Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do I change the ppp forgivable payroll cost report from 8 weeks to 24 weeks

I'm here to provide you a few information about the PPP payroll cost report and help you with your concern, nhhc.

For the QuickBooks Desktop Cash compensation report for PPP Loan Forgiveness. you'll have to select a time period consistent with the SBA’s guidance on payroll costs eligible for forgiveness. You can only change it to 8 weeks if you received the PPP loan funds before June 5, 2020. The same thing with your Payroll Cost Report. Please read these articles for additional information:

In case you have some questions about QuickBooks Desktop, you can browse these helpful articles to locate what you need.

Keep in touch if you need further assistance with the payroll cost report. To make sure that this gets sorted out, you can reply and comment below if you have questions along the way.

Thank you for the reply Maria-

I was misunderstood. My PPP compensation report only gives me an eight week period and I need a 24 week period. Furthermore, our loan disbursement was 4-29-2020, yet we wish to choose an alternate period starting 5-4-2020 and ending on 10-18-2020 (24 weeks). How do I access a PPP compensation report that will allow us to use an alternate period for 24 weeks. Our lender is requiring this quickbooks report. We are running quickbooks pro 2019 , we produce paychecks with this version, and we do not have payroll support (we don't need it because we only have 2 full time and 2 part time employees).

Thanks for getting back here, nhhc.

The Cash Compensation report reflects certain cash compensation identified in your QuickBooks account based on the time period selected.

You can access the report by going to Reports located at the top and selecting PPP Cash Compensation.

For more details about the report, you can read the articles provided by my colleague MariaSoledadG.

I'm here if you have any additional questions or other concerns with QuickBooks.

Trying to run PPP cash compensation report in Quickbooks Enterprise Desktop. Report will not accept ending date past 12/31/2020. Loan was funded in February 2021, so need report to show cash comp in 2021

Thanks for joining this thread and I'm here to share why the report won't accept an ending date beyond 12/31/2020, DrDan1.

There's a possibility that you've selected the 8 weeks period after the Loan Forgiveness Covered Period (LFCP) start date.

Your LFCP generally begins on the date when you received your loan proceeds from the lender. Your LFCP may end on any date you choose between 8 and 24 weeks after your LFCP start date.

I suggest contacting our QuickBooks Desktop Payroll Team to check if they can change the period or customize the report. Here's how to contact them:

I'm also adding these links to learn what reports to pull up for the loan:

Stay in touch with me on how the contact goes by commenting below. I'll be around whenever you need additional information about the PPP cash compensation report.

I have the QB Premier Plus Manufacturing & Wholesale Edition 2020. I need to run an SBA PPP report for specific classes. There are seven classes I'd like on this report. How do I create that?

Hey there, @Tmoney1522.

Thanks for following the thread and sharing your concerns.

At this time, the PPP reports that are available in QuickBooks are automated and are not able to be customized. However, I can see how this would be beneficial for you and your business, so I've submitted a feedback request to our Product Development Team. Our product developers review each new request and considered them for future updates.

In the meantime, you can follow all of our latest happenings and updates by using our Blog Site.

Please let me know if you have further questions or concerns. Take care and enjoy the day!

Why don't I see the PPP Reports listed under reports? I am using QuickBooks Enterprise 21.0

Thanks for joining the conversation, @KECShirelle. I'm here to ensure you're able to see the PPP reports.

You'll need to make sure that you have an updated version of QBDT. This way, you get the latest fixes and improvements like the PPP reports.

You can update your QBDT (2021) version either automatically, manually, or schedule future updates. If you opt to set up automatic updates, here's how:

I've attached a screenshot below that shows the last four steps.

If you want to update QuickBooks manually or schedule future automatic updates, I'd recommend checking out this article for the step-by-step guide: Update QuickBooks Desktop to the latest release.

Then go to the Reports menu again to see these statements.

