Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGlad to have you here, plainvi3w.

Refunds are recorded differently depending on how the purchase is recorded. If you enter expenses or write checks, you can use the following steps below.

Here's how:

These are the steps if you receive a credit for the returned item:

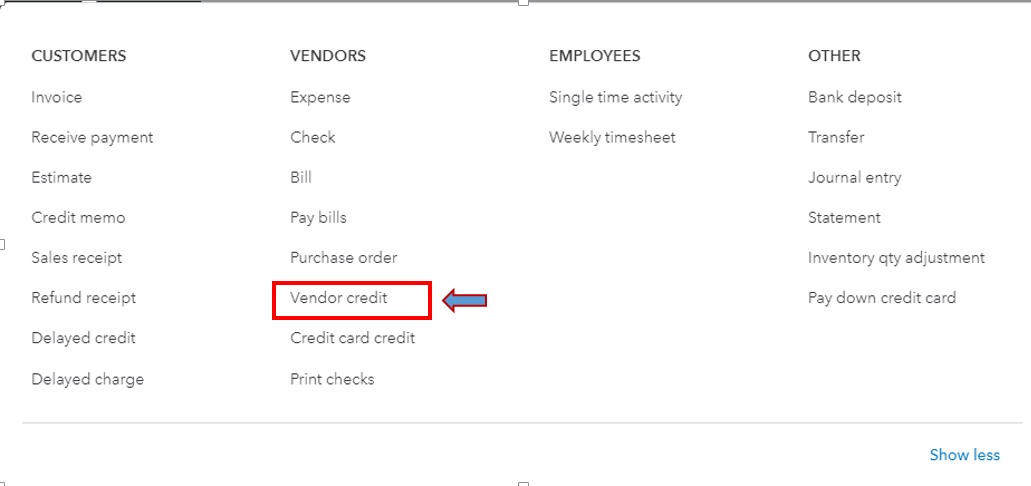

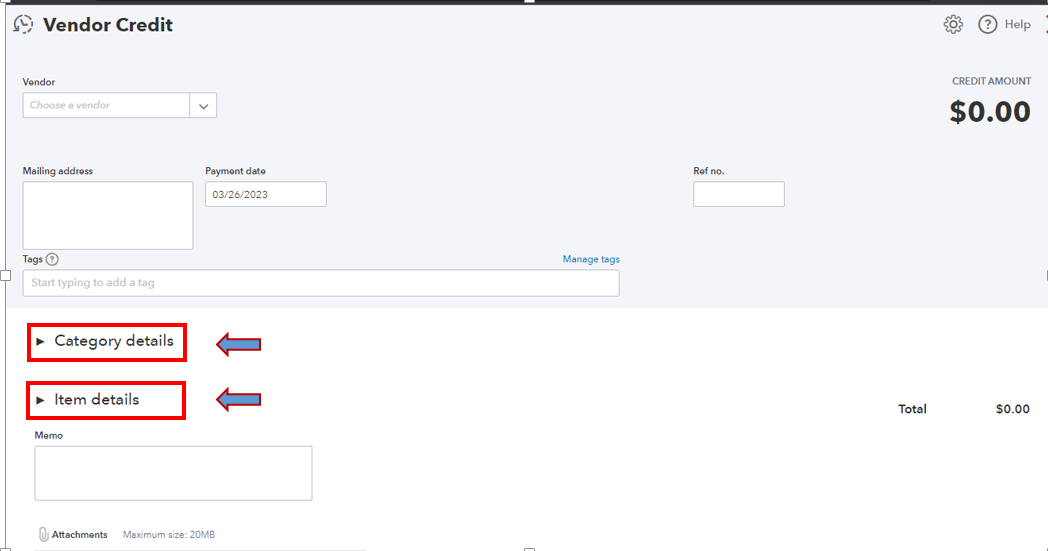

Create a vendor credit:

