Thanks for the detailed input with your concern, @TahoeJohnny. I want to ensure you can categorize your transactions accordingly in QuickBooks Self-Employed (QBSE).

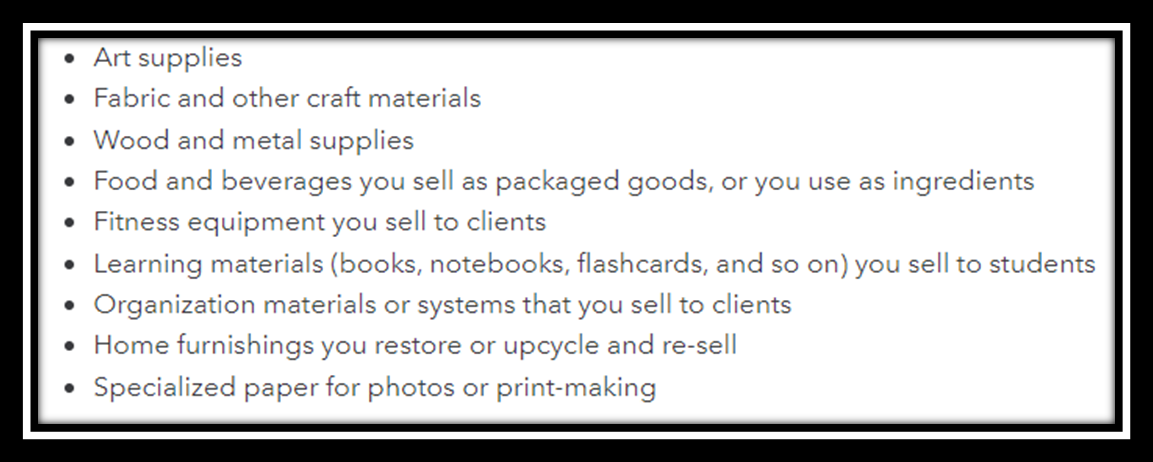

Here is a list of transactions that can be classified as Materials and Supplies:

Please refer to this article on Schedule C and expense categories in QBSE for a list of category corresponding to your small tour company transactions.

In addition, I recommend consulting your accountant to ensure that the categories you have selected are accurate. They can share with you their finest practices.

If you require extra references for future transactions, you can refer to the following links below:

The Community is always available if you have any inquiries. I'll be available to assist. I wish you a fantastic day, @TahoeJohnny.