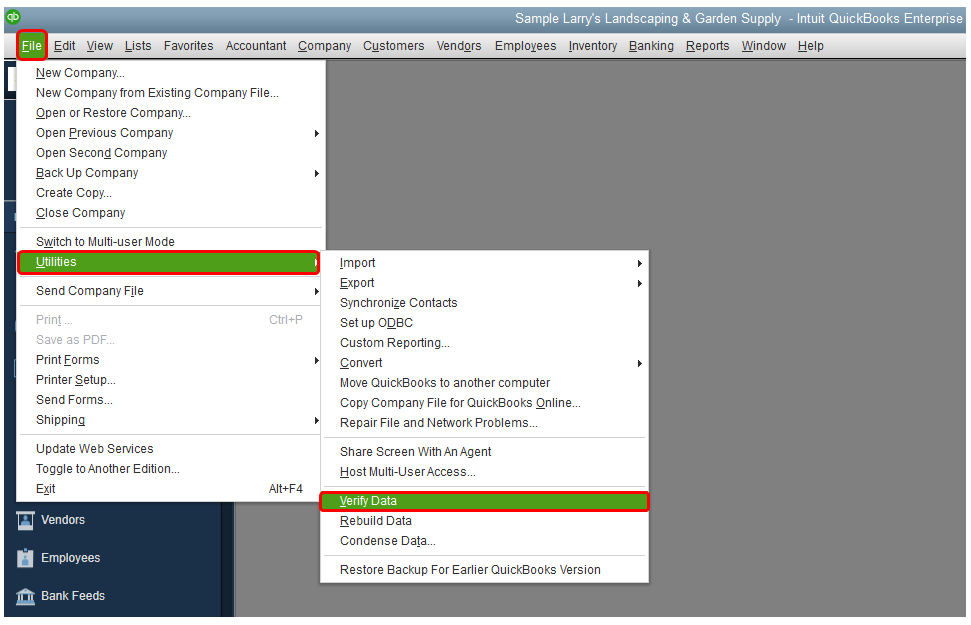

Also, let’s try running the Verify and Rebuild Data Utility Tool to resolve any data integrity issues on the company file. Always create a backup to avoid any accidental data loss before performing the steps. Check out this article for reference: Resolve data damage.

Additionally, here are links that cover all the details on how we extract the data for these reports.

Please feel free to let me know if you have any questions or concerns. I'll be here every step of the way. You can reach out to the Community at any time. We've got your back. Take care and have a great day!

The reports for 2021 PPP forgiveness have not been updated and there is no timeline as to when it will be updated as of today June 22, 2021.

My QB is up to date but the PPP forms won't allow an end date beyond 12/31/2020. When will this be resolved?

Hi there, @CT-Coalition.

The Cash compensation report for PPP Loan Forgiveness uses the time period you select for purposes of your PPP Loan Forgiveness Application. Thus, you need to select a time period consistent with the SBA’s guidance on payroll costs eligible for forgiveness.

Please know that each borrower has a Loan Forgiveness Covered Period (LFCP). Cash compensation is eligible for forgiveness if paid in your LFCP, or incurred in the last pay period of your LFCP and paid by the next regular payroll date.

Your LFCP generally begins on the date when you received your loan proceeds from the lender. Therefore, your LFCP may end on any date you choose between 8 and 24 weeks after your LFCP start date.

In addition, the report is limited to paychecks for individuals whose address is in the United States and for which the pay date or pay period overlaps with your selected period.

For more details, you can check out this article: Understanding your Cash compensation report for PPP Loan Forgiveness.

Moreover, you can see our Paycheck Protection Program loan forgiveness article. This will give you more info about PPP loan forgiveness and loan forgiveness Covered Periods.

I'll be here if you have other questions. You take care and have a great day!

When will the PPP cash compensation report be available for time periods beyond Dec 2020? Is there a time frame to access for 2021 reporting?

Thank you for your response. No matter what "Covered Period" I enter, it will not allow me to put in the correct date for the Loan Disbursement (it keeps switching back to 11/6/2020) and will not allow a date beyond 12/31/2020 for the "End Date".

Hello there, @CT-Coalition.

We can close your company file and re-open QuickBooks Desktop to refresh your data. If you've done this process, we can run the verify rebuild to fix data-related issues on a company file. Data issues could be why it'll not allow you to put in the correct date for the Loan Disbursement.

The steps below will guide you through the process.

If the issue persists, we'll need to check your account in detail to further review and figure out why it's happening. Within your QuickBooks Company file, select QuickBooks Desktop Help from the Help menu.

Alternatively, you can also press F1 on your keyboard to bring up the same Help panel. To route you to the correct support expert, we need to know what type of question you have. Give a brief description of your issue and click Continue.

Another way to contact our support team is by following the steps below.

Please go back here if you have more questions. I'm right here together with the Community people to help you out. Stay safe!

From what I am reading in the comments I think I have a similar question which no one is stating...our second PPP loan IS IN 2021 AND THE CLOSING IS 8-24 WEEKS IN 2021 SO YOU CANNOT RUN THE CASH COMPENSATION FOR THE DATES I WOULD NEED. Is Quickbooks going to update this?

Hello Faefave!

Thanks for joining this thread. Allow me to share additional info and help you with the PPP reports.

We already escalated this issue and our engineers are working diligently to get this resolved. You'll want to contact our Support Team so that your email will be included in the case and you'll receive updates to this investigation.

As a workaround, you'll want to run any payroll report. You can generate Excel-based payroll reports from the system.

Comment again here if you need more help. Take care!

waiting on answer

waiting also

i'm waiting also

i have the same problem

and would also appreciate an answer

thanks

Hello there, @bmhc.

I appreciate you for joining this thread. I'll be providing the latest information about the investigation conducted for PPP reports in QuickBooks.

For now, our engineers are still working on resolving this and we're not given any time frame when it will be sorted out. Rest assured, our engineers are continuing to work on solving this unexpected behavior as soon as possible.

In case you’ve not been added to the list of affected users, I’d suggest getting in touch with our Customer Care Team. They'll be able to add you to the list of affected users and for you to receive updates via email. You can follow the steps below or the steps shared by my colleagues above.

Still, you can generate Excel-based payroll reports from the system by pulling up any payroll reports that give you the data you need. For more insights, you can read through this article: Summarize Payroll Data in Excel.

If you have other concerns with QuickBooks, please utilize the Reply button. I'll respond and help you as soon as I can. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here