There's a similar report in QuickBooks that can help with your reporting as a non-profit organization, 887.

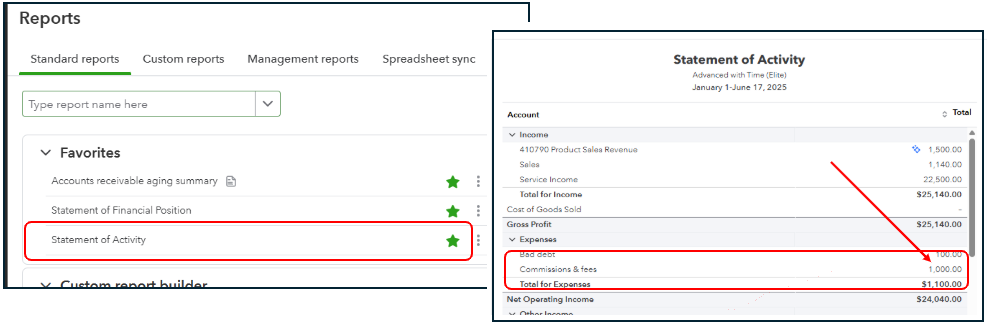

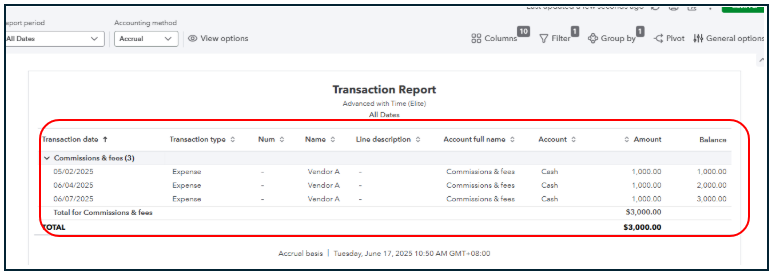

While QuickBooks Online doesn't currently offer the Statement of Functional Expenses, you can run the Statement of Activity to view the different classifications of expenses. You can easily click the total amount on each expense category to see the list of transactions that are posted under it.

Here's how:

- Go to the Reports menu and look for Statement of Activity.

- Select the expense account, then click the total amount.

Aside from that, you might also want to use the Class tracking and sub-account features. They will let you add another layer of classification to your transactions for easier reporting.

Check out these articles for more details:

You may also want to use these articles as additional resource materials when running reports:

As always, feel free to post follow-up questions or new inquiries if you need anything else.