Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm completely at a loss! When I do the P/L and open expenses, new inventory, I see both Accts Receivable and Accounts Payables. I see customers but most of them are 0! It's pretty obvious that I've done something wrong but I can't figure it out. Attached is what the P/L looks like when opened under new inventory and also how I enter items in the system. When we look at the Expenses it increases the total a lot. I hope someone can point me in the right direction to fix this. Thank you!

Hello there, nancyl.

I'd like to share some insights on how Profit and Loss (P&L) report works in QuickBooks Desktop.

When you run the P&L report and open the Transaction Detail by Account through the Expense account, it's normal to see both Accounts Receivable and Accounts Payable. This is because the report is designed to show double-entry to know which accounts are being debited and credited.

Learn more about customizing reports in QuickBooks Desktop through this article: Customize reports in QuickBooks Desktop.

On the other note, the increase in total of your expenses is caused by unnecessary transactions that contributes the increase, such as bills and checks. That said, I suggest you review all the expense transactions to identify what's causing the increase.

Let me know if you need more help. I'm always happy to lend a hand. Wishing you the best of luck!

I think you just saved my job! My boss was insisting it was wrong. The only other question I have is why are there some items cost on some of the customers invoices? These invoice are paid.

I appreciate you getting back to us, @nancyl.

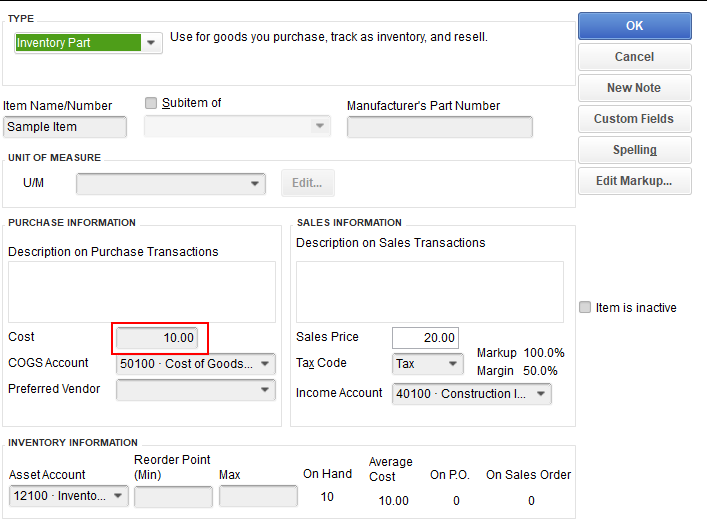

It's possible that some of the items have a cost amount associated when creating them that's why it's showing on the customer's invoices. Let's check each item to ensure these items have a cost amount associated.

First off, go back to the invoices and take note of the item used. Once done, let's go to the Item List window and verify if each item has a cost amount. Here's how:

Once verified, it's the reason why you're seeing Cost in your customer's invoices even if it's paid.

Just in case you want to send online invoices, feel free to check out this article for the detailed steps and information: Send online invoices in QuickBooks Desktop.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day and keep safe.

Thanks so much! I was going to check that out. We do have a lot of items with no cost but considered new inventory. This is the way the boss wants it. I'm sure that issue is also playing havoc with the reports also.

Thanks so much for your time and information. Tomorrow first thing I will go over everything you've offered me. Your the best!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here