Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have 18 employees who are expense submitters. They primarily use their phone's browser to log in and submit expenses. There have been no issues doing this until very recently. Now, if an expense submitter tries to change the date for the expense they are trying to submit, they receive an error that says the date is invalid and they can't submit the expense. If they leave the date alone, they get no error, but then the date for the expense is wrong. This only happens if they use their phone's browser, and this does not appear to be specific to one type of browser. I tried it with Chrome on my phone and got the same error. No issue if I use a computer, but that isn't always an option. QuickBooks chat said they can't help unless the issue is happening on a computer where they can screen share. How do I fix this issue?

It's essential to ensure that the employee has entered the correct date for the expense and that it falls within a valid date range for the current or upcoming pay period, @The Accountant 1917. To resolve this issue smoothly, follow the troubleshooting steps below.

Since you've mentioned that the system works fine on your computer but presents an invalid date error on your phone's browser, I recommend you access the account and submit the expense using private incognito mode on your phone’s browser, which avoids storing cache files that could disrupt web-based programs. Here’s how to do it:

For Android users:

For iPhone or iPad:

If you can submit the request successfully using incognito mode without encountering an error, proceed to clear your regular browser’s cache and cookies to remove accumulated data. Instructions are as follows:

For Android:

For IOS:

If the issue persists, consider using another supported browser or device, as the current one may have compatibility issues with the program.

Regarding employee reimbursements for business expenses, this payment type is processed outside of payroll tax documentation. For more information, here are some resources:

With the reimbursement pay type set and the accounting preference updated, you can now create paychecks that include the reimbursement amount in QuickBooks.

If further questions about managing employee expenses arise, feel free to revisit this thread. I'm here to help and will respond as soon as possible. Keep safe.

Unfortunately, clearing my cache and using incognito mode did not work. I also tried Internet Explorer, Mozilla Firefox, and Samsung's browser. The issue persisted. I found a work around by putting my chrome browser in desktop mode.

I am having the same issue.

Let's verify the correct date format is selected so you or your employees can submit expenses without issues, KM3902. I'll also outline the steps to contact our live support team to examine this unusual behavior further.

Once you or your employee have verified that the correct date format is selected, I recommend following the troubleshooting steps provided by my colleague above. Occasionally, outdated or corrupted cache files can lead to system issues.

If you've already done this process and the issue persists, I recommend contacting our live support team to examine this unusual behavior further. Our experts can arrange a screen-sharing session if necessary.

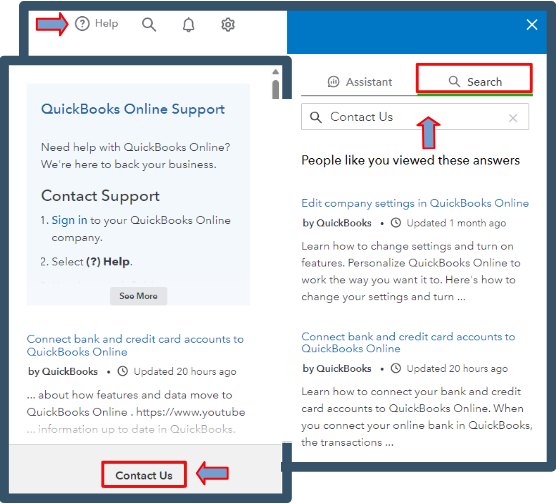

Here's how to reach them via web browser:

In the meantime, your employee can log in using their web browser to adjust the date for the expense they intend to submit.

Once your employee submits their expense claims, you can review, accept, or reject them.

Contacting our live support team will ensure everything is thoroughly checked. This process will allow your employees to submit their expenses successfully. I'm still here to help if you need any further assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here