Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I know this question has been dealt with on the regular such as this thread (https://quickbooks.intuit.com/learn-support/en-us/reports-and-accounting/link-cogs-for-non-inventory...).

We have suppliers that drop ship on our behalf. The process is the customer places their order on our website for the non-inventory items, we then create a purchase order with our vendor, when the vendor has fulfilled the order we mark the order complete and it now pushes over from the ecommerce to QBO. At the same time we now convert the purchase order to a bill.

Since these items that are being drop shipped are of substantial in value ranging anywhere from a few hundred to to ten thousand or more and a major component of revenue in our business it would be ideal if we were still able to track these in COGS. We could create a separate expense account for each of these items by category but how would we now get them to reflect in the "sales by product/service" report so we can track our margins and profitability? Ideally we should be able to just set them to COGS and be able to track but that doesn't seem to be in the option.

I had posted about this prior but it seems like I may need to convert all my non-inventory items to inventory. This seems feasible as when I convert a PO to a Bill the item is immediately consumed as it would occur at the same time as the order is completed with the customer and pushed to QBO thus reducing the inventory.

Is there a way to create a new type of inventory? For example, something like "inventory in transit" as all our drop shipments are FOB, so technically once the shipment is on board the carrier and we convert the PO to a bill, we have taken possession of it till it reaches the customer. Not the most ideal way to do it but any other suggestions?

Hello there. I want to share some information about managing sales items in QuickBooks Online.

The Sales by Product/Service Detail report shows the sold items already grouped by category. If you want the expense account to reflect on the report, then you can run the Purchase by Product/Service Detail instead.

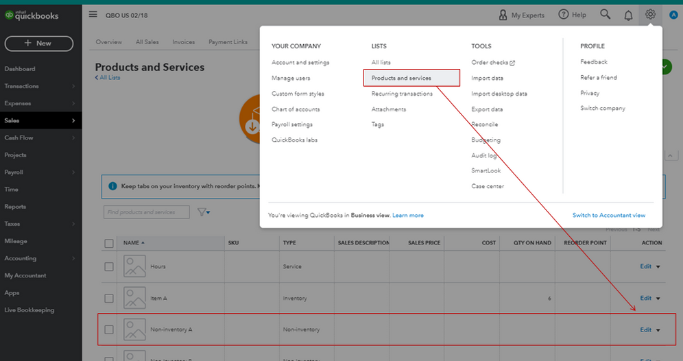

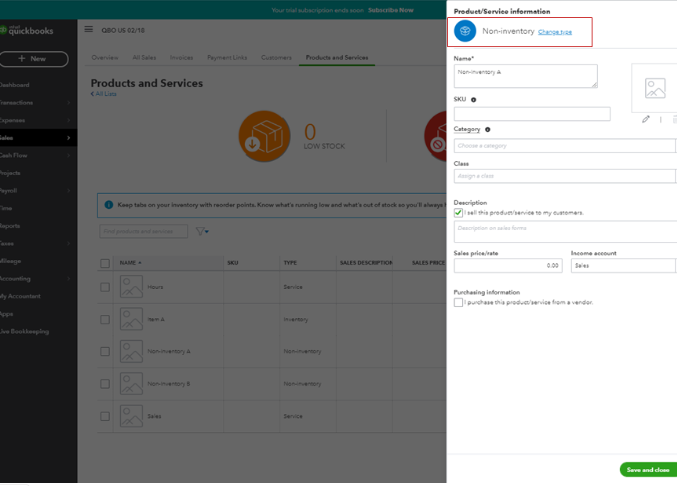

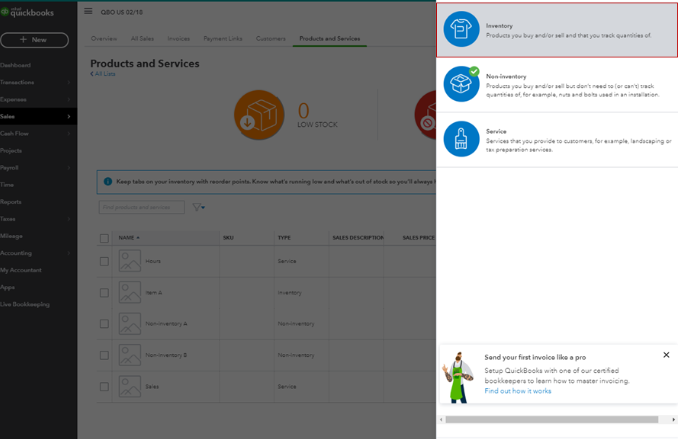

Moreover, you can manually update your non-inventory items to inventory by navigating through the Product and Services window. I'll show you how:

While the option to add a new inventory type in QBO is currently unavailable, you can still utilize the existing ones that have already been added. We highly recommend providing feedback to us regarding this limitation, as it allows our product engineers to improve your overall experience when using the software.

For additional resources about managing your products and services, you can also open these articles:

Please let me know how else I can help you with updating your item types in QuickBooks Online. I'm more than happy to help. Have a good one!

I have been on the phone and in chats with support on this matter.

Thank you for the advice Mich_S, though booking in all non-inventory items as inventoried items does not solve the problem. It is more of a workaround, to the problem at hand.

In this day and age dropshipping and third-party items are extremely common. My company carries a mix of physical inventory and third-party goods. As I want to keep a correct inventory value at my warehouse locations, adding 1 product group that is non-inventory would ultimately complicate all other reports.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here