Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIf I sell an inventory item or an inventory assembly to a customer and then the customer never receives the item because the carrier loses it, how do I give a refund to the customer without increasing the inventory amount for the item that was sold to them?

On the invoice, if I click "refund/credit" then the inventory item I am giving the refund on will be added back in to inventory. However we do not have the item so that would be incorrect.

We will attempt to file a claim with the carrier, however we have found it is extremely rare for a carrier to pay even if it is clear they are at fault. But there would be two options I need to understannd:

1) refund the customer without putting the item back in inventory and the carrier does not pay for the lost item

2) refund the customer without putting the item back in inventory and the carrier does pay for the item.

The only way I can think to handle this is to refund the customer (which will put the item back in inventory), then do an inventory adjustment of -1 with the account being a loss/theft expense account.

Thank you.

Solved! Go to Solution.

You're on the right track in processing a refund, @elsalty.

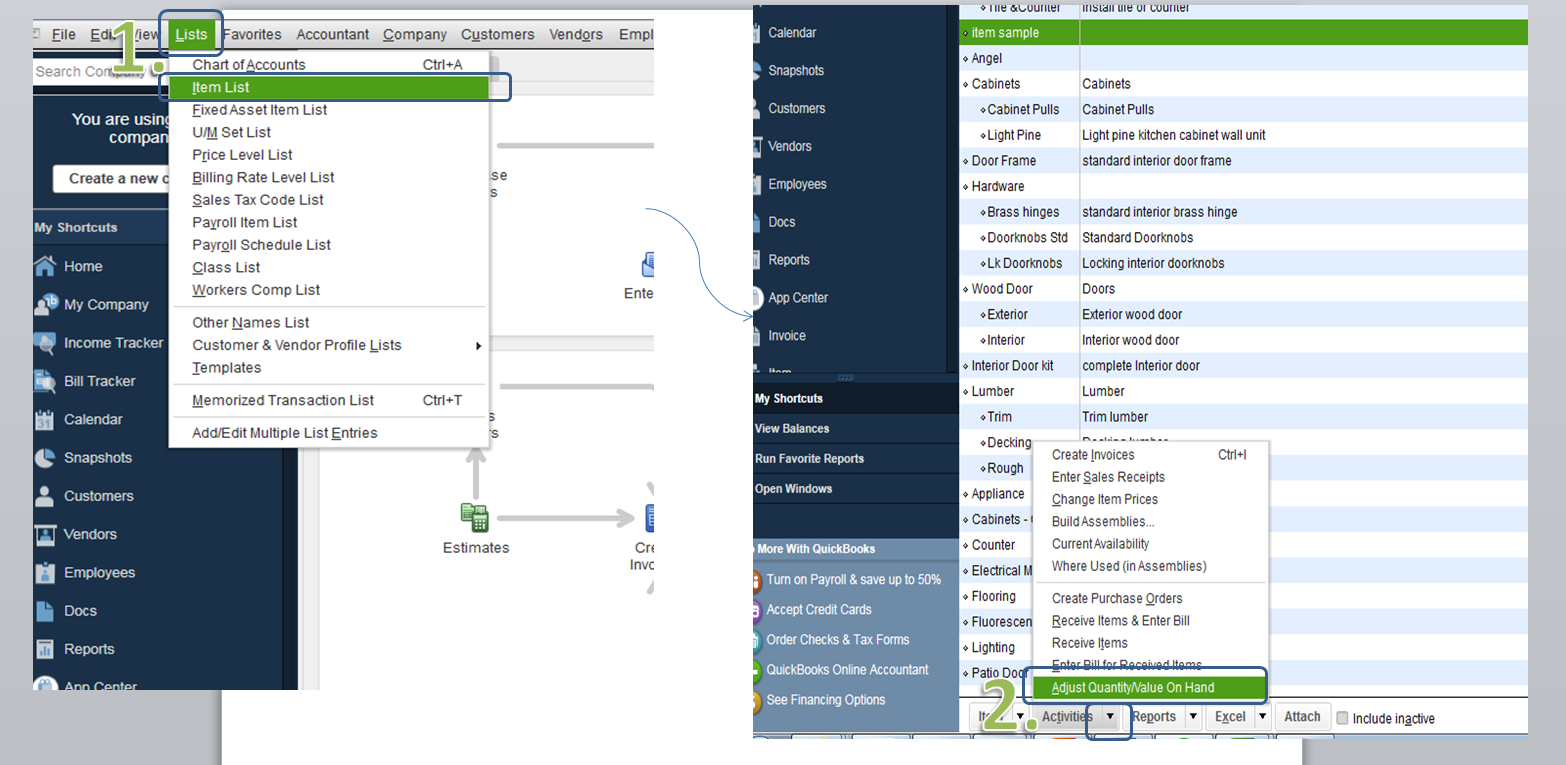

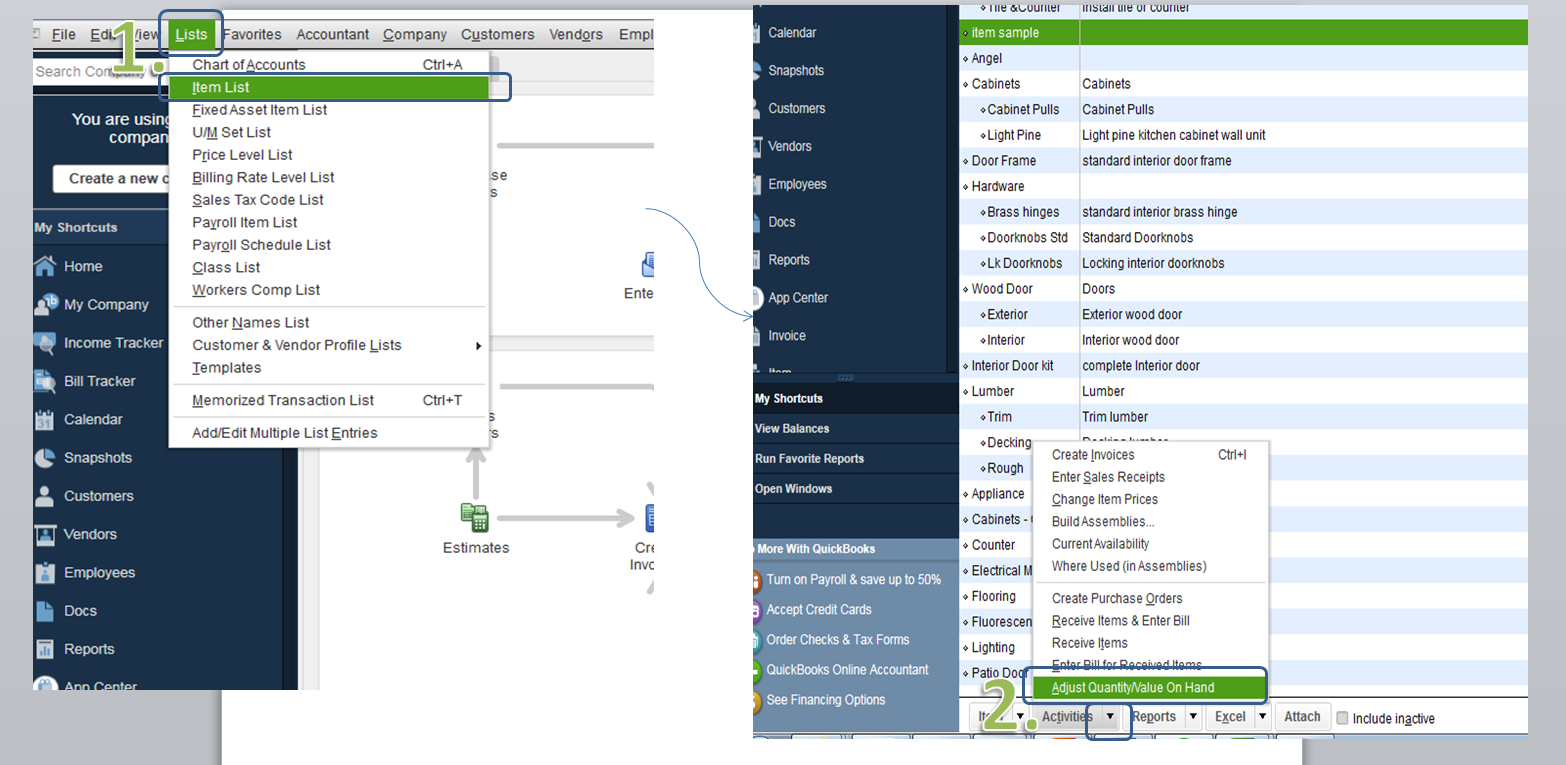

You can perform an inventory adjustment to lower the quantity of your inventory items. I can guide you in doing so.

I'd recommend consulting with an accountant in choosing an Expense Account as the Adjustment Account. By doing so the transaction will reflect on your profit and loss report. You can read through this article for more details about the process: Adjust your inventory quantity or value in QuickBooks Desktop.

On the other hand, you can use this article as a reference if you have specific invoices that become uncollectible: Write off bad debt in QuickBooks Desktop.

Feel free to visit us here if you have other questions about tracking your income and expenses in QuickBooks. I'm always here to help.

You're on the right track in processing a refund, @elsalty.

You can perform an inventory adjustment to lower the quantity of your inventory items. I can guide you in doing so.

I'd recommend consulting with an accountant in choosing an Expense Account as the Adjustment Account. By doing so the transaction will reflect on your profit and loss report. You can read through this article for more details about the process: Adjust your inventory quantity or value in QuickBooks Desktop.

On the other hand, you can use this article as a reference if you have specific invoices that become uncollectible: Write off bad debt in QuickBooks Desktop.

Feel free to visit us here if you have other questions about tracking your income and expenses in QuickBooks. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here