It’s great to see you in the Community, am-balaw-us.

Based on the description of the term, we’re unable to set it up in QuickBooks. As a workaround, you’ll have to enter the down-payment as a separate transaction. Then set a term for 30 days.

I can help and guide you through the step by step process. Here’s how to record the vendor prepayment.

There are two ways on how to track this type of transaction in QuickBooks. You can either use the Accounts Payable to record it or use the asset account to associate the prepayment.

For the Accounts Payable, we’ll have to create a check. Then, enter a bill to apply the prepayment. Here’s how:

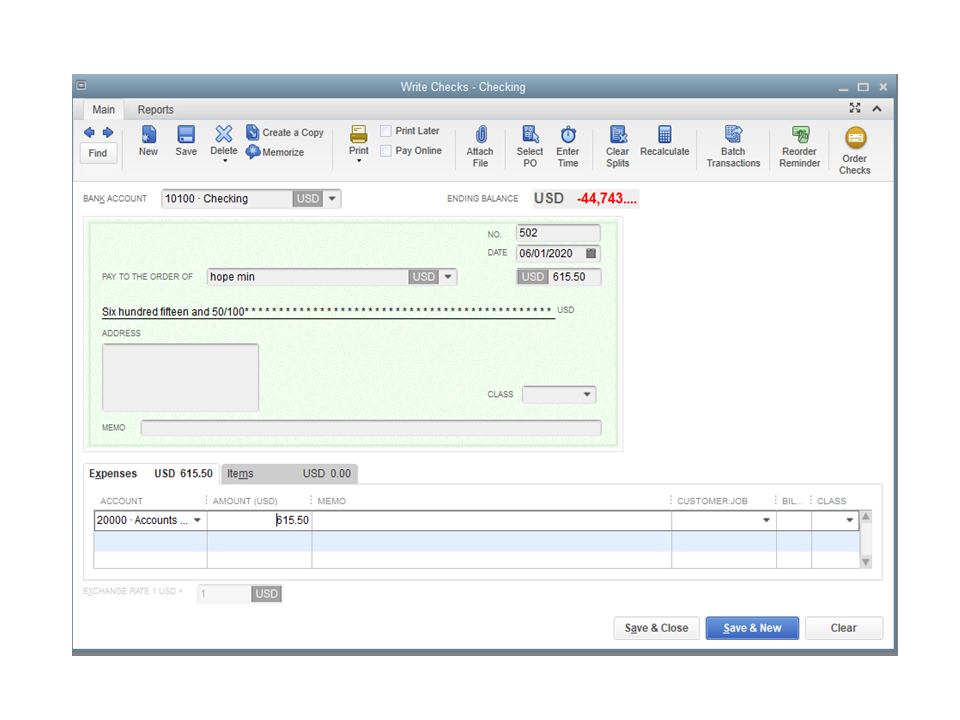

- Go to the Banking menu at the top bar to choose Write Checks.

- Enter the vendor name, date, and payment amount.

- Choose the Expenses tab and under the Account column and key in Accounts Payable.

- Click the Customer: Job drop-down to choose the vendor name.

- Hit Save & Close.

To make a bill:

- Tap the Vendors menu at the top to choose Enter Bills.

- Fill in the field boxes on the Bills page.

- Click Save & Close.

For the downn payment:

