Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for reaching out to the Community, @deborah-a-ellis-. I'll be happy to provide the steps on how to record an insurance claim in QuickBooks Online (QBO).

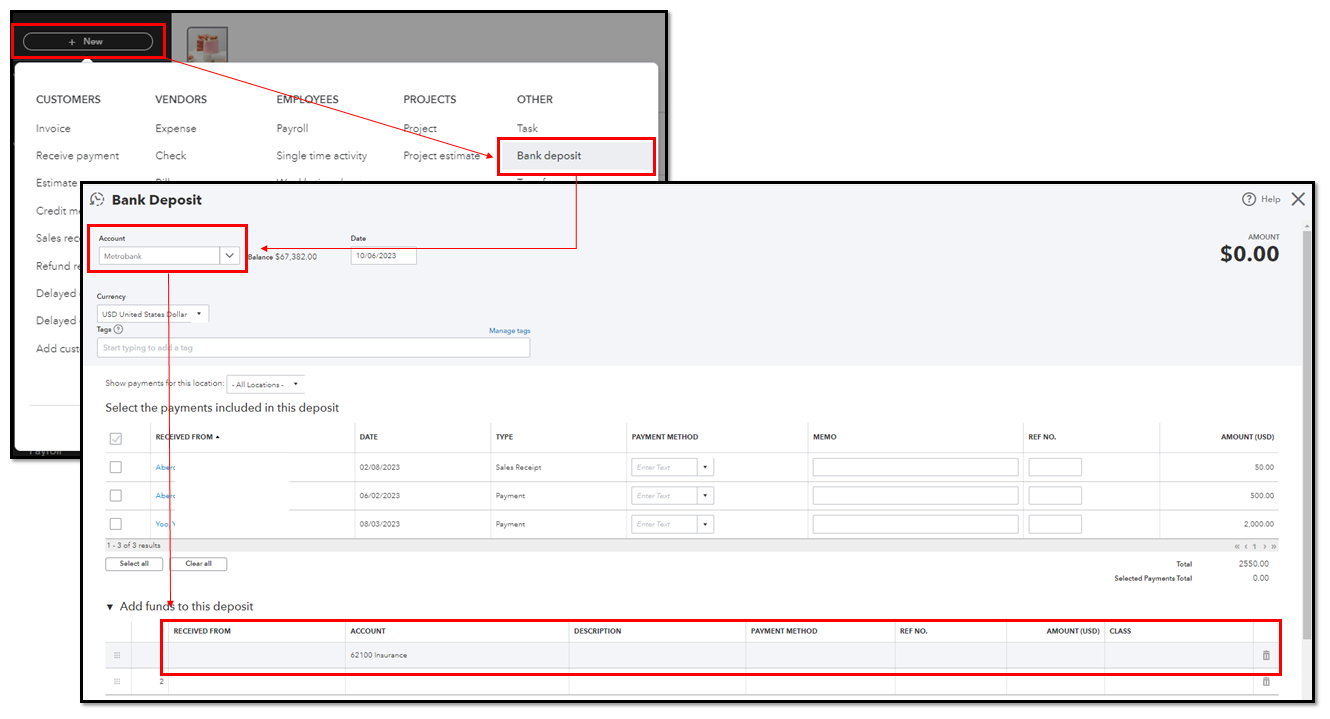

To record the insurance claim, let's deposit the check into the bank and utilize the same Expense account you used for the insured property damage expenses.

Please refer to these steps:

Additionally, we advise linking your bank to QBO so that transactions will download and automatically categorize into the correct accounts.

Let me know if you have follow-up questions about depositing an insurance claim. We're always around to assist you further. Keep safe and have a great rest of the day!

@deborah-a-ellis- , I do like the response given by @JaeAnnC .

The only thing I would add is if the expense related to the insurance claim was from a previous year, then I would treat the accounting a little differently. In this case, I would create a miscellaneous income account (if you don't have one already). Then book the entry to that Miscellaneous Income account and add insurance claim info to the description line of the transaction.

Reasoning: The expense was incurred in a year where the books were closed already (the company paid taxes on the final amounts and all). You wouldn't want to credit an expense account that doesn't have a related debit to offset the amount in a current year.

If this is the case, then whether you go with my suggestion or @JaeAnnC 's you will still end up with the same profit (increase in revenue is going the same way as a decrease in expense).

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here