Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy client has negative numbers on their Balance sheet in these areas.....

Assets

Clearing Account - Negative Number

Other Current Assets

Undeposited Funds – Cash and Checks – Negative Number

Payroll Asset – Negative Number

Liabilities

Accounts Payable – Negative Number

Equity

Retained Earnings – Negative Number

Net Income – Negative Number

How can I fix these?

You came into the right place for help, BuckheadBookkeeper.

The negative numbers showing on the accounts indicate that there is a credit balance that made the company paid more than the expected amount. This can be fixed by creating a Journal Entry to credit the accounts affected. This way, the balance will be zeroed out.

Before doing so, I recommend reaching out to your accountant so they can guide you on which accounts to choose.

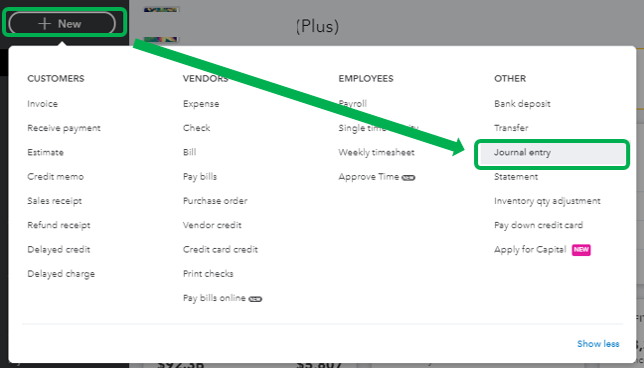

Here's how to create a journal entry:

I've got a visual guide on Understanding the Balance Sheet: Asset, Liability,; and Equity. This contains helpful information about managing the balance sheets in QBO.

You might also want to check out these articles that can give some insight into reconciling process:

Categorize and match online bank transactions in QuickBooks Online

Fix issues when you're reconciling accounts in QuickBooks Online

I want to make sure that you're able to get back to running your business as soon as possible. I'll be back around shortly.

Hi, BuckheadBookkee

Hope you’re doing great. I wanted to see how everything is going about the negative numbers on the Balance Sheet. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

I also have a negative number on the PayPal on the balance sheet, how can I fix this ? Oh and my bank has a recon discrepancy of the same amount also negative balance.

Let's go over to your reports and register to fix discrepancies in your entries, @PRECIOUSs. This way, we can ensure an accurate record of your finances.

In QBO, when your bank balance is negative, it usually results from making payments or processing checks that exceed the available funds in your checking account. This results in a negative figure on your balance sheet report. Additionally, mis-categorized or mismatched transactions can also lead to a negative balance.

To address this, we can pull up your Balance Sheet report and click on the negative amounts to identify which transactions are causing discrepancies.

Regarding the reconciliation issue, the negative amounts stem from transactions that were deleted after being marked as reconciled. Duplicate entries can also impact your register's balance. To resolve this, we'll need to check your bank register for valid transactions that are marked as unreconciled and re-reconcile them. After that, we will unreconcile the duplicate entries once they have been verified.

Furthermore, you can review these articles to guide you in customizing reports streamlined to your business needs and fix issues after reconciling an account:

If you have any further questions or need assistance with any specific transactions or reconciliations, please don't hesitate to reach out. We are here to help you achieve clarity and accuracy in your financial management.

Hi

Thank you for the response, so I isolated the entries giving the negative balance on the balance sheet . It is the same entries that were reconciled that I corrected and are now recorded as deleted in the bank, how do I fix this.

We can check the information on your deleted entries, @PRECIOUSs. Ensuring you we can fix this.

Let's review your bank statement to identify the specific transaction that needs to be restored. This way, we can check and get the info in the Audit Log.

After confirming, you can now re-enter the deleted transactions.

Then, let's reconcile these entries and recheck the balance sheet report.

If there are uncertainties, I suggest reaching out to your accountant for proper guidance.

Additionally, you'll want to refer to this article and learn to save the current customization settings of your report: Memorize reports in QuickBooks Online.

I'll be here to address if you need additional assistance managing your balance sheet. You can leave them in the comments. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here