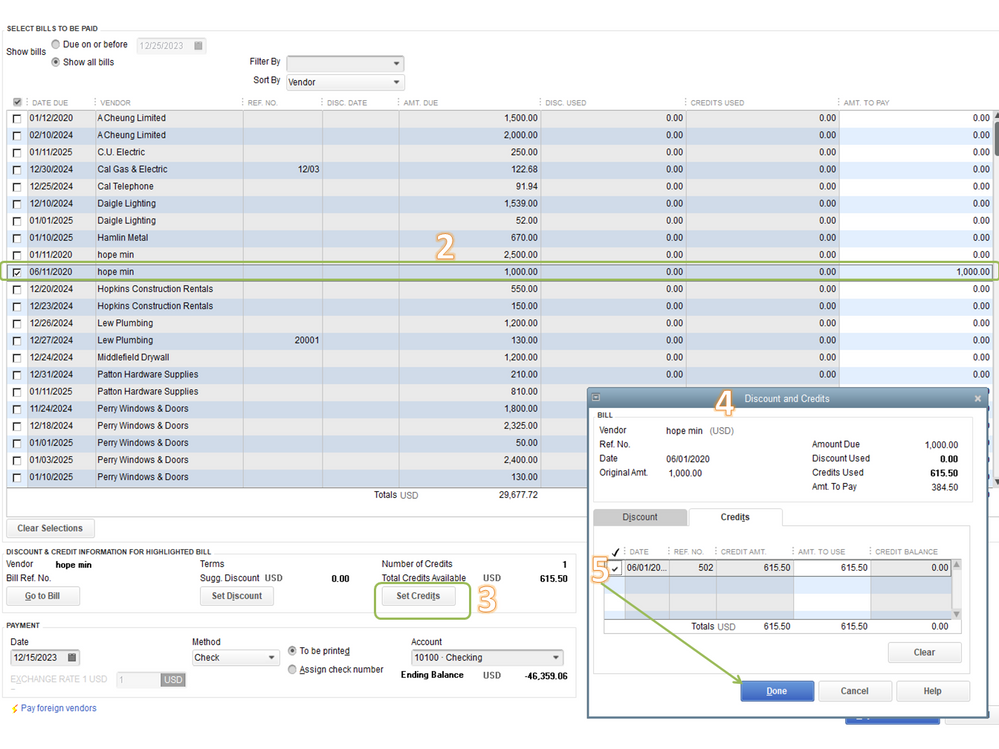

- Choose the Vendors menu at the top and pick Pay Bills.

- Highlight the bill you want to associate with the prepayment.

- Click Set Credits.

- This action will take you to the Set Credits screen.

- From there, make sure it is checked and click Done.

If you want to use the asset account, let me share the Record vendor prepayments or deposits for prepaid parts or services guide and proceed directly to Option 2. It outlines the complete instructions on how to record the down payment using this method.

Next, let’s set the term for your vendor. Let’s go to the Terms page to do this one.