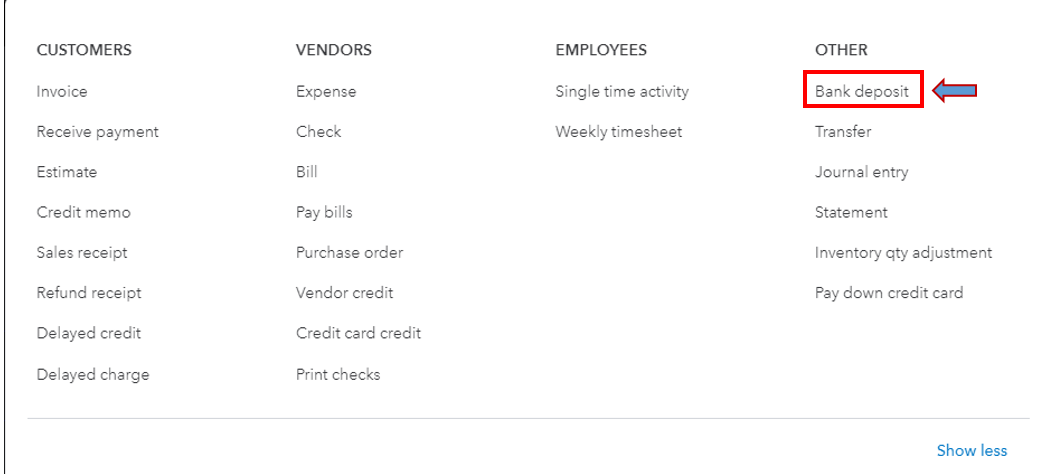

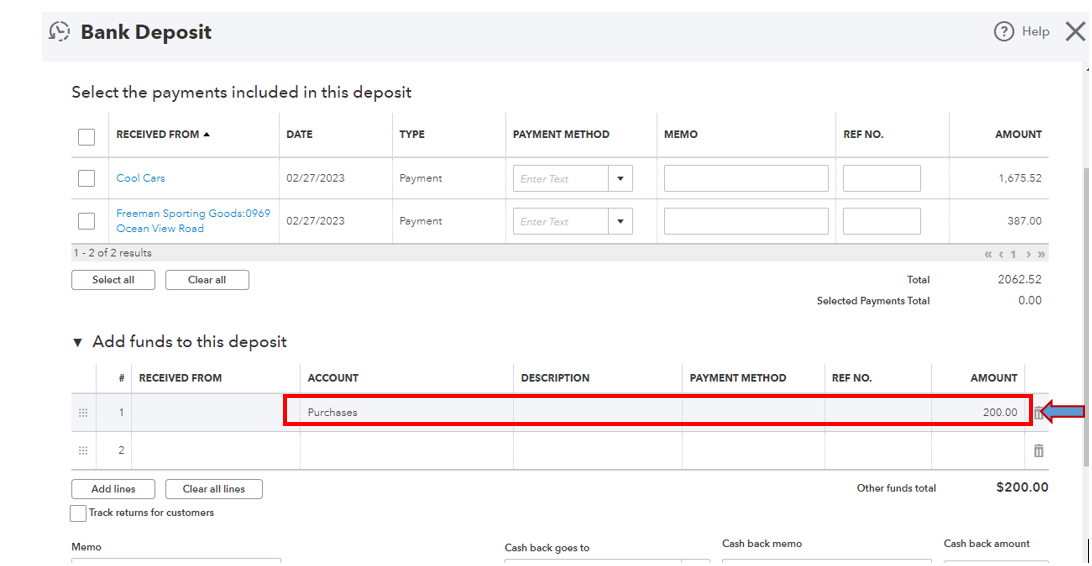

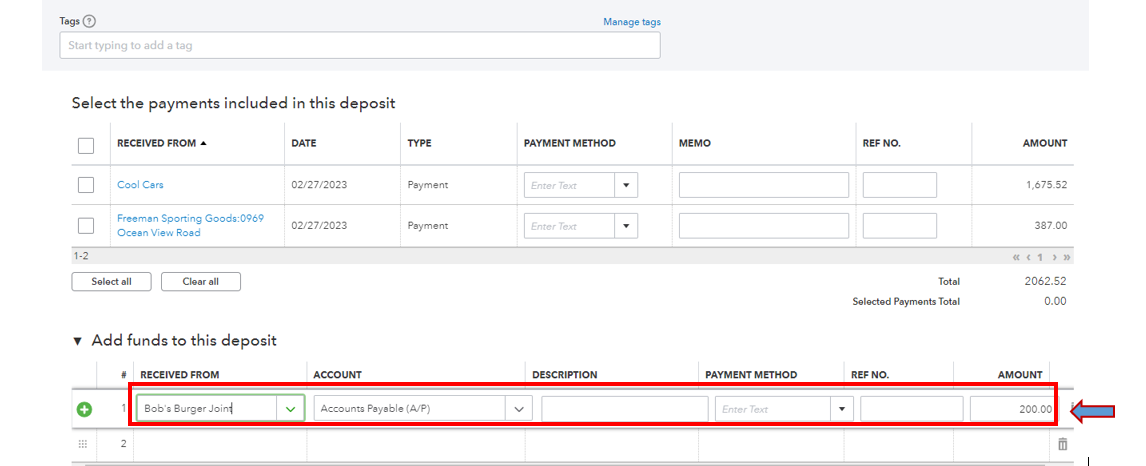

Deposit the money you got from the vendor:

