Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Labor Costs on Job Profitability Detail

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

Hi, I'm trying to use the Job Profitability Detail report to track Actual Cost vs Actual Revenue specifically for labor (and once I figure out how to do this for labor, I think I'll be able

I have Service items called *Labor and *Materials for Invoicing. These are showing up under the Actual Revenue column which is what I want. The payroll items are also Service items called Wage (tied to gross wages in the COA). There are various payroll items based on task. They all tie back to Gross Wages. These are showing on the Job Profitability Report under Actual Cost, but not as "Labor".

In the Item List, *Labor, I have checked off "This service is used in assemblies or is performed by a subcontractor or partner" and listed the Expense Account as Gross Wages and the Income Account as Construction Income. Similarly, in the item list for "Wages", I checked off the same box and listed the Expense Account as Gross Wages and the Income Account as Construction Income. I thought doing so would tie the two on the report so that the Labor line item would show the Labor from the invoice and the total Wages.

How do I get the report to show Actual Labor/Payroll costs alongside the Actual Labor revenue?

Solved! Go to Solution.

Labels:

Best answer October 30, 2023

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

I commend you for figuring it out in your end! Now, I'll share some information and guidelines to help you get through this.

You are correct! When the Actual Cost column on the Estimated vs. Actuals report accounts for the Employee Paid Union Dues, the Actual Cost will not equal the Actual Cost on the Job Profitability Report nor the Expenses on the P&L because it deducts those dues. If you don't want them to show like that, you'll want to correct the item associated with the deductions (Union Dues). Navigate and edit the item, then ensure to uncheck the Track Expenses By Job.

Next, in QuickBooks Desktop, the time created for an employee cannot be directly billed to the customer or associated with a sales order. If you want to associate time with a customer, you will need to follow these steps:

1. Create the time entry for the employee by going to the Employees menu, selecting Enter Time, and then choosing Use Weekly Timesheet.

2. Ensure you choose the appropriate customer in the Customer: Job column when entering the time.

3. Save the time entry.

Remember this time entry will not automatically be associated with a sales order. To manually create a sales order without associating the employee's time, you can follow these steps:

1. Go to the Customers menu and select Create Sales Orders.

2. Fill in the necessary details for the sales order, such as the customer, items, and quantities.

3. Save the sales order.

These steps can create a sales order without associating the employee's time. If you want to bill the customer for the employee's time, you create a separate invoice and manually enter the time as a billable item. And, if you want to associate time with a customer, you must record it for the vendor and bill it to the customer when you generate the bill.

You can visit these articles you can use in the future:

- Track job costs in QuickBooks Desktop.

- Add, edit, and delete items in QuickBooks Desktop.

- Understand reports.

Feel free to post here again if you have further QuickBooks-related concerns. We are available 24/7 to lend a hand with each of your queries. Stay safe!

4 Comments 4

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

Thank you for elaborating on your concerns regarding the Labor Costs on Job Profitability Detail report, @Lilalykat. I understand your desire to show Actual Labor/Payroll costs alongside the Actual Labor revenue on the report. Providing some information about this matter is my priority.

