Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi @info933,

I'll provide you some insights on how to go about with bank reconciliation.

The first thing to do is decide when you'll start tracking the ending balance of your actual bank account, which in turn will be the starting balance of your QuickBooks Online (QBO) bank account.

Once done, you can proceed with adding your downloaded bank transactions to your books. If you manually record your transactions, then match those downloaded transactions.

When you decide to start the reconciliation process, always have the bank statement of the period in question handy. It will serve as your reference, especially in checking if there are any missing transactions.

As for the actual reconciliation process, please view this article: Reconcile an account in QuickBooks Online. Here you'll find the steps for the process, as well as screenshots for easy reference.

If ever you encounter any issues during this process, take a look at this article: Fix issues when you're reconciling accounts in QuickBooks Online. It has a list of common errors, as well as the respective solution for it.

Let me know if you need anything else by leaving a comment below. I'll get back to you as soon as I can.

Thank you, I followed the first steps the banking and Credit cards came in fine.

I am use a business application called Flight Schedule Pro. We are a flight training school.

IN that system invoices are created and paid through that systems, They have an integration to QBO .

I just have to maintain Customers and product and services in both systems for the invoices to come over, they will already be paid.

The settlement will be deposited into the bank account next day.

So I might have an invoice of 500.00 and a deposit of 480.

So I need to match up the deposit(bank transaction to the customers invoice), then put a adjustment for the processing fee, in my example of 20.00.

What account do I use to credit the customers invoice a Processing Fee Expense?

Now the invoices all came over from October, when we started the school. It looks like they all were set to Transfer by default and showed as sales receipt, I thought that was wrong, so I deleted all invoices and was going to load them again, however the source system things they are already loaded. I will have to get that resolved to reload the invoices.

So where I am at, I have all the customers and their payments, I was going through bank transactions and figuring out what customer made a payment and assigning it to the customer and accounts receivable and when invoice comes in I can apply customer balance to it.

The challenge is the deposits from CC processing system is a single amount , so I have look it up in source system and split it to which customers made the payment.

Sorry if I am over explaining, this is a little out of my swim lane and want to get it setup

So to recap,

I am waiting to reload invoices

Assigning deposits (venmo, CC payments) to appropriate customer which may be a split,

Question is I know what the expense is for the ProPay the card processor is, how do I apply to the customers account.

When invoices come in I just do paid by customer and use money on account?

Thank you in advance for your help.

Let's get this sorted out, info933.

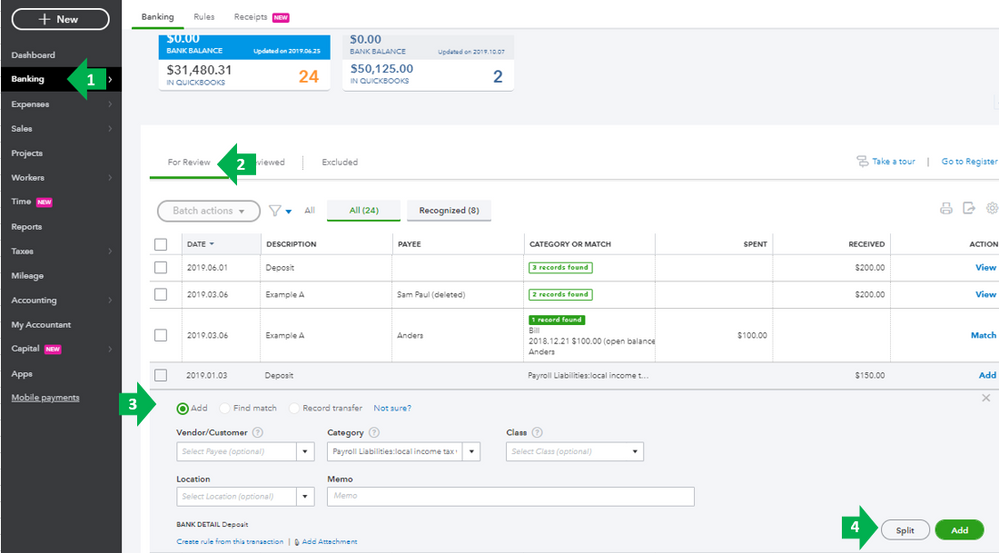

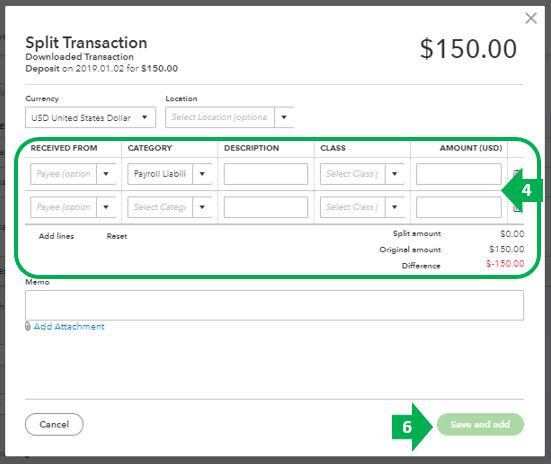

For your deposits, you can use the Split option. This is to apply the amount to the specific customers. I'd be happy to guide you through the steps below:

All of this and more about categorizing transactions can be found in this article: Categorize and match online bank transactions in QuickBooks Online.

Finally, when the invoices comes in, you can create a receive payments for these invoices and use the correct bank account.

Here's how:

Learn more about recording invoice payments in QuickBooks Online through this article: Record invoice payments in QuickBooks Online.

Get back to me if you have any other questions. I'm a post away to help. Have a great day!

Good morning, I think i want someone to look at my setup and make sure i am good before i go any further.

Would i schedule through you or go to support, I want to be sure.

I had an issues with Invoices loading into the system from the 3rd party integration.

My invoices come over already paid, i need to match deposits to the invoices. And as mentioned previously i have to split the deposit to the customers.

I deleted the invoices because it thought they loaded wrong, i can not reload as the 3rd party system thinks they are already there .

Sales transactions still show with out invoices, this is not clear to me if this is behavior or a problem.

I appreciate you for getting back, info933.

I understand you want to make sure you're on the right track. Please know that we share the same goal. If you need help from a live support to perform the above steps, feel free to contact our QuickBooks Care Support. You can request for a screen sharing session so they can guide you through the whole troubleshooting steps.

If you have other questions, just let me know. I'm always happy to assist you further. Have a great day ahead.

i have the system reset, QBO had to be cleared are reset. Anyways all my invoices and deposit for the invoices are loaded in the system, my invoices are paid prior to being synchronized to QBO.

Questions i have,

Venmo deposits i am getting for a customer do not align with an invoice, the sum of the invoices align. ...

How do i handle a venmo, deposit i know the customer it is from, thats it.

Second question, because the CC processor ProPay deposits directly into bank, i need to match the deposit to the invoice, however the dollar amounts are different, less the fee. Example a 185 invoice, i will see a ProPay Deposit for 178.46, I need to match it and record a Processing fee of 6.54 for it to match the invoice.

What is the process for this start with Customer invoice match to deposit( and sometime i will have to split it because more than one invoice could be in that deposit, i have a list on this) how do i record the fee?

currently the deposit is sitting in undeposited funds, ..

Thanks for getting back to this thread with additional details, info933.

The invoice can be edited where you can add the processing fee in the second line. This will allow you to match the invoice with the downloaded transaction from ProPay since they already have the same amount.

You can either create a Service or Non-Inventory item in your Products and Services section which you can use to record the processing fee. Here's how:

After setting up, open each invoice and add the item in the second line. Then, proceed to making the match.

Once done, create a bank deposit to move the customer payment fro Undeposited Funds to the correct account. Use this article as a guide on how to create a bank deposit: Record and make Bank Deposits in QuickBooks Online.

Please add another reply below if you still have a follow-up question. We're always here to offer our help again.

ok, i have been given to scenarios and i believe it is because the way QBO treats invoices and sales receipts.

Looks like i have invoices, which would be treated like you said , processing fee product, however the amount would entered as negative so as to reduce the invoice total to match the deposit.

If it is a sales receipt i have to Record a bank deposit on the deposit i want to adjust,

from customer, account :Processing expense:ProPay Fee amount: Negative -33.00

then when i go to match receipt for customer it finds the deposit

So i have to treat fees 2 different ways, is that correct.

If need be is there a service i can pay for that could go through this and make sure this is correct.

Thank you for all your support.

Joe

Hello info933,

Yes, you just need to follow the steps provided by Jeno_P and the other colleagues. Once you're done matching the transactions, you can already reconcile the account. You can use this link for more information about the reconciliation process:

Reconcile an account in QuickBooks Online.

Keep us posted if you require further assistance on any of the processes on this thread. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here