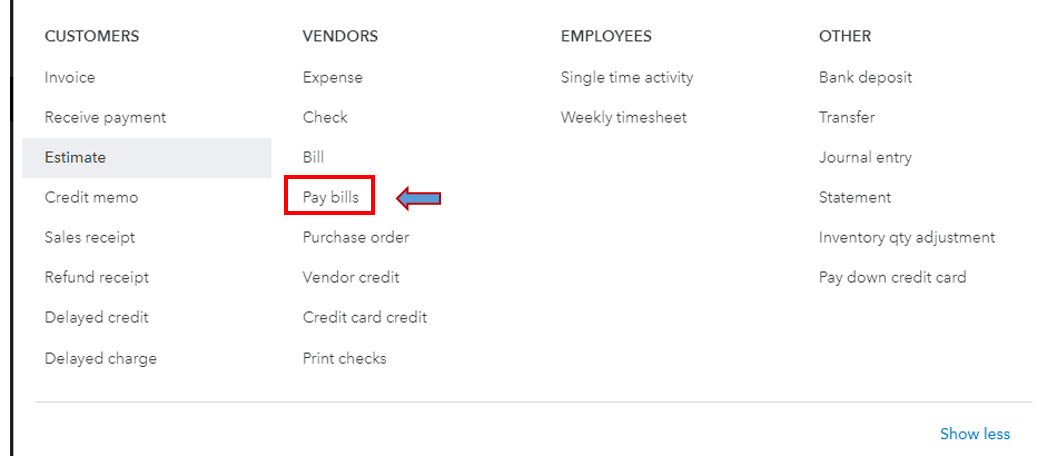

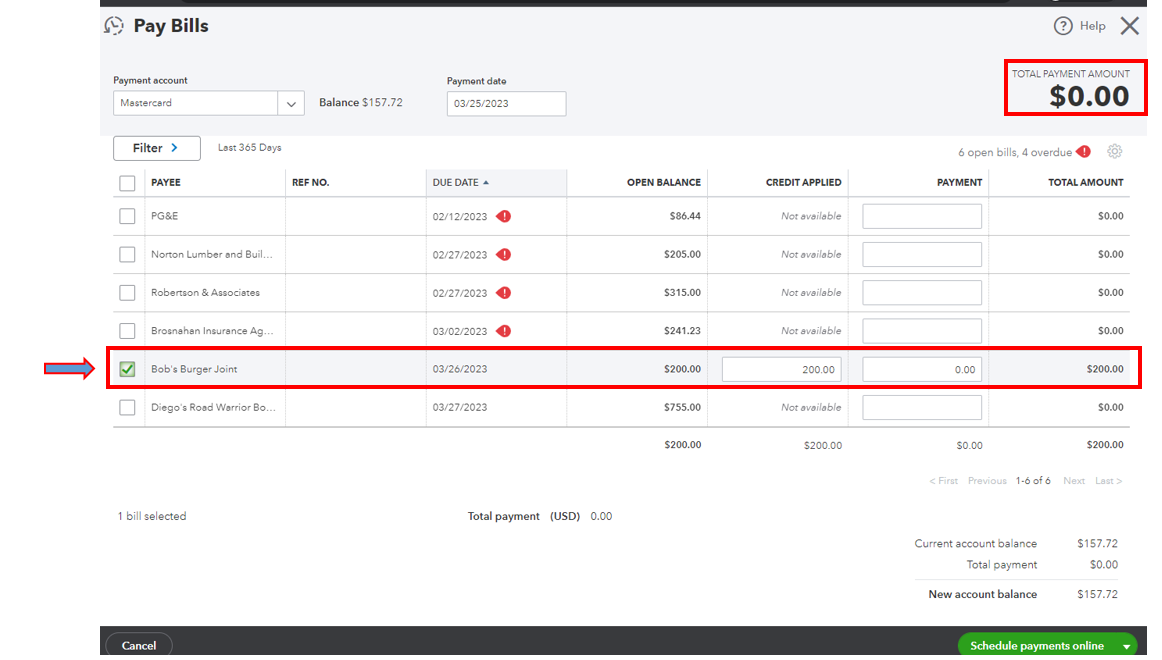

Lastly, link the deposit and vendor credit using the Pay Bills feature.

Here's how:

Refer to this link that contains all the instructions about this process: Enter vendor credits and refunds in QuickBooks Online.

If you need tips or related articles in the future, please visit our website: Help Articles page.

You're welcome to post again if you have further questions about the refund process. I'll be here to help you.

Thank you for such detailed response!

Really, all I'm wanting to do is categorize these Amazon and Office Depot refunds properly so it doesn't appear that I received "$37.58", for example, as literal income from Amazon and/or Office Depot.

As of now we have about 11 "transactions" that need "review" and categorized. The options are some form of "supplies income" or "assets" . These are neither. They're just "purchase refunds", but Quick Books has no category to label them as such.

Thanks again

there must be a way to categorize a purchase return without it being logged as income

Choose the same expense category (account) on the refund as you did for the purchase. That reduces the expense instead of increasing income, which is what you want.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here