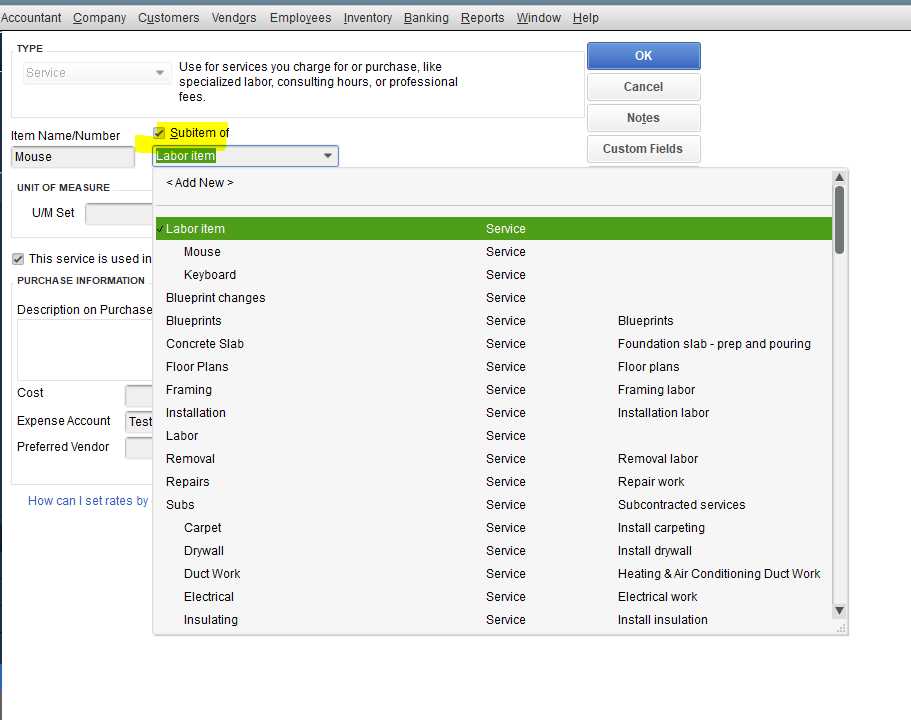

You'll want to review your account setup. Factors could be you aren't able to add the items as a sub-account or a sub-item of the Labor. In this case, they won't show up under the Actual Labor/Payroll costs alongside the Actual Labor revenue.

To learn more about tracing job costing and comparing it to revenue, refer to this article: Track job costs in QuickBooks Desktop.

For more tips on personalizing reports, including the data, columns, and style, check out this guide: Customize reports in QuickBooks Desktop.

With this information, you should be able to verify why the Actual Labor/Payroll costs are not showing alongside the Actual Labor revenue. If there's anything else I can help you with, let me know. I'll be here to assist you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

Thank you. I think I was able to figure it out by changing my items and making sure the invoice is the same as the item. I was using an Income item on the Invoice, but need to use the Expense item that is now identified as a 2 sided entry on the Invoice.

2 more questions related to job costing:

(1) The Actual Cost column on the Job Profitability Report is the same as the Expenses on the P&L which is as it should be. However, the Actual Cost column on the Estimated vs Actuals report takes into account the EmployEE Paid Union Dues, so this Actual Cost does NOT equal the Actual Cost on the Job Profitability Report nor the Expenses on the P&L because it is deducting those dues. Is this a bug? I don't think Employee Paid Union Dues should be a factor when calculating Actual Cost of the Project.

(2) I have an Estimate and Sales Order for Labor, but this is an ongoing job and all the labor won't be billed at once. I want to pull in the Time from Payroll, so I choose create Invoice from Sales Order, Select Outstanding Billable Costs (Labor) and the Labor pulls in but it does not update the Sales Order as being partially billed. Am I doing something wrong? How do I tie invoice/labor hours from payroll to the Sales Order so that the Sales Order reflects number of hours/amount billed so far?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

I commend you for figuring it out in your end! Now, I'll share some information and guidelines to help you get through this.

You are correct! When the Actual Cost column on the Estimated vs. Actuals report accounts for the Employee Paid Union Dues, the Actual Cost will not equal the Actual Cost on the Job Profitability Report nor the Expenses on the P&L because it deducts those dues. If you don't want them to show like that, you'll want to correct the item associated with the deductions (Union Dues). Navigate and edit the item, then ensure to uncheck the Track Expenses By Job.

Next, in QuickBooks Desktop, the time created for an employee cannot be directly billed to the customer or associated with a sales order. If you want to associate time with a customer, you will need to follow these steps:

1. Create the time entry for the employee by going to the Employees menu, selecting Enter Time, and then choosing Use Weekly Timesheet.

2. Ensure you choose the appropriate customer in the Customer: Job column when entering the time.

3. Save the time entry.

Remember this time entry will not automatically be associated with a sales order. To manually create a sales order without associating the employee's time, you can follow these steps:

1. Go to the Customers menu and select Create Sales Orders.

2. Fill in the necessary details for the sales order, such as the customer, items, and quantities.

3. Save the sales order.

These steps can create a sales order without associating the employee's time. If you want to bill the customer for the employee's time, you create a separate invoice and manually enter the time as a billable item. And, if you want to associate time with a customer, you must record it for the vendor and bill it to the customer when you generate the bill.

You can visit these articles you can use in the future:

- Track job costs in QuickBooks Desktop.

- Add, edit, and delete items in QuickBooks Desktop.

- Understand reports.

Feel free to post here again if you have further QuickBooks-related concerns. We are available 24/7 to lend a hand with each of your queries. Stay safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Labor Costs on Job Profitability Detail

Thank you for the quick response! I didn't realize Union Dues was checked to Track Expenses by Job, I will change that. Much appreciated. For billing time to a customer and associating it w a Sales Order, your response is what I suspected, I just wanted to make sure I wasn't missing a step. Thanks again.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Featured

Ready to pay your team? Watch our Quickbooks 101 video below to get

started...

Join us fromMarch 17th-21st, to spring into action with Quickbooks this

sea...

QuickBooks Solopreneur was built with our brave, determined, and busy

self-...