Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I am doing our QB desktop for my husbands business, it is an INC and no longer sole proprietor.

He loaned money to the company when needed or buys things with his personal card and I’m trying to put it in so the company can pay him back.

I do have an account That is a long term liability and also a notes payable. But when I put it in under one, it deducts out of the other. Am I missing a step or doing something wrong?

Hi there, Swalker90.

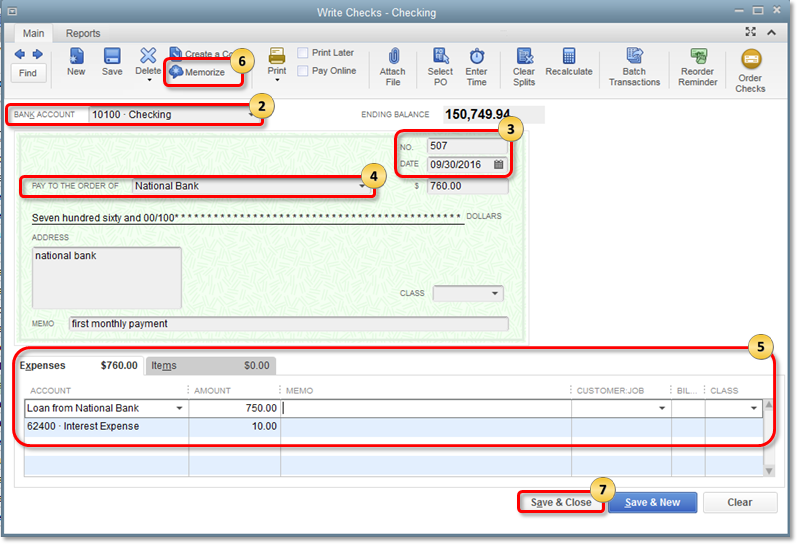

Thanks for posting in the Community, I'm happy to help. If you already have a liability account set up you can record the purchases made with the personal card as a loan payment. Follow these steps to set it up:

You can find these steps and much more information on the topic at this link: Manually track loans in QuickBooks Desktop.

If you have any other questions or concerns, in the meantime, feel free to post here. Thank you and have a nice afternoon.

Thank you for your help! Since it is a person card that we use, do I need to creat a fake bank account to use? I am just stumped because they are purchases we’ve made from our personal account.

Let me give you information about this, Swalker90.

We recommend not to mix business and personal funds. Although, we know this happens sometimes. However, I suggest reaching out to your accountant for the best way on how you can do it.

Also, the IRS recommends opening business-only banking accounts for any new business. You'll also want to make your checking and credit card account business-only accounts.

I've added some helpful articles in case you have questions about QuickBooks: Reports And Accounting.

Feel free to let us know if you need anything else. I'll be here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here