Your commitment to providing your client with a thorough understanding of their Chart of Accounts (COA) is commendable, @ArtyFacts123. Let me assist you in exploring alternative options to better meet your needs.

While a detailed Profit & Loss (P&L) report could provide some insights, it might not be the most effective for this specific purpose. A P&L report primarily shows income, costs, and expenses during a specific period, which might not clearly show the transactions assigned to each account.

Instead, consider using the Account Listing report. This report provides a list of all the accounts in your Chart of Accounts (COA). However, it’s important to note that this report does not typically include transaction details for each account.

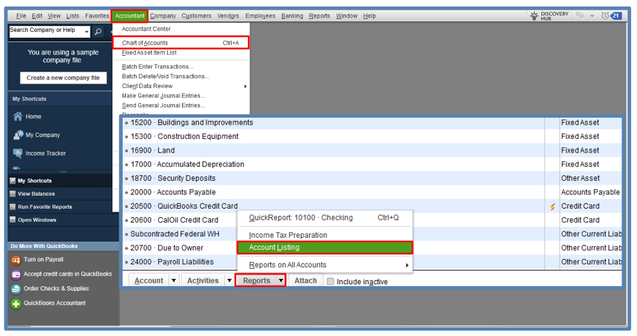

To run the report, here's how:

- Navigate to the Accountant menu, then Chart of Accounts.

- Click the Reports dropdown below.

- Select Account Listing.

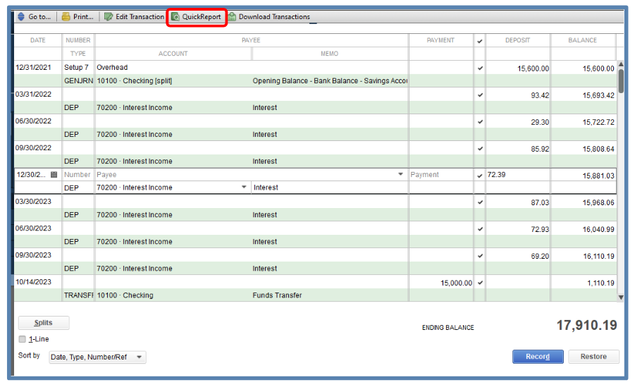

If you’re looking to provide a report to your client that includes the transactions assigned to these accounts, you can either run a QuickReport to every account in your COA or utilize the Transaction Detail by Account Report to show each transaction, the date it was posted, its amount, and the account it was posted to.

In addition, you can personalize the report by customizing it further to better suit your needs.

If you want to save the customized report settings for future use, you can, you can memorize reports in QuickBooks. This will eliminate the need to go through the customization process again.

I'm still around to help if you need more help with managing invoices in QBO. I'd be glad to extend a helping hand. Take care always.