I'd love to help you set up and invoice for services and not pledges in QBO, @SFWC Office Manager.

You can create a service item to be used on the services that you have in your organization. This way, the item will be selected upon creating the invoices.

To do that:

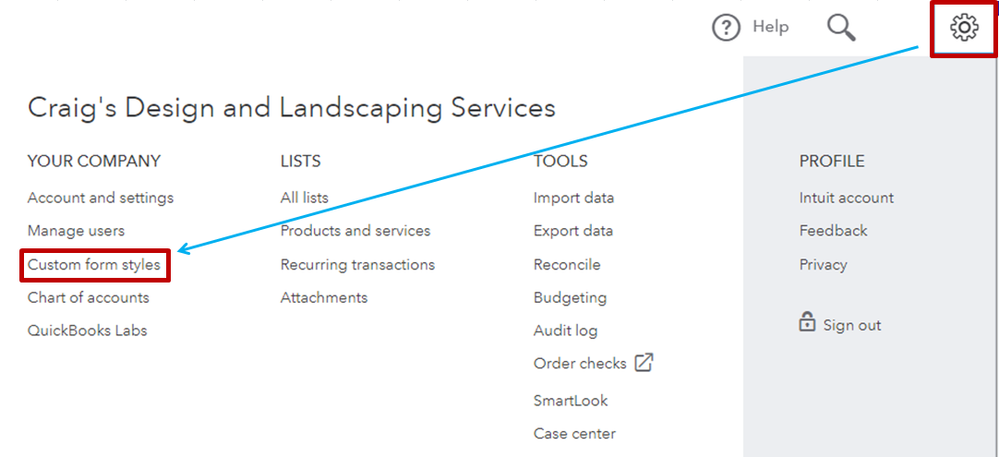

- Click the Gear icon located in the upper right-hand corner.

- Under List, click Products and Services.

- Press the New button, and select the Type.

- Enter the information.

- Tick on Save and Close.

To give you more tips in adding item in QBO, please see this reference: Add product and service items to QuickBooks Online.

After that, you may change the name of your template and make it Services Invoice so it will match to the transaction that you've processed.

To do that:

- Go to the Gear icon and select Custom Form Styles.

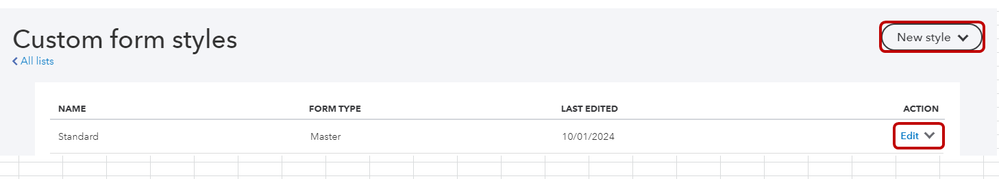

- If you'd like to modify an existing style, click Edit in the Action column. If not, click New style and choose Invoice.

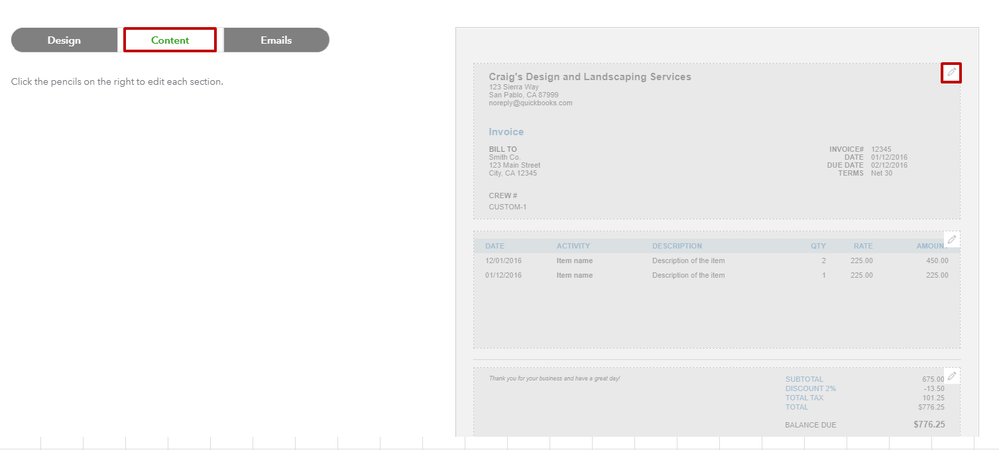

- On the Content section, click the pencil icon on the top box.

- Under Form names, type in Service Invoice in the box beside Invoice.

- Hit on Done.

Lastly, I'm sharing this great link that you can visit to help you manage your funds in QBO: Fund Accounting for non-profits.

Know that you can always count on me if you have any other concerns. I'll be right here to address them for you. Have a good one!