Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood morning, @melissa-pennflee.

Congrats on making your first post here in the Community. I can share some helpful tips to get this situation taken care of with reconciled vendor credits that need to be voided.

If you void or delete these vendor credits, that have already been reconciled, it will mess with your reconciliation.

In this case, I suggest consulting with your accountant to be sure of what steps to take in order to resolve the problem. They'll be able to give you the best advice based on your business.

Keep us updated on how the process goes. I'm only a post away if you have any other questions. Have a great day!

IMO, the best way to clear them is to create bills using the same accounts from the credits and then paying those bills with the outstanding credits. This will clear the credits and the bills and credits will offset each other. Also, this will leave a better audit log in case anyone ever needs to track it. You can enter "to clear credits" as the bill number and make a note of why the bills are being entered in the memo field.

Thanks so much for your reply. That is what I thought I could do as a last resort, but wanted to make sure it wasn't a bad thing to do. Have a great day!

If you do create invoices to offset the credits do you need to back date the invoices to the year of when the credit was entered or can you do it in the current year?

If I create new invoices to void out the old credits do I need to back date the invoices to the year that the credit was entered or can I create an invoice in the current year?

You can use the current date when recording invoices, @ds5644. I'll share further details below to resolve your concern.

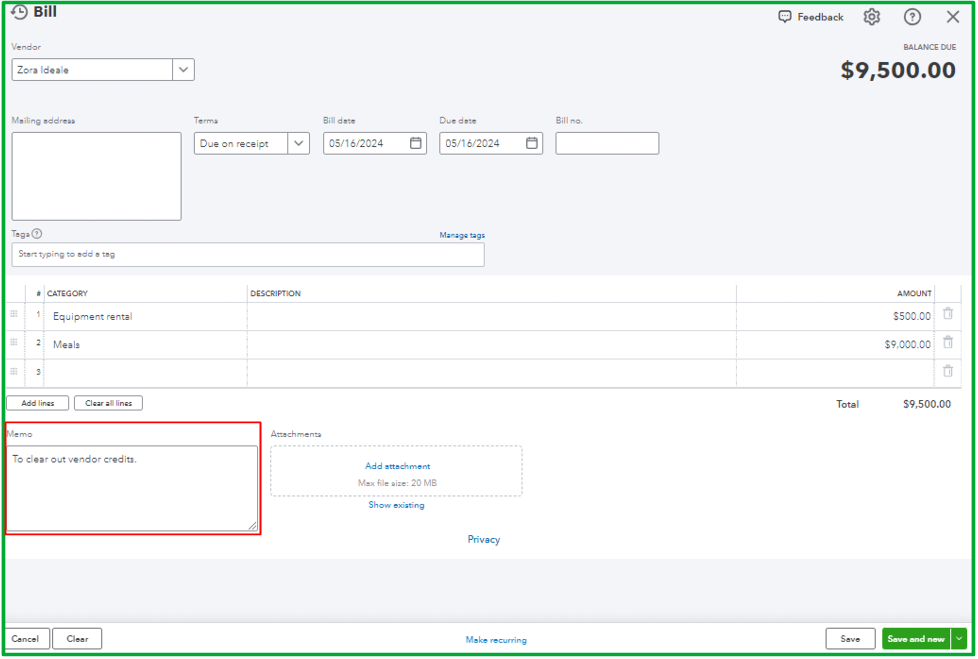

If you are in the same situation above and have outstanding vendor credits to clear out, you can simply create bills using the current year. Just use the same accounts from your credits and ensure that you indicate in the Memo section of the bill that you made it to clear out your vendor credits.

