on your Homepage. You may also use this guide for classifying transactions: Schedule C and Expense Categories.

You can also review your tax reports to ensure that all your business expenses, including hotel charges, are properly accounted for.

If you have any further questions or need additional assistance, don't hesitate to reach out. We're here to help you make the most of QuickBooks Self-Employed and ensure your business finances are well-managed.

Hey thanks for your reply. The thing is all my transactions are already categorized as business expenses/travel expenses (is there a differenece?) ... but for example i have a single hotel bill that exceeds the amount indicated as my entire expenses for the year to date. For some reason QBSE simply doesn't seem to factor anything into the so-called expense report. Hoping there is just some switch i haven't pulled that will properly account these expenses.

Hello there, @usermparrish3333.

Thank you for responding to our inquiry in the Community. Rest assured, I will assist you in generating an accurate report with the correct data.

When generating the report, ensure that the date and posting account of the transaction is accurate. Incorrect information in these fields could be the reason for any discrepancies. To resolve this, simply navigate to the Transactions page and filter the entries by date and account.

Here's how:

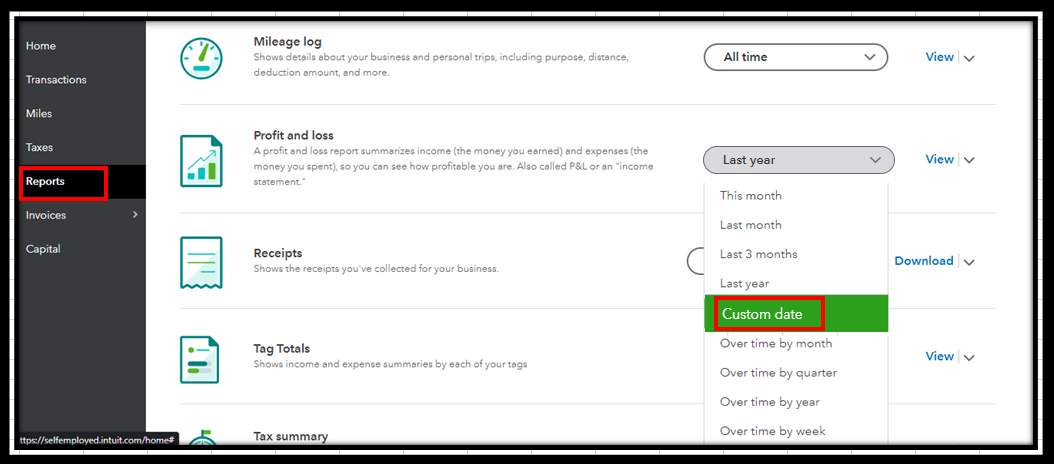

I’ve added screenshots for visual reference:

You can also check this link to get additional details about custom categories in QBSE: Custom categories in QuickBooks Self-Employed.

I'll include this helpful resource that you can read to provide guidance in calculating your taxes in QBSE: Automatically estimate your income tax in QuickBooks Self-Employed.

I'm pleased to share these details with you today. If you have any further questions regarding your reports or statements, please feel free to leave a comment below and I will be happy to assist you. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here