Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thank you for contacting us, dfwrapsct.

Let me walk you through charging a convenience fee to your customers who use credit or debit card payments.

Just a heads up, charging customers a fee for credit card payments are currently prohibited in 10 states—Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma, and Texas.

If your business operation is located in these states, it would be best to consult a tax adviser to get suggestions on how to record the customer charge.

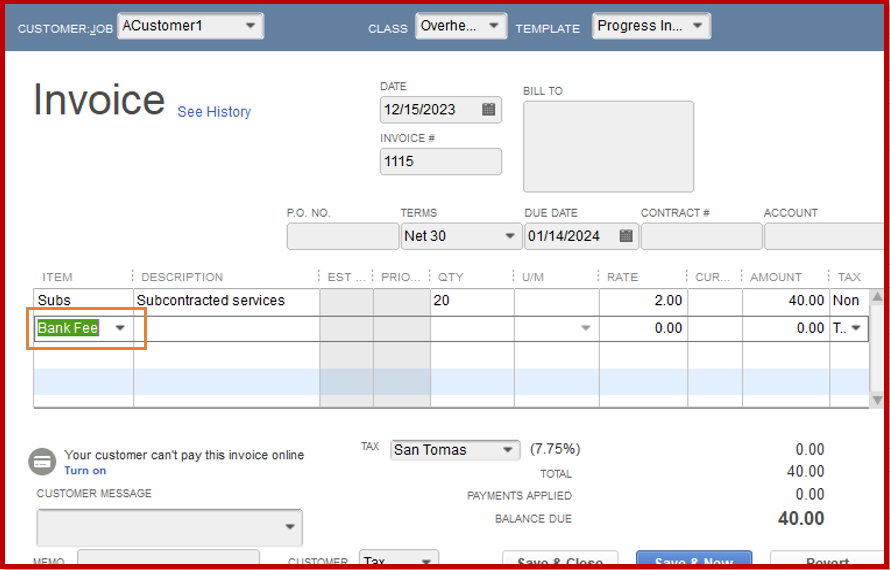

Also, QuickBooks won't automatically calculate service charges or late fees on open invoices at this time. There isn't also an existing section on invoices for additional charges. You need to create a separate invoice or include it as another line item.

Here's how to do this:

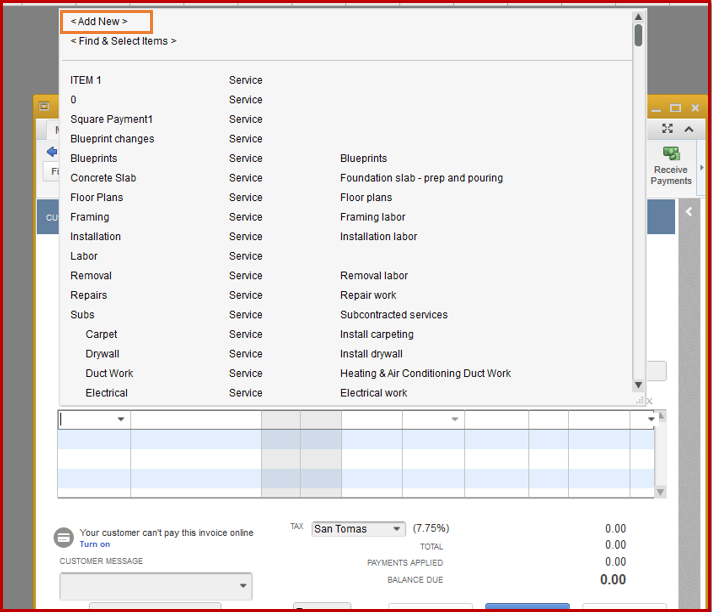

Create an invoice for an additional charge

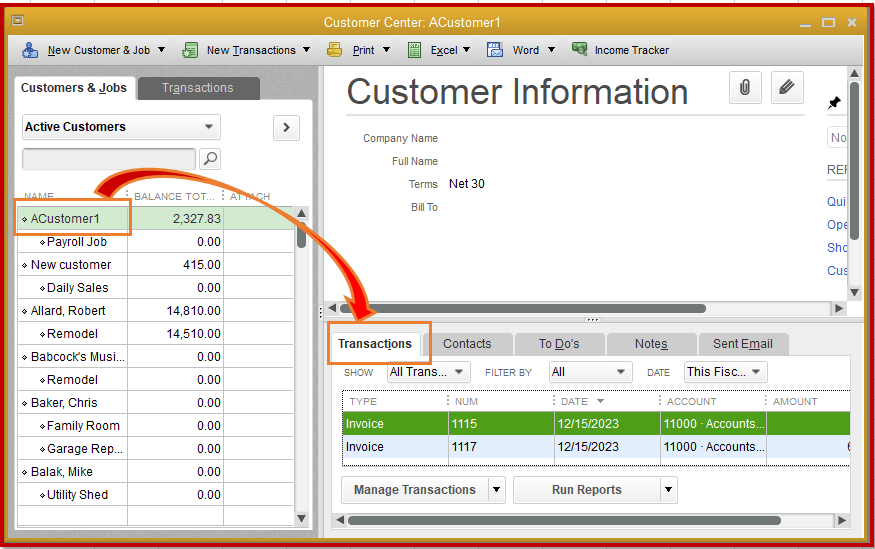

Add an additional charge on an existing invoice

To learn more recommendations about accounting credit card fees, you may refer to this blog for details: Everything You Ever Wanted to Know About Credit Card Fees. Just scroll down and look for Should You Accept Credit Cards In Light Of All The Credit Card Fees? and Tips For Offsetting Credit Card Fees sections.

Keep me posted if there's anything else you might want to ask concerning QuickBooks. I'm always around to help you out.

Take care always!

I could use some assistance in setting up this convenience fee as an expense in quickbooks since it is going back to the CC company. Any help would be appreciated.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here