Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhy is my P&L report gross total different than my STL report gross report?

What's an "STL report gross report"?

Good day to you, 3254848. It's my top priority to help review and identify the factors contributing to the discrepancy of your reports within QuickBooks.

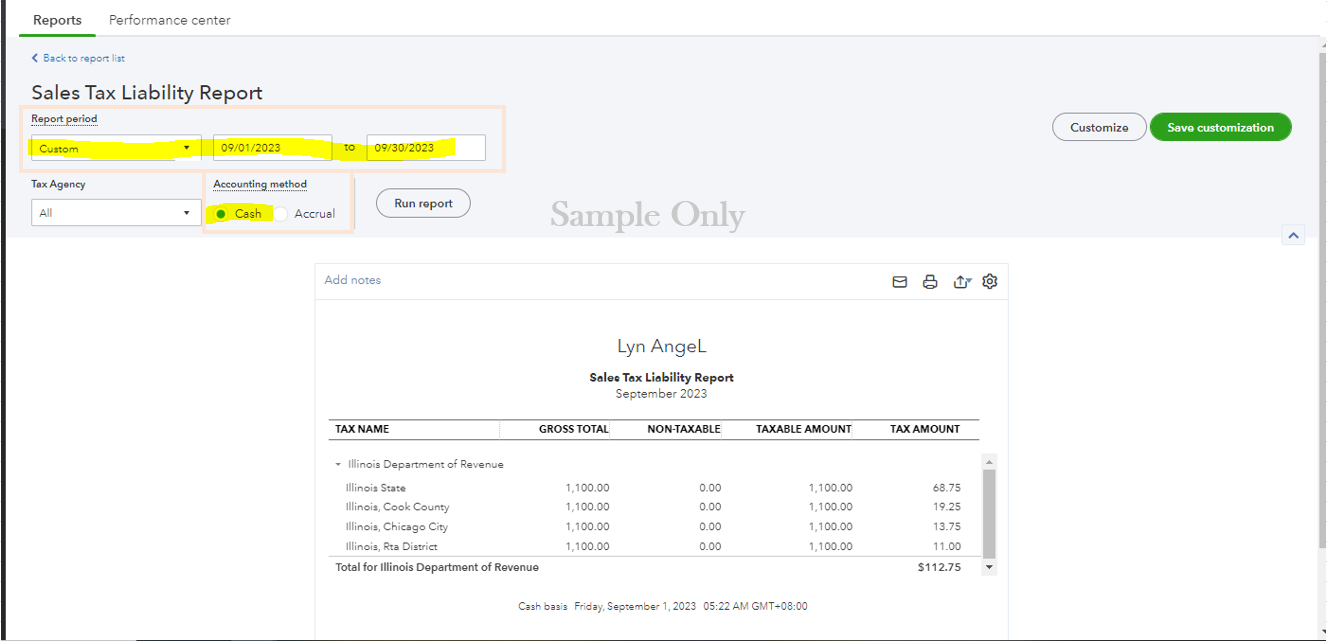

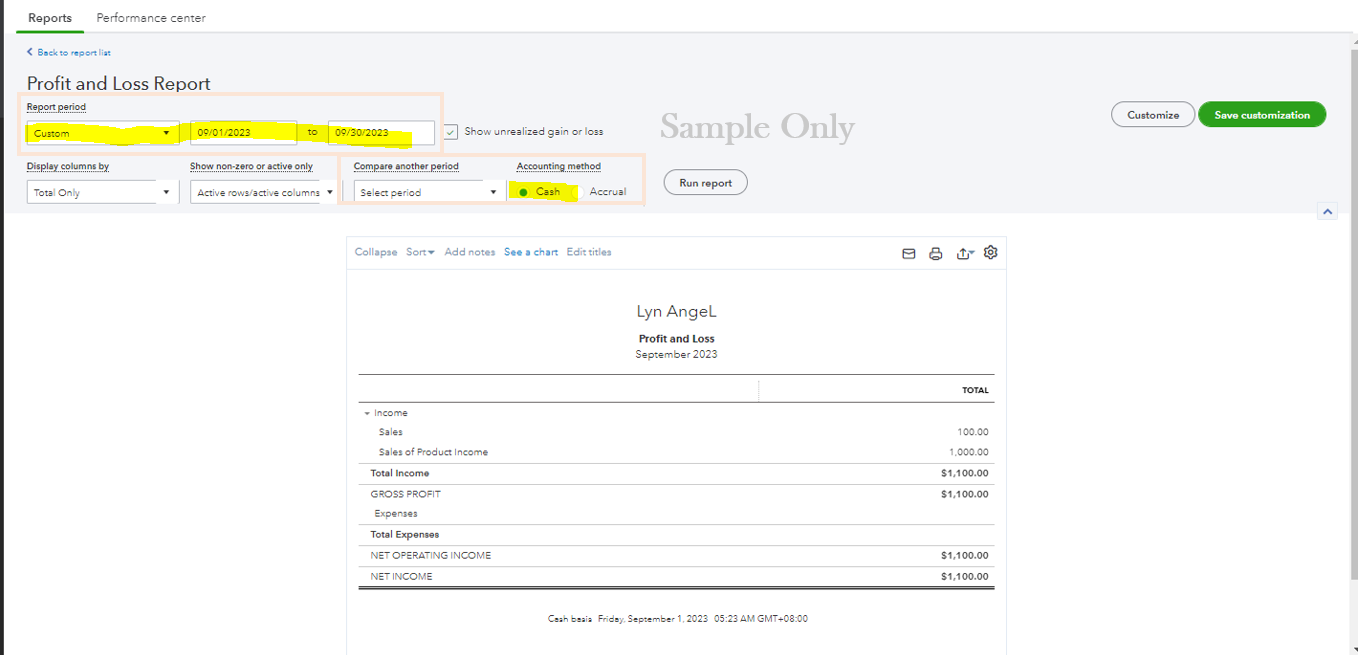

A noticeable discrepancy between your Profit and Loss (P&L) and Sales Tax Liability (STL) reports could potentially arise from various issues, including, but not limited to your reports period and accounting bases. To drill this down, let's ensure that the report dates and accounting methods are aligned and set appropriately.

Here's how:

To enhance your experience when running and customizing reports within our system, I suggest exploring the details provided in these links:

Additionally, you may consider exporting your reports to Excel if you'd like to modify their font styles, colors, or other visual attributes.

Please notify me in the comment section below if you have follow-up questions while comparing your P&L and STL reports in our system. I'm just a few clicks away to help you again. Have a good one!

@3254848 RE: Why is my P&L report gross total different than my STL report gross report?

Notably, the reports don't attempt to be the same:

- The P&L shows summaries for various accounts, including income accounts. It includes amounts from accounting rows that use income accounts from any sort of transaction. For example, you can use an income account in the detail area of a bill or a check or a credit card charge. None of those transactions are included in sales.

- The Sales Tax report is focused on dales, which is different. For example, 'sales' are limited to sales transactions like invoices and cash receipts and credit memos. Also, sales can be related to accounts that aren't income accounts, and even accounts that don't appear on your P&L at all, such as asset or liability accounts. This makes sense for a sales tax report (and other sales reports) because if you sell a taxable thing you owe sales taxes on it no matter what type of account you have associated with the sale.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here