Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am feeling quite dumb because I can't figure out how to populate a report that will show Payroll Adjustments made in 1st and 2nd quarter for specific employees. Can anyone give me a lending hand? Or is there a report that even exists with payroll adjustments?

Solved! Go to Solution.

You've come to the right place, utilitree. I'd like to help and share what I know about running reports in QuickBooks Desktop (QBDT).

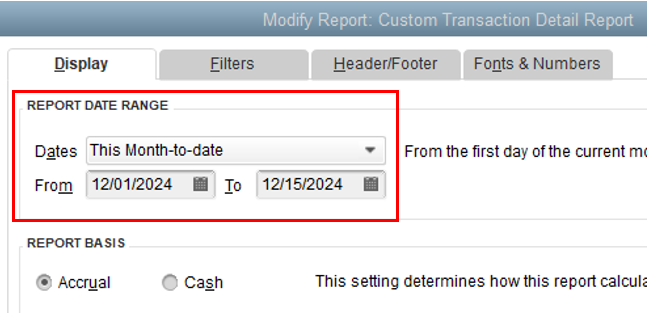

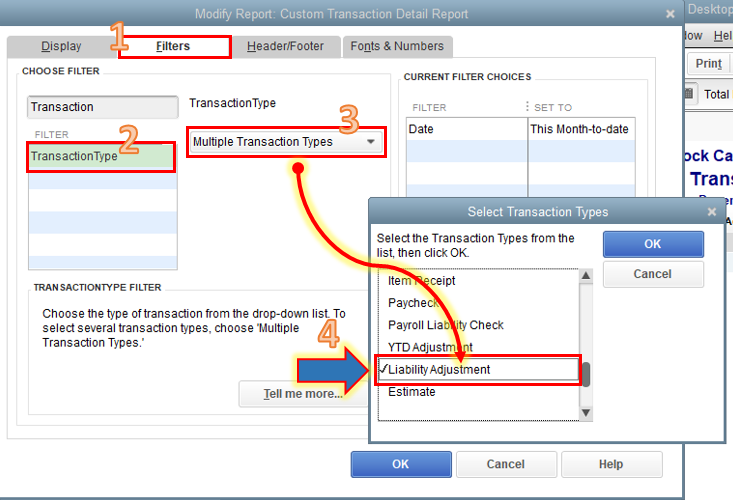

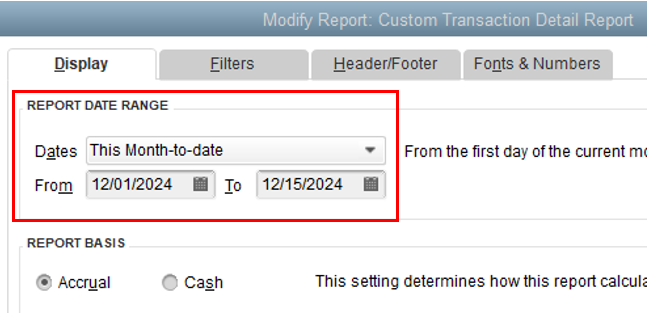

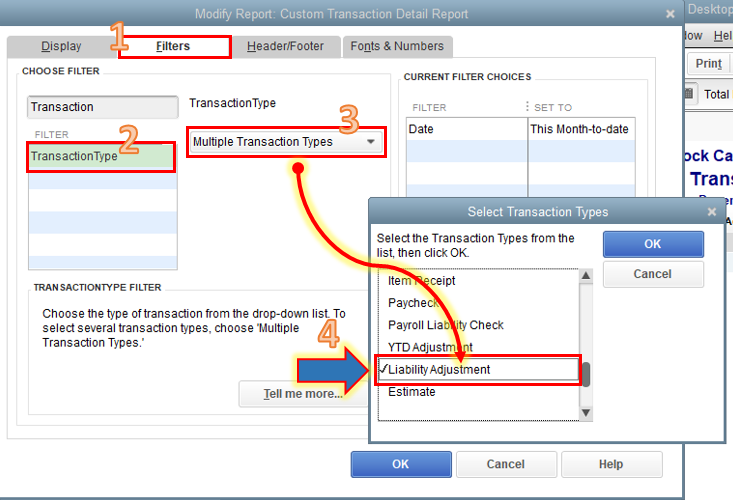

We can run a Transaction Detail report and customize it to view all the payroll liability adjustments made in QBDT. Here's how to pull it up:

I've added this article to guide you if you want to personalize reports in QuickBooks Desktop: Customize reports in QuickBooks Desktop.

Moreover, I'll also share this article which can serve as your reference if you want the same settings of the customized reports to be available for future use: Create, access, and modify memorized reports.

Visit us again in the Community if you have other concerns with running reports in QBDT. I'm happy to help. Have a good one!

You've come to the right place, utilitree. I'd like to help and share what I know about running reports in QuickBooks Desktop (QBDT).

We can run a Transaction Detail report and customize it to view all the payroll liability adjustments made in QBDT. Here's how to pull it up:

I've added this article to guide you if you want to personalize reports in QuickBooks Desktop: Customize reports in QuickBooks Desktop.

Moreover, I'll also share this article which can serve as your reference if you want the same settings of the customized reports to be available for future use: Create, access, and modify memorized reports.

Visit us again in the Community if you have other concerns with running reports in QBDT. I'm happy to help. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here