Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for visiting the Community, @vjs-avila.

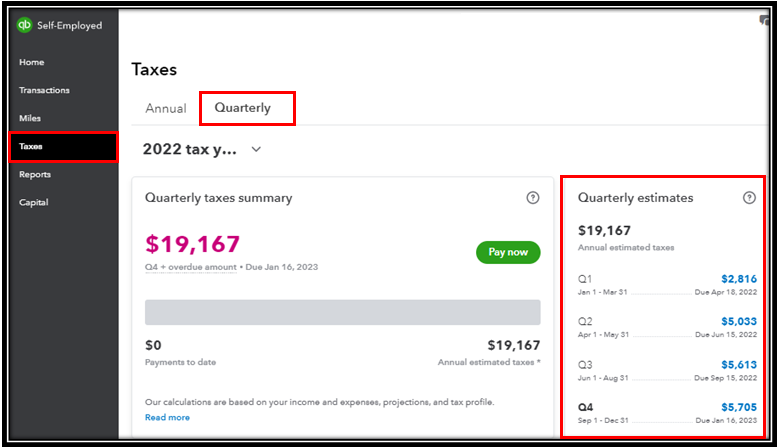

I suppose you're referring to how QuickBooks Self-Employed (QBSE) gives you an estimate for federal income and self-employment taxes. If that's the case, it is calculated by applying income tax rates to your total self-employment taxable profit from your business plus any personal income you enter from outside your company. Here's how you can view your tax estimate:

For more information about this process, kindly visit this resource: Automatically estimate your income tax in QuickBooks Self-Employed.

On the other hand, if you meant paying your estimated quarterly taxes in QBSE, you could simply check out this article for the detailed process: Pay federal estimated quarterly taxes in QuickBooks Self-Employed.

However, if this isn't the case, can you please share additional information on what you're trying to achieve within the QBSE program?

Additionally, you'll want to check out this resource about how to get the quarterly and annual tax info in QBSE: Get quarterly and annual tax info from QuickBooks Self-Employed.

Please know that you can always get back to this post if you have other questions about estimated quarterly taxes. I'm always here to help. Have a good one.

Hello,

Does any version of QuickBooks (other than Self Employed) calculate quarterly estimated tax payments?

Hi there, @Ben650.

Allow me to provide information about calculating quarterly estimated tax payments.

Currently, QuickBooks Self-Employed is the only version of QuickBooks that calculates federal estimated quarterly taxes.

I'm including this article which explains the features of QuickBooks Online and QuickBooks Desktop: Product feature comparison.

We're always available so keep on sharing your concerns with us. I'm always around to help!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here