Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

QB Online duplicated my tax agency. I now have an extra tax agency with fictitious, non zero accounts for sales and use tax. I'm requesting instructions how to delete these non zero accounts. I have performed my due diligence on this board and every response gets one half way through and then says call you accountant. While grateful for your efforts, despite how spurious they appear, please don't populate the thread with those half answers.

How to delete a fictitious, non-zero account in QB Online?

I appreciate the time you've invested in addressing this issue, Michael. I want to assure you that you’re not alone in this. You deserve a straightforward solution for managing your duplicate tax agency account in QuickBooks Online. Let’s go through the steps together to resolve this.

In QuickBooks Online (QBO), we can effectively resolve this issue of duplicate non-zero tax agency accounts by marking the unwanted agency as inactive. This process will help simplify your sales tax management and ensure that only the necessary accounts remain active. It will lead to a more organized and streamlined management of your sales tax obligations.

Here’s how to proceed:

I've included screenshots for your reference:

While QBO doesn't permit the deletion of accounts with non-zero balances, I recommend clearing the balance first by creating a Journal Entry. It will allow you to zero out the account before marking it inactive. For accurate accounting practices, I suggest consulting with your accountant to determine the appropriate debits and credits to use in this process.

Additionally, I've collected a variety of valuable resources that can empower you to navigate sales tax management confidently in QBO.:

Your feedback on the responses you've encountered matters, Michael. I encourage you to reply to this post for assistance when needed or if you have any other inquiries or concerns regarding your sales tax agency in QBO. My team and I are ready to assist you in any way we can.

Thank you for your efforts. You said:

Here’s how you can do it:

I don't have a "sales tax settings" exactly, but chose "Edit sales tax settings" and made the sales and use taxes inactive. I still have the tax agency and owed taxes in the sales tax center. I'm guessing your approach disables the repeated taxes moving forward, but I still have them moving backwards, and even better, they have no payments against them, so it's years of sales tax accumulated as a liability.

I tried going to chart of accounts and making them inactive there, but the system refuses, claims non-zero balance, or part of an automated workflow, or one of the default accounts in my chart of accounts. Notably, two of those accounts are not only zero, they've never had a single entry. I still cannot make them inactive.

How do I access the master commands or command line system? Obviously software will always have bugs and humans will always err, and there has to be tools for development. Clearly there's a way to directly edit bad data in the file, e.g. zeroing an account and deleting it altogether.

i appreciate the intuit may wish to hold this close to their chest, but its my data. My company file is not the property of Intuit, obviously they cannot vandalize it with impunity. There must be a way to clean up files of bad records. And while I understand everything had to match and offset, those fake records Intuit generated don't have any match or offset. They came from the ether. They can go back there. Legitimately.

Hello there, Michael.

I acknowledge the challenges you're facing with the persistent sales tax liabilities in QuickBooks, even after deactivating the sales and use taxes in the settings.

While QuickBooks does not have a direct master command or command line system accessible to users, there are alternative methods that can be explored to address this issue.

Your input is highly appreciated as it helps us understand your experience and improve our services. We take customer feedback seriously and use it to enhance our products and support.

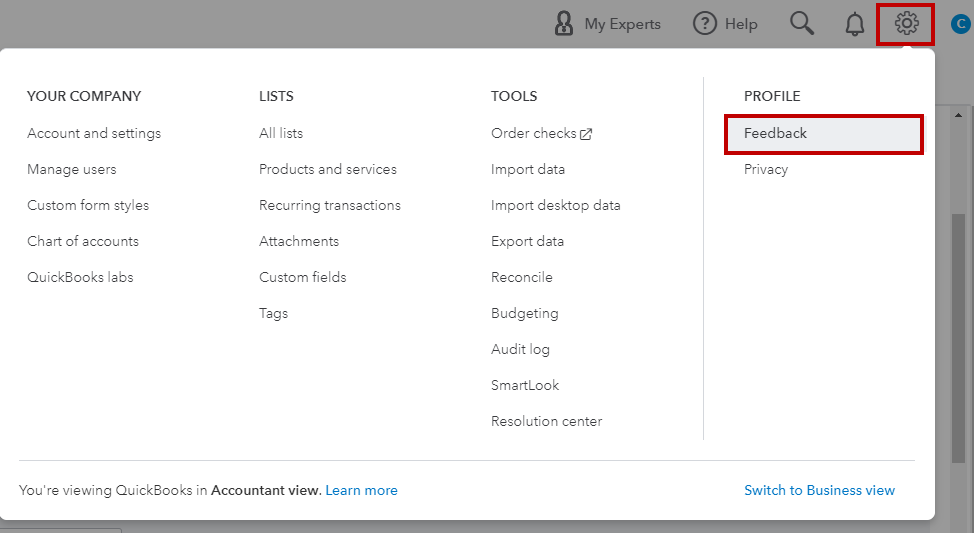

Here are the steps to share your feedback:

Your relevant feedback goes to our Product Development team to help heighten your experience in QuickBooks Online (QBO). You can track feature requests through the QuickBooks Online Feature Requests website. Additionally, you can keep an eye on our QuickBooks Blog to stay up-to-date with the latest news.

I'm adding some related links for your references with the sales tax feature in QuickBooks Online:

Visit us anytime if there's anything else you need assistance with sales tax processes in QuickBooks. We are always here to help you out. Have a nice day and take care.

You're telling me you have a command line system to repair the damage to my financial records but you refuse to allow me to access it?

You are claiming there are alternative methods to explore this issue, but you refuse to tell me what they are? Are you just being malicious? Do I have to pay a bribe to find out the secret?

You say the feedback is taken seriously and you use it to enhance your products and support, okay, how? You aren't even entering a bug report! You go on to tell me to do it! You realize you are being paid by Intuit for support and I'm paying Intuit, and you want me to do support's job, for which you are being paid, rather than support my own family?

Did you write this yourself? Who put you up to this? What is the name, please, of the Intuit employee that set you up to lie to me, insult me and make a complete buffoon out of yourself with illogical, irreconcilable statements, such as noted above? Let's all learn the name of the person that thought so lowly of you to set you up, rather than do it themselves. Who got you to lie for money? How? What is their name? Unless you think what you guys are doing he is in some way ethically, or socially, defensible?

I am disheartened and disgusted. How filthy could Intuit be?

Please inform me whom to call, that has command line access, to delete the damage Intuit did to my company file. Its vandalism. It's falsification of tax records and we don't have any agreement that covers that. I'm certain my states attorney will be interested to know QuickBooks users must all now calculate sales and use by hand because QuickBooks is vandalizing their private financial data. Maybe he can submit feedback and watch the blog to see if you guys are addressing your felonies.

For Pete's sakes, are you really going to escalate this? Because I sure will.

AbigailS, are you Abigail Parris in Georgia? I'm trying to file a legal complaint against you but don't want to harm anyone innocent, you know, like you are doing to me by refusing to repair the company file you stated you had the tools to fix but refused.

i wonder if we can end QuickBooks DCAA certification over this? I'll add them to the list to file a complaint.

i cannot believe you are still escalating rather than repairing the file, but you be you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here