Welcome to the Community, orlandochavez202.

Allow me to share some information on how the Receipts feature works.Then, guide you on how to bring your receipts into the program.

If you only need one 1040-ES for multiple companies, yes, upload the receipts and expenses to QBSE. There are several methods on how to input your expense receipts.

You can either take a picture of the entries or attach them to the ones entered in the company. The process differs depending on how you wish to bring them into the system.

Here’s how to do it on a browser:

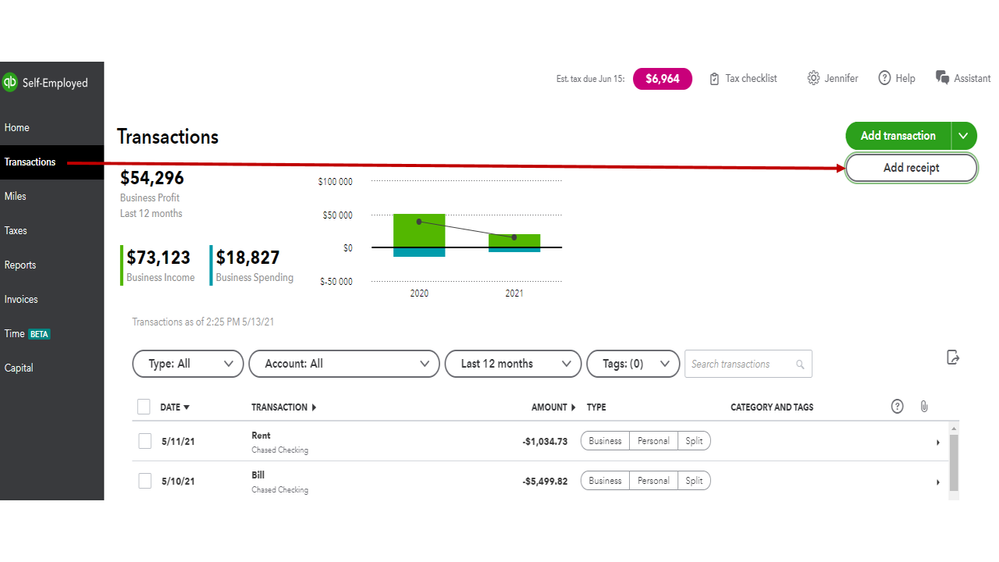

- Tap the Transactions menu on the left panel and click the Add Receipt button.

- This will open a screen where you can attach the receipt.

- Choose browse or Drag/drop you receipt here method.

- Then, pick the image you wish to attach.

- Hit Upload and Save.

For other ways on how to bring the transactions into QBSE, check out this article: Record or attach expense receipts.

However, if you’ll have to provide a separate 1040-ES for each business, I suggest subscribing to another QBSE account. This way, you can track the entries properly.

Let me share these links for additional resources. These guides provide an overview of classifying entries and emailing receipts to the self-employed program.

Don’t hesitate to visit the Community again for any other concerns. Please know I’m only a few clicks away for help. Have a great rest of the day.