Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

When I enter a bill, I choose COGS under the expense tab. I enter what I purchased and mark it as billable to a customer. I then create an invoice and choose the customer. The Add Time/Costs menu opens, I select the expenses, and add them to the invoice. The thing is when I run a P/L report, the COGS sold account shows zero (a debit and a credit for the amount), and the Sales account shows nothing. Please help!

Solved! Go to Solution.

Hello, @karma0016.

Thanks for dropping by in the Community. I'd be pleased to help run a P&L report showing your income after invoicing your billable expense.

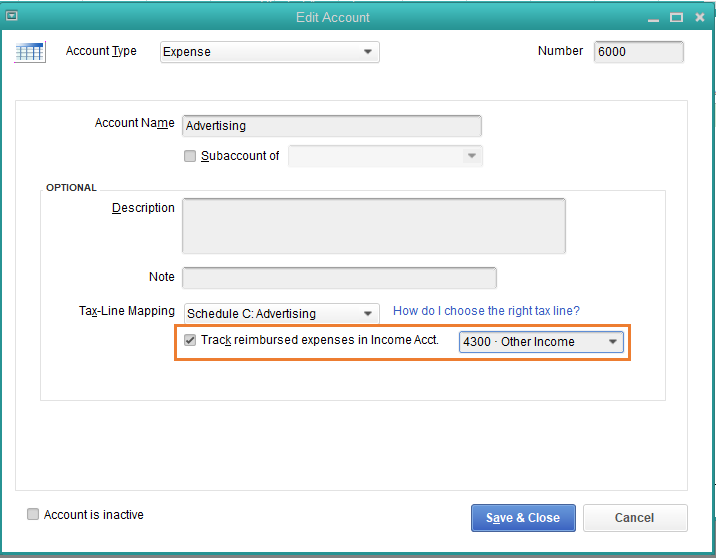

In QuickBooks Desktop, you cannot track reimbursed expenses in income account using COGS. When entering a bill, you'll need to choose another expense account. Then you'll have to put a check mark on the Track reimbursed expenses in Income Acct. box.

Here's how to track the income on the expense account:

When entering the bill, make sure to select the expense account. You'll need to either delete or edit the previous transactions you've already created

Once done, open your P&L report again to verify the amounts on your Expense and Income accounts.

As always you can check out our site if you may need some helpful references in the future: Help articles for QuickBooks Desktop.

Let me know if you have additional questions about your billable expense. I'll be here to help however I can. Have a good one.

Hello, @karma0016.

Thanks for dropping by in the Community. I'd be pleased to help run a P&L report showing your income after invoicing your billable expense.

In QuickBooks Desktop, you cannot track reimbursed expenses in income account using COGS. When entering a bill, you'll need to choose another expense account. Then you'll have to put a check mark on the Track reimbursed expenses in Income Acct. box.

Here's how to track the income on the expense account:

When entering the bill, make sure to select the expense account. You'll need to either delete or edit the previous transactions you've already created

Once done, open your P&L report again to verify the amounts on your Expense and Income accounts.

As always you can check out our site if you may need some helpful references in the future: Help articles for QuickBooks Desktop.

Let me know if you have additional questions about your billable expense. I'll be here to help however I can. Have a good one.

I understand you're explanation, but I am not using the Bill feature. The transaction is entered using the credit card icon. The expense is 0'd out and there is no income reported. What am I doing wrong?

Thanks for joining this thread, lisa_bke,

You'll want to use an income account when making an expense as billable. This way, the invoice is reported on your report as an income.

Just change the account on your preference to accomplish this. Let me show you how:

Once done, delete the credit card you've created and start over with the entry by writing a check. Then, mark it billable to the customer.

After that, create an invoice from the expense, then check again your reports for the results.

Let me know if you have follow-up questions by commenting below. I'm always right here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here