Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

I have all the instructions you'll need to record the refund and match it with the bank transaction, @bonnie-sc-techse.

When you receive a refund from a vendor, you'll have to record first a vendor credit for the expense that the refunded payment was applied to. Then, you'll have to make a credit card (CC) credit for the credit received. After that, apply or link the CC credit to the credit memo with a "zero dollar" payment. I'll show you how to do it.

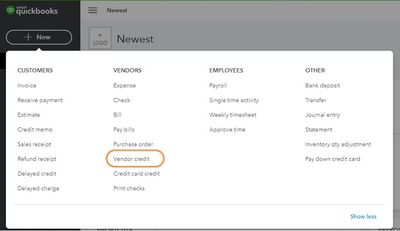

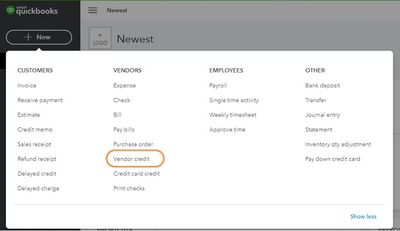

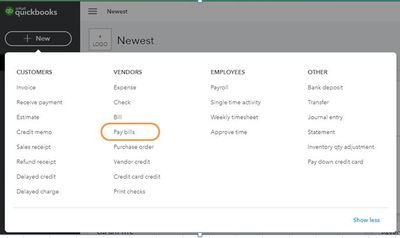

Here's how to enter the vendor credit:

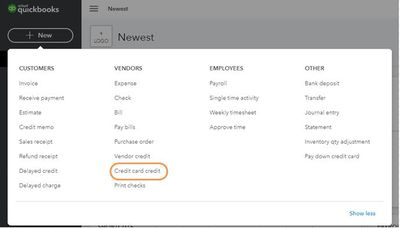

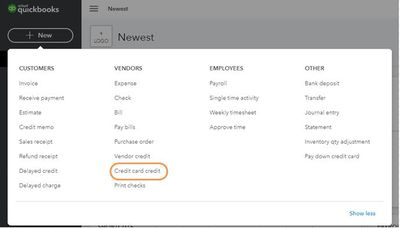

Then, let's make a CC credit for the credit received.

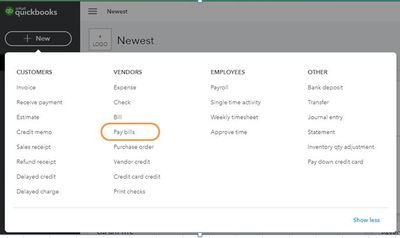

Lastly, let's link the CC credit to the vendor's credit memo with a "zero dollar" payment.

Once done, it will allow you to match the bank transaction with the credit card credit you've entered. Then, you can reconcile your account to make sure they match your CC statement.

Should you need any further assistance getting your vendor credits straightened out, please don't hesitate to comment below.

I have all the instructions you'll need to record the refund and match it with the bank transaction, @bonnie-sc-techse.

When you receive a refund from a vendor, you'll have to record first a vendor credit for the expense that the refunded payment was applied to. Then, you'll have to make a credit card (CC) credit for the credit received. After that, apply or link the CC credit to the credit memo with a "zero dollar" payment. I'll show you how to do it.

Here's how to enter the vendor credit:

Then, let's make a CC credit for the credit received.

Lastly, let's link the CC credit to the vendor's credit memo with a "zero dollar" payment.

Once done, it will allow you to match the bank transaction with the credit card credit you've entered. Then, you can reconcile your account to make sure they match your CC statement.

Should you need any further assistance getting your vendor credits straightened out, please don't hesitate to comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here