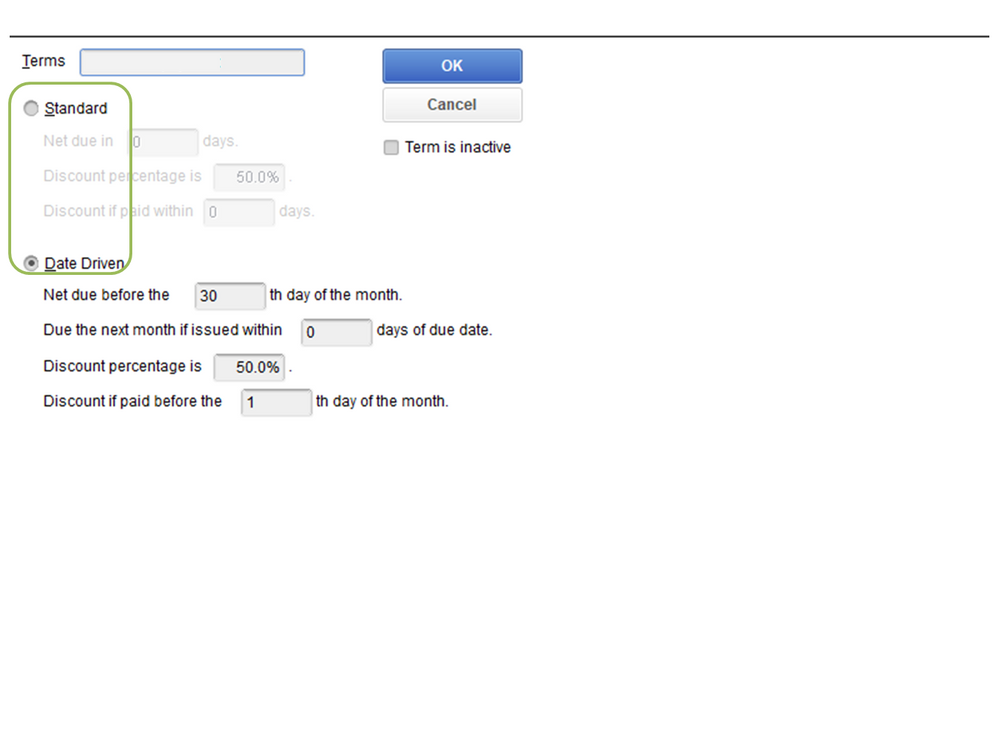

- Press the Lists menu at the top bar and choose Customer & Vendor Profile Lists to select Terms List.

- On the Terms page, scroll down to the bottom of the page and click the Terms drop-down to select New.

- Type a name that will easily identify the term in the field box.

- Choose which option will work for you: Standard or Date Driven.

- After selecting, fill in the field boxes and press OK to keep the changes.

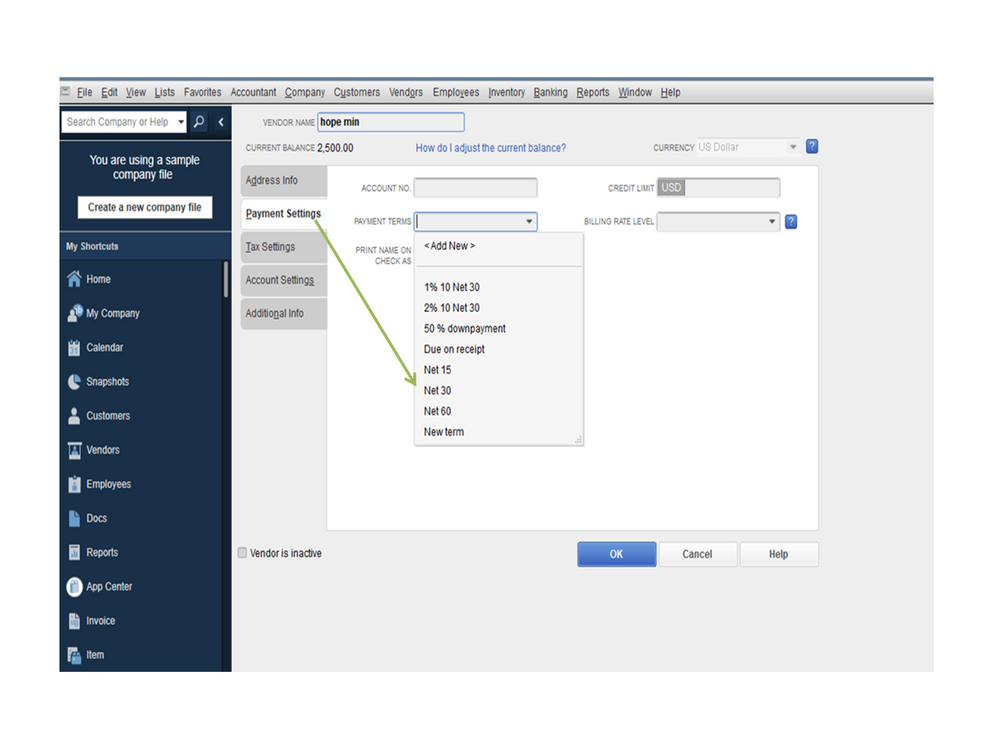

Now that we’re done setting it up, go to the vendor’s profile to link the term. Here’s how:

- Tap the Vendors menu at the top to select the Vendor Center.

- Choose the Vendors tab and double-click on the supplier’s name to view more details.

- Click the Payment Settings tab on the left panel and click the PAYMENT TERMS drop-down to associate the newly created term.

- Press OK to save the changes.

You can also bookmark the Setup payment terms article for future reference. It provides an overview of when to use the Standard and Date Driven method.

Keep me posted if you have any other concerns or questions. I’ll be right here to answer them for you. Enjoy the rest of the day.