@richmenchio

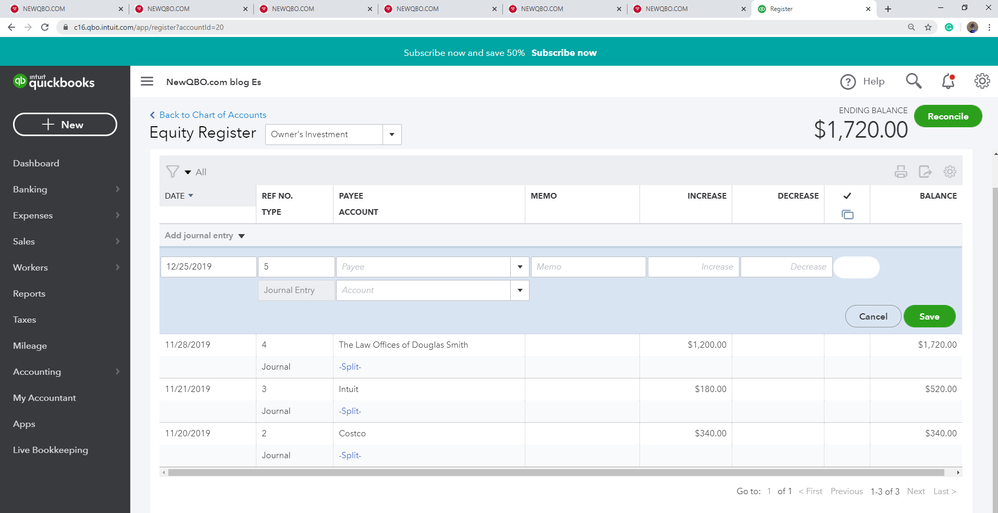

If these are business expenses paid by you (as an owner) and need to be recorded in QuickBooks but don't need to be reimbursed, you can always add directly to the Equity Register. This is one way of doing it and it's very easy to do.

From the left dashboard Accounting > Select Chart of Accounts > Select Equity account like Owner's Investment type > Add Journal Entry (under date column)

- Enter posting date per receipt

- Enter the Payee field (Vendor's Name)

- Select Account Category

- Write Memo

- Enter amount paid (under Increase column)

- Save

It will show as added Owner's Investment on the Balance Sheet. See the screenshot below for reference.