Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI want to make sure you're able to change the status of your estimate, @

luann4369.

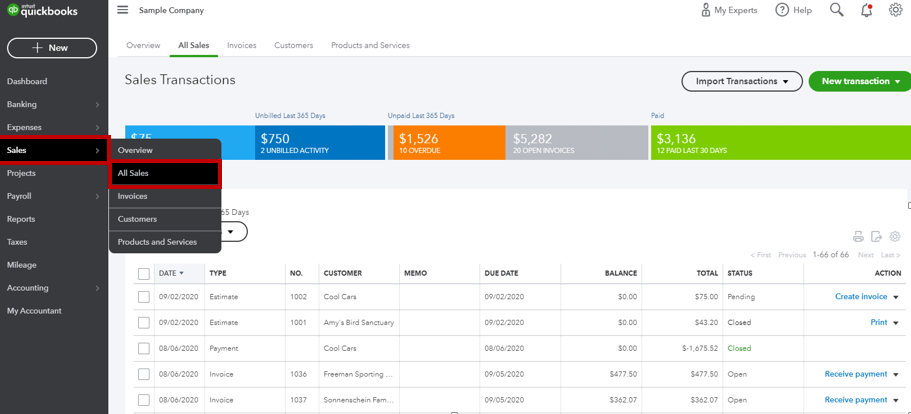

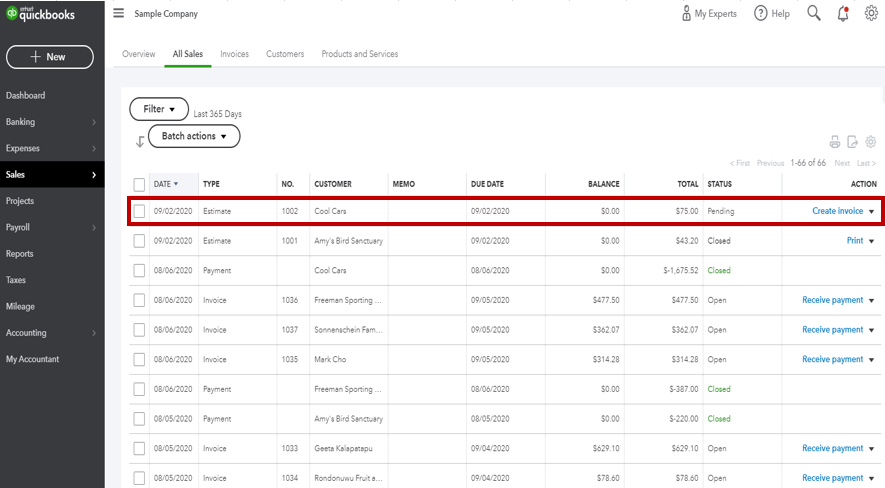

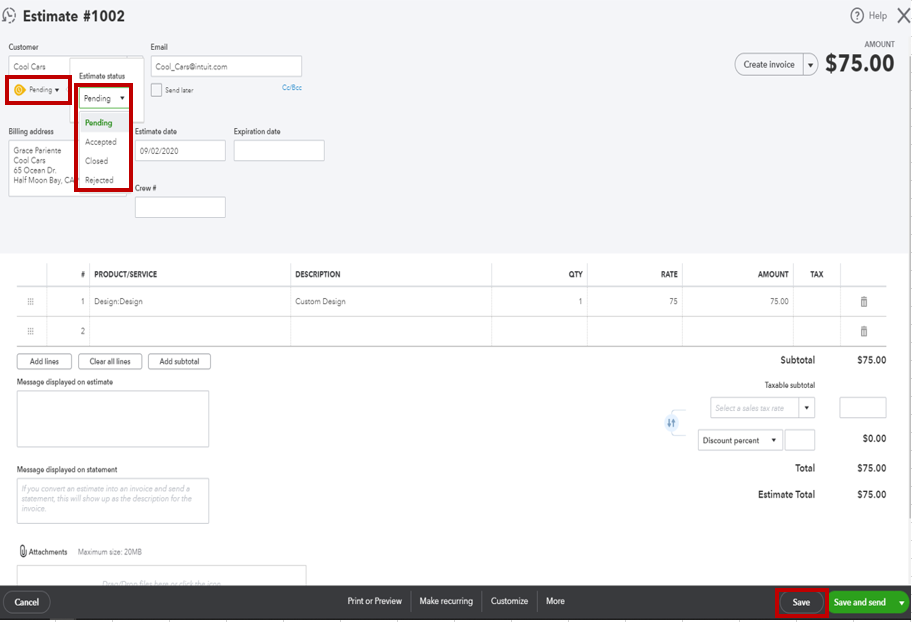

We can go to the Sales menu to find the estimate, then modify its status. Let me show you how:

I'm also adding this article for future reference. This can guide you through the process in case you need to add an estimate to an invoice in QuickBooks Online.

Let me know if you have other queries with your estimates. I'm always here in the Community to help you. Have a great day.

I can't seem to edit any estimate from a previous/closed year. When I try to edit, there is a pop-up (see attached screenshot) saying that it is from a previous/closed year and to enter a password. I should be able to edit any estimate, since it is not a transaction and doesn't affect the books, correct?

Thank you for joining the thread and sharing a screenshot of your concern, @KHuihui.

Yes, you're correct. You can modify the estimate from your closed books since it's a non-posting transaction. Moreover, the system will always ask you to enter a password when trying to edit a transaction to closed books. You can enter the one you write when closing the books. However, if you forgot the password, I suggest resetting it so you can enter a new one. Here's how:

Once done, you can now start modifying the estimate from your closed books.

I'm adding this article to learn more about changing the password of your closed books: Edit your closed books.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day.

Is there a way to circumvent this for estimates only? We frequently have estimates that the timeframe of a month between the time they are sent and accepted and need to be converted to an invoice. Unfortunately after month end close the estimates are locked. Is there a way the turn off the locking function for estimates only?

I second this as a needed change. My accountant sets the password so that I cannot change anything from the previous year, potentially changing something on the tax return. In the current QBO setup, that includes estimates, but my estimates may change to add or deduct via change order the year after they are made.

As the Accountant, we close the books for our clients so that they cannot accidentally change closed accounting data. We do not share the password with our clients. With Estimates being non-posting transactions, the client should be able to modify an Estimate without having to put in a password and without having to contact us to "open" the accounting period just to change an Estimate. That wastes both of our times. As it stands now, I cannot close the period for a few of my clients because they are constantly updating Estimates. It seems like QBO could figure out how to allow non-posting transactions to not be affected by closing periods. I waste so much time trying to re-balance accounts on a monthly basis because I can't close the books.

Couldn't agree more. I have a quote for a client from June which I am unable to edit because it is now August and our accountant has closed off our books. Now that the client wants to proceed with this particular quote number, I need to duplicate the quote and supply them with a new quote number to provide a PO against. Quotes are non-posted transactions and should NEVER be locked out by closing the financial year out.

Couldn’t you change the date to the current year to avoid the date for year end?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here