Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am just starting off, and I have sent 2 invoices to different clients, each one for $1,000. One has been paid, one is pending payment. I have had no true expenses that I can think of so far.

On my quickbooks dashboard it shows as an expense.

Why would an invoice paid or pending payment be classified as an expense?

Solved! Go to Solution.

@Steadfasthome, I would agree with @LieraMarie_A.

and when you change the income account of an item, you'll see a checkbox that says "Also update this account in historical transactions". Be sure to put a check in it to retroactively update your transactions. that's all you wanna do

I'm here to help you classify your items properly, @Steadfasthome.

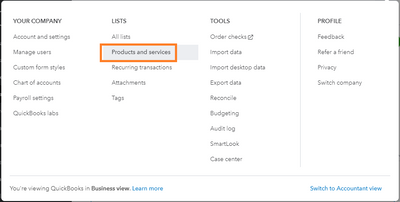

The account tied to that specific item may be an expense account. Let's verify the information on the Products and Services page.

Here's how:

You can find these instructions from our guide: Add product and service items. You can also add, edit, or delete accounts to make sure your transactions are categorized correctly.

I'm only a few clicks away should you need further assistance with tracking your accounts. Have a great day.

@Steadfasthome, I would agree with @LieraMarie_A.

and when you change the income account of an item, you'll see a checkbox that says "Also update this account in historical transactions". Be sure to put a check in it to retroactively update your transactions. that's all you wanna do

That was the fix!

My error was assuming something assigned to deposit would be income not expense.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here