Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello Quickbooks community!

I'm having an issue where there is an egregious difference between my QBO balance ($181,432.18) and my bank balance ($27,696.73). I suspect that this is connected to the fact that, when I run a profit/loss report on a cash basis for 2020, QB is counting deposits towards my income, along with credit memos and invoices. In my transaction report for 2019, only my credit memos and invoices were counted (last year there were no discrepancy issues with my QBO and bank balances).

My first question is, why are my deposits being counted toward income in addition to invoices? And second, how can I determine if this is causing the discrepancy?

I've got your back, @KarenBloomberg. Let me share some insights about QBO and bank balance discrepancy and how to fix this.

There is a possibility that you created a bank deposit that affects income as you receive the invoice payment. This is why deposits are counted towards income in addition to invoices.

To determine if this is causing the discrepancy, we can review the invoice and its payment. Let me show you how:

Also, the QuickBooks balance is the total balance of all bank transactions that you’ve added or matched to QuickBooks. While the bank balance is your bank's actual balance from the last bank feed update.

If the bank and your QuickBooks balance have a discrepancy, you may have a bank transaction that is causing a difference. Depending on the factor, there are different steps to fix your issue. Here’s an additional article you can check for your guide: How to Fix Differences Between QuickBooks Balance and Bank Balance.

I'm also adding this resource to guide you reconcile your accounts in QuickBooks Online.

I got you covered if you have any other concerns with the QBO and bank balance discrepancy in QuickBooks. Have a pleasant day.

Hello! And thank you for your detailed reply!

Almost all of my invoices have been linked to deposits and the transactions that are up for review in my banking feed can't account for the difference between the two balances. I've reconciled my account for 2020 by using QBO's "Reconcile" feature under the "Accounting" menu.

You’re always welcome, @KarenBloomberg.

I know how important to match these balances. Since most of your invoices we’re linked properly to the deposit, try the troubleshooting instructions listed in this reference to fix the difference between QuickBooks balance and bank balance.

Each step on the guide can narrow down the issue. This way, you’re able to determine the cause of the discrepancy. You can also reach out to your accountant for further assistance. They can help and give you the advice to get this settled.

You can read this reference to learn the reconcile workflow in QuickBooks. This guide helps make sure the amounts match your real-life bank accounts.

We’ll be here anytime to help. Just add a comment below if you have other concerns besides this balance discrepancy. Always take care!

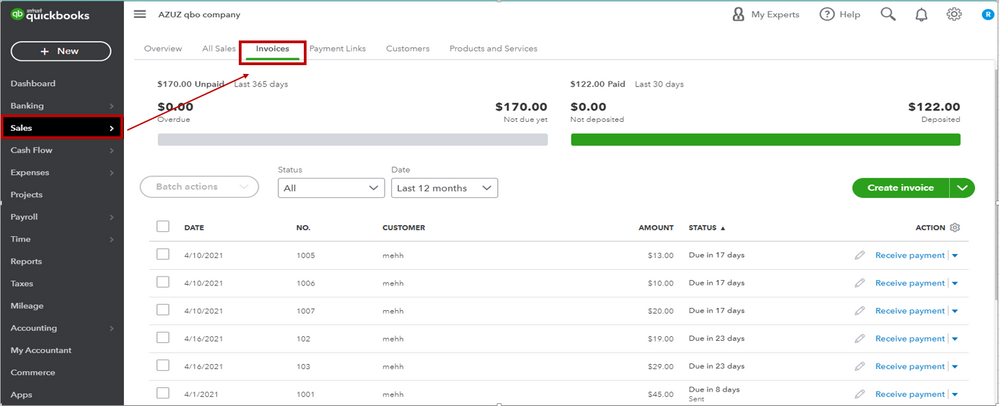

I think I have figured it out. When COVID started, I began depositing all of my check payments online, which are automatically entered into QBO through my bank feed. However, I kept manually entering my deposits into QBO. I've added up all of the potentially duplicating deposits and it's in the ballpark of the discrepancy between my balances. What would be the best way to determine for certain if this this the source of the discrepancy? If it is the source, should I delete the manually added deposits? Assuming that it is, how would I link the online deposits in my bank feed to the payments I've entered into my customers' profiles (through the Sales menu)?

Hi,

Instead of a deposit, you should have closed the invoice with receive payment option.

Else there will be doubled up.

I suggest do bank reconciliation and delete duplicate deposits.

To do bank reconciliation,

Click on Gear icon < Tools < Reconcile.

Let me know if this helped you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here