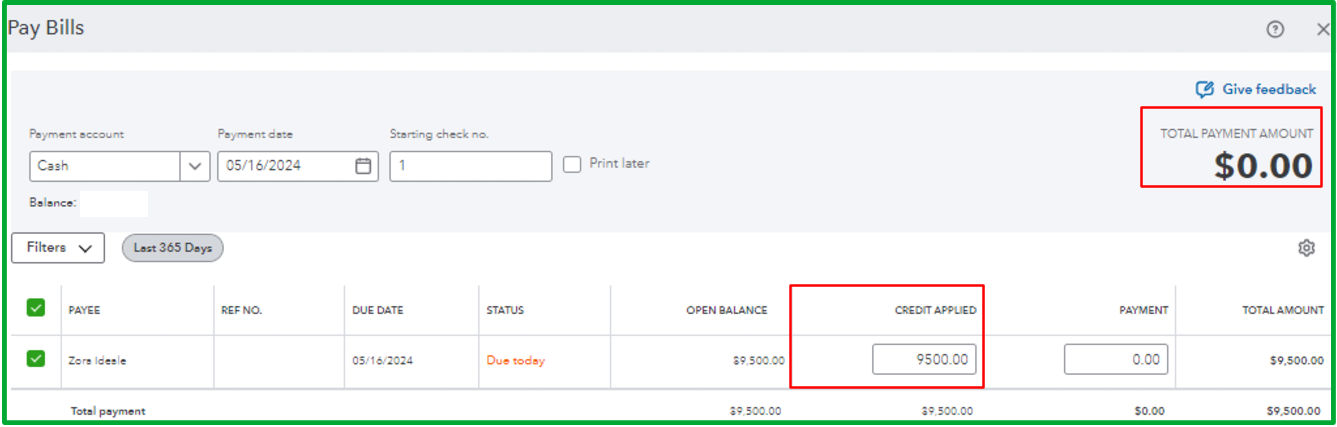

After creating bills, use Pay Bills to connect them to the vendor credit to keep your expenses accurate. Here's how:

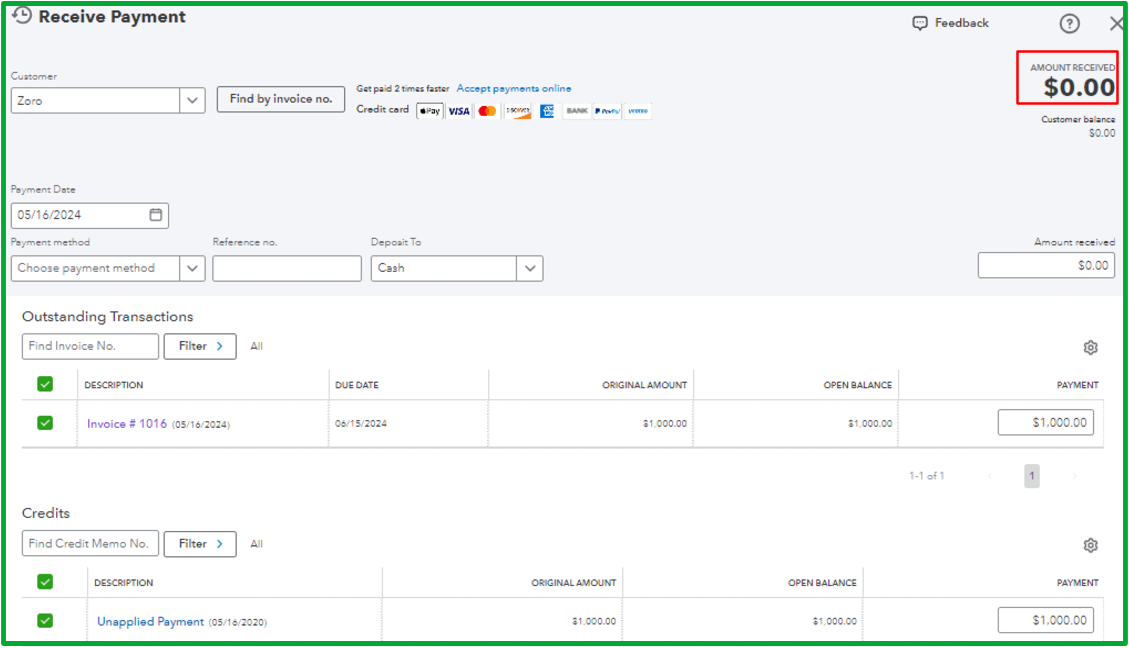

On the other hand, you can just use the current year for invoices if you mean clearing out customer credits. Use the same items/accounts from your credits and still indicate in the Memo section of the invoice that you made it to clear out your customer credits. Then, use the Receive Payment feature to clear out them.

Additionally, you'll want to check out this article for the detailed steps in case you need to review all your vendor transactions in QBO: How to view and edit vendor transactions in QuickBooks Online.

I'll be around to help if you have any other questions besides clearing out outstanding credits in QBO. Just let me know by replying below. Wishing your business